Delving into the intricate world of mutual fund fees, this guide aims to shed light on the various types of fees investors encounter and how they impact investment returns.

Exploring the nuances of expense ratios, sales charges, redemption fees, exchange fees, and 12b-1 fees, this overview will equip readers with essential knowledge to make informed investment decisions.

Types of Mutual Fund Fees

When investing in mutual funds, investors need to be aware of the various types of fees that can impact their returns. Understanding these fees is crucial for making informed investment decisions.

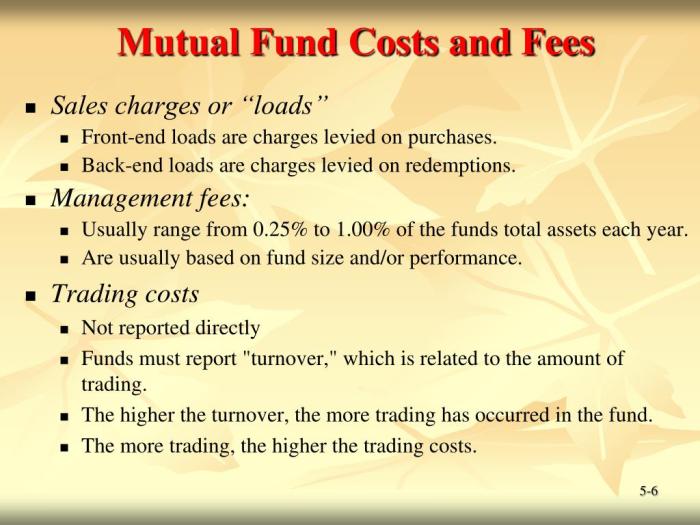

Sales Load Fees

Sales load fees are charges that investors may pay when buying or selling mutual fund shares. These fees are typically used to compensate brokers or financial advisors. There are two types of sales load fees: front-end loads and back-end loads.

– Front-end loads are paid when purchasing fund shares and are deducted from the initial investment.

– Back-end loads are paid when selling fund shares and are deducted from the proceeds of the sale.

Management Fees

Management fees are ongoing fees charged by the mutual fund company for managing the fund’s portfolio. These fees are typically expressed as a percentage of the fund’s assets under management (AUM).

– For example, if a fund has an annual management fee of 1%, an investor with a $10,000 investment would pay $100 in management fees each year.

Expense Ratio

The expense ratio represents the total annual expenses of a mutual fund as a percentage of its average net assets. This ratio includes management fees, administrative costs, and other operating expenses.

– A lower expense ratio is generally preferable for investors, as it means a larger portion of their investment is being put to work in the fund.

Other Fees

In addition to sales load fees, management fees, and expense ratios, mutual funds may also charge other fees such as redemption fees, account fees, and 12b-1 fees (marketing and distribution expenses). These fees can vary depending on the fund and can further impact an investor’s overall returns.

Understanding the different types of mutual fund fees is essential for investors to evaluate the total cost of investing in a particular fund and make informed decisions about their investment strategy.

Expense Ratio

The expense ratio of a mutual fund is a measure of the total annual costs incurred by an investor to manage and operate the fund. It includes management fees, administrative expenses, and other operational costs, expressed as a percentage of the fund’s average net assets.

Variation in Expense Ratios

Expense ratios can vary significantly across different mutual funds depending on various factors such as the fund’s investment strategy, size, and management style. Actively managed funds tend to have higher expense ratios compared to passively managed index funds due to the additional research and trading costs involved.

- Actively managed funds may have expense ratios ranging from 0.5% to 2% or even higher, reflecting the higher costs associated with professional management and active trading.

- On the other hand, index funds typically have lower expense ratios, often below 0.2%, as they aim to replicate the performance of a specific market index with minimal management and trading activities.

Investors should consider the expense ratio when selecting a mutual fund, as higher fees can eat into returns over time.

Impact on Long-Term Investments

The expense ratio plays a crucial role in the overall performance of a mutual fund and can significantly affect long-term investments. Even seemingly small differences in expense ratios can compound over time and result in a substantial reduction in returns for investors.

- For example, a fund with a 1% expense ratio will reduce the annual return by 1% compared to a similar fund with a 0.5% expense ratio.

