Delving into investment diversification, this introduction immerses readers in a unique and compelling narrative. Investment diversification is a crucial strategy that investors use to spread their risk across different assets, ensuring a more stable and balanced portfolio. By understanding the various aspects of investment diversification, individuals can make informed decisions to optimize their investment returns.

In the subsequent sections, we will explore the concept of investment diversification, different types of diversification strategies, and the associated risks and challenges that investors may encounter.

What is Investment Diversification?

Investment diversification is a risk management strategy that involves spreading investments across different assets to reduce exposure to any single asset or risk. This strategy aims to minimize the impact of volatility in the market and protect the overall portfolio from significant losses.

Importance of Diversification in an Investment Portfolio

Diversification is essential in an investment portfolio due to the following reasons:

- Diversification helps spread risk: By investing in a variety of assets such as stocks, bonds, real estate, and commodities, investors can reduce the impact of a decline in any particular asset class.

- Minimizes correlation risk: Different assets have varying levels of correlation with each other. Diversification helps mitigate the risk associated with assets moving in the same direction during market fluctuations.

- Enhances potential returns: While diversification aims to reduce risk, it also provides opportunities for potential growth by exposing the portfolio to different market sectors and industries.

- Protects against unforeseen events: Economic, political, or market events can impact specific industries or asset classes. Diversification helps safeguard the portfolio against such unforeseen events.

Examples of How Diversification Can Reduce Risk

Here are some examples illustrating how diversification can effectively reduce risk in an investment portfolio:

- Scenario 1: An investor who allocates all their funds into a single stock faces significant risk if the company underperforms or faces financial difficulties. Diversifying across multiple stocks, industries, and asset classes can help mitigate this risk.

- Scenario 2: During a market downturn, bonds tend to perform better than stocks. By holding a mix of stocks and bonds in the portfolio, investors can offset losses in equities with gains in fixed-income securities.

- Scenario 3: Geographic diversification involves investing in assets across different regions or countries. This strategy can protect the portfolio from localized economic downturns or geopolitical risks in a particular region.

Types of Investment Diversification

Investment diversification is a strategy used by investors to spread their risk across different asset classes, geographical regions, and sectors. By diversifying their investments, investors aim to reduce the impact of volatility in any single investment on their overall portfolio.

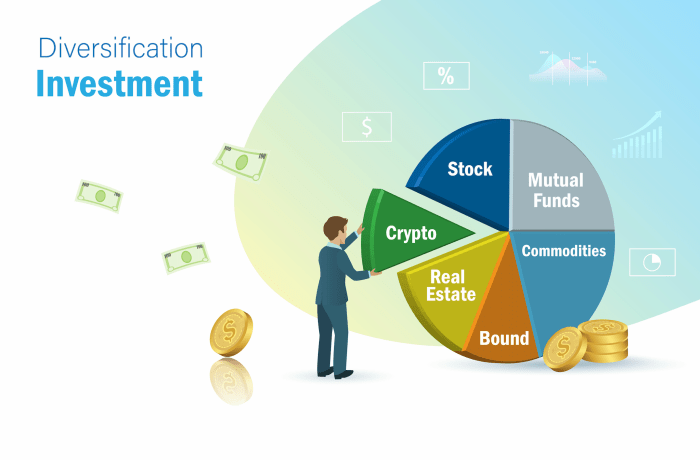

Asset Class Diversification

Asset class diversification involves investing in different types of assets such as stocks, bonds, real estate, and commodities. Each asset class has its own risk and return characteristics, and by diversifying across asset classes, investors can achieve a balanced portfolio that is less susceptible to market fluctuations.

Geographical Diversification

Geographical diversification involves investing in assets located in different countries or regions. This strategy helps investors reduce their exposure to country-specific risks such as political instability, economic downturns, or currency fluctuations. By spreading investments globally, investors can benefit from growth opportunities in different markets and protect their portfolio from local market crises.

Sector-Based Diversification

Sector-based diversification involves investing in companies operating in different industries or sectors of the economy. This strategy helps investors reduce the risk associated with a specific sector downturn and take advantage of growth opportunities in other sectors. Sector-based diversification can also help investors capitalize on market trends and technological advancements across various industries.

Overall, a well-diversified investment portfolio combines different types of diversification strategies to minimize risk and maximize returns over the long term.

Strategies for Implementing Diversification

Diversification is a key strategy used by investors to manage risk and optimize returns in their investment portfolios. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the impact of volatility in any one area of the market. Here are some strategies for implementing diversification effectively:

Understanding Correlation and its Role in Diversification

Correlation measures the relationship between the price movements of different assets. Assets with a correlation coefficient of +1 move in perfect harmony, while assets with a correlation of -1 move in opposite directions. Diversification works best when assets have a low or negative correlation, as it helps to minimize the overall risk in the portfolio.

Tips for Achieving Diversification in a Portfolio

- Diversify across asset classes: Include a mix of stocks, bonds, real estate, and commodities in your portfolio to spread risk.

- Diversify within asset classes: Within each asset class, invest in a variety of securities to avoid concentration risk.

- Consider geographical diversification: Invest in both domestic and international markets to reduce exposure to any single economy or region.

- Rebalance regularly: Over time, the value of different assets in your portfolio may change, leading to an imbalance. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain the desired allocation.

Examples of How Rebalancing Maintains Diversification

Rebalancing is a crucial part of maintaining diversification in a portfolio. For example, if the stock market has a strong rally, the value of stocks in your portfolio may increase significantly, leading to an overweighting of equities. By rebalancing, you can sell some stocks and reinvest the proceeds in other asset classes to bring your portfolio back to its target allocation.

Risks and Challenges of Diversification

Diversification is a crucial strategy for mitigating risk and maximizing returns in an investment portfolio. However, like any investment approach, it comes with its own set of risks and challenges that investors need to be aware of in order to make informed decisions.

Potential Risks of Over-Diversification

While diversification is essential for reducing risk, over-diversification can actually have negative consequences. Investing in too many assets can dilute the potential for significant returns. It can also lead to higher transaction costs and make it difficult to monitor and manage the portfolio effectively. Additionally, over-diversification may result in the investor missing out on the full benefits of a well-performing asset because it is spread too thin across numerous investments.

Challenges Faced by Investors in Diversification

One of the main challenges investors face when trying to diversify their portfolio is finding the right balance between risk and return. It can be a complex and time-consuming process to select a mix of assets that will provide optimal diversification while still achieving the desired level of returns. Investors also need to consider factors such as correlation between assets, market conditions, and their own risk tolerance when building a diversified portfolio.

Optimizing Returns with Diversification and Concentration

Balancing diversification with concentration is key to optimizing returns in an investment portfolio. While diversification helps to spread risk, concentration allows investors to capitalize on high-performing assets. By striking the right balance between the two, investors can reduce overall portfolio risk while still capturing the potential for significant returns. It is important for investors to regularly review and adjust their portfolio to ensure that it remains aligned with their investment goals and risk tolerance.