- Over a long investment horizon, this difference can lead to a significant variance in the final value of the investment, impacting the investor’s wealth accumulation goals.

Sales Charges (Loads)

When investing in mutual funds, investors may encounter sales charges, also known as loads. These fees are designed to compensate brokers or financial advisors for their services in helping investors buy or sell fund shares. Understanding sales charges is essential for investors to make informed decisions about their investments.

Front-end Loads vs. Back-end Loads

Sales charges can take the form of front-end loads or back-end loads. Front-end loads are charged at the time of purchase and are deducted from the initial investment amount. For example, if an investor decides to invest $1,000 in a mutual fund with a 5% front-end load, only $950 will actually be invested in the fund, with $50 going towards the sales charge.

On the other hand, back-end loads are charged when investors sell their mutual fund shares. These fees are also known as contingent deferred sales charges (CDSC) and typically decrease over time if the investor holds the fund for a certain period. For instance, if an investor sells their shares within the first year of owning the fund, they may be charged a higher back-end load compared to selling after holding the fund for several years.

Influence on Investment Decisions

Sales charges can have a significant impact on investment decisions. Investors need to consider whether the services provided by the broker or financial advisor justify the sales charge. Additionally, the presence of loads can affect the overall return on investment, as they reduce the amount of money actually invested in the fund.

It is crucial for investors to weigh the potential benefits of working with a professional against the cost of sales charges. Some investors may opt for no-load funds that do not charge sales fees, while others may find value in the guidance and support provided by advisors, even with the additional cost of loads.

Redemption Fees and Exchange Fees

Redemption fees and exchange fees are additional charges that investors may incur when buying or selling shares of a mutual fund. These fees are imposed by the fund company to discourage short-term trading and help offset the costs associated with buying and selling securities within the fund.

Redemption Fees

Redemption fees are charged when investors sell their shares in a mutual fund within a certain period after purchasing them. These fees are typically a percentage of the amount being redeemed and are designed to deter frequent trading. For example, a mutual fund may charge a 2% redemption fee if shares are sold within 90 days of purchase.

Exchange Fees

Exchange fees are incurred when investors transfer their money from one mutual fund to another within the same fund family. This fee is charged to cover administrative costs associated with processing the exchange. For instance, an investor may be charged a $25 exchange fee when moving funds from one mutual fund to another within the same investment company.

Examples of Scenarios

– Redemption fees may apply if an investor sells shares of a mutual fund within a specified holding period, such as 60, 90, or 180 days.

– Exchange fees may be charged when an investor switches from one mutual fund to another within the same fund family.

Strategies to Minimize Impact

To minimize the impact of redemption and exchange fees, investors can consider the following strategies:

– Hold mutual fund shares for the recommended holding period to avoid redemption fees.

– Consolidate investments within a single fund family to reduce or eliminate exchange fees.

– Research and choose funds with lower or no redemption and exchange fees to save on costs.

12b-1 Fees

12b-1 fees are fees charged by a mutual fund to cover marketing and distribution expenses. These fees are named after the SEC rule that allows mutual funds to use them. They are typically included in a fund’s expense ratio, which represents the total percentage of assets deducted annually to cover operating costs.

Controversy Surrounding 12b-1 Fees

- Controversy arises from the fact that 12b-1 fees can reduce an investor’s returns over time. Since these fees are deducted directly from the fund’s assets, they can eat into the overall performance of the investment.

- Another issue is the lack of transparency surrounding 12b-1 fees. Some investors may not be aware of these fees or understand how they impact their investments.

- Critics argue that 12b-1 fees can create a conflict of interest for financial advisors, as they may be incentivized to recommend funds with higher fees in order to earn more compensation.

Evaluating the Impact of 12b-1 Fees

- Investors can evaluate the impact of 12b-1 fees by comparing the expense ratios of different mutual funds. Funds with lower 12b-1 fees may be more cost-effective in the long run.

- Consider the historical performance of the fund relative to its fees. If a fund with high 12b-1 fees has consistently underperformed its benchmark, it may not be worth the additional cost.

- Look for funds that offer fee waivers or discounts on 12b-1 fees for larger investments. This can help mitigate the impact of these fees on your overall returns.