International investments play a crucial role in the global economy, offering individuals and organizations opportunities to expand their financial portfolios beyond domestic boundaries. In this guide, we will delve into the significance, benefits, risks, and factors influencing international investments, providing a thorough understanding of this complex yet rewarding financial landscape.

Understanding International Investments

International investments refer to the allocation of capital across national borders in order to generate returns. These investments play a crucial role in the global economy by facilitating capital flows, supporting economic growth, and promoting international trade and development.

Types of International Investments

- Foreign Direct Investment (FDI): This involves a company or individual from one country making a physical investment in another country, such as establishing a subsidiary or acquiring a stake in a foreign company.

- Portfolio Investment: In this type of investment, individuals or institutions purchase financial assets in foreign markets, such as stocks, bonds, or other securities, without taking an active role in the management of the invested companies.

Reasons for Engaging in International Investments

- Diversification: International investments help diversify investment portfolios by spreading risk across different markets and asset classes.

- Access to New Markets: Investing internationally provides access to new markets, customers, and business opportunities that may not be available in the domestic market.

- Higher Returns: Emerging markets and developing countries often offer higher growth potential and returns on investment compared to mature markets.

- Strategic Expansion: Companies engage in international investments to expand their operations, gain a competitive advantage, or acquire valuable resources and technology.

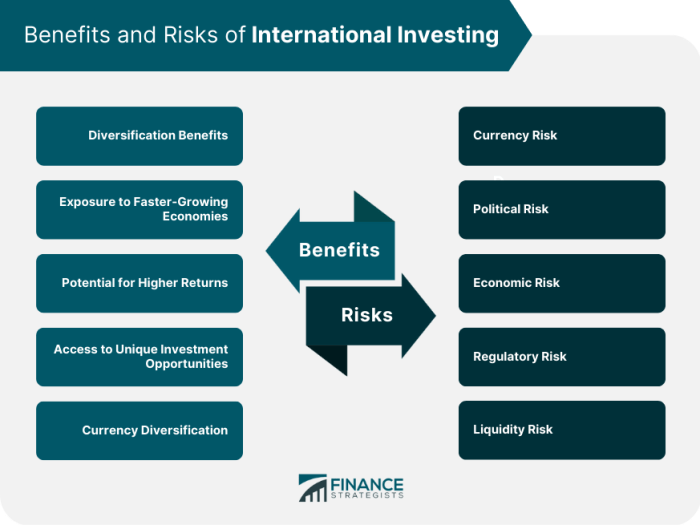

Benefits of International Investments

International investments offer a range of advantages that can significantly benefit investors looking to diversify their portfolios and maximize returns while minimizing risks.

Diversification of Investment Portfolios

- Diversifying investment portfolios through international investments allows investors to spread their risk across different markets, industries, and currencies.

- This diversification can help reduce the impact of a downturn in any single market or sector on the overall portfolio performance.

- By investing in a variety of international assets, investors can potentially enhance their long-term returns and minimize volatility.

Mitigation of Risks Associated with Domestic Market Fluctuations

- International investments can act as a hedge against domestic market fluctuations and economic downturns.

- When one market is experiencing a decline, another market may be performing well, balancing out the overall investment portfolio.

- By spreading investments globally, investors can reduce exposure to country-specific risks and geopolitical events that may impact domestic markets.

Potential for Higher Returns Compared to Domestic Investments

- International investments offer the potential for higher returns compared to domestic investments due to access to emerging markets and faster-growing economies.

- Investors can capitalize on opportunities for growth and innovation in foreign markets that may not be available in their home country.

- By diversifying geographically, investors can tap into a broader range of investment options that have the potential to deliver superior returns over the long term.

Risks and Challenges

International investments come with a set of risks and challenges that investors need to be aware of in order to make informed decisions. These risks can stem from various factors such as political instability, economic downturns, and fluctuations in currency exchange rates. In addition, challenges may arise when investors enter foreign markets due to differences in regulations, cultural norms, and business practices.

Identifying Risks in International Investments

- Political Risks: These include changes in government policies, political instability, and potential expropriation of assets by the host country.

- Economic Risks: Economic downturns, inflation, and changes in interest rates can impact the performance of investments in foreign markets.

- Currency Exchange Risks: Fluctuations in currency exchange rates can affect the value of investments and lead to potential losses.

Challenges in Foreign Markets

- Regulatory Challenges: Adhering to different regulations and legal frameworks in foreign countries can be complex and require careful navigation.

- Cultural Differences: Understanding and adapting to cultural norms and business practices in a foreign market is essential for building successful relationships and operations.

- Market Entry Barriers: Entry barriers such as tariffs, quotas, and restrictions on foreign ownership can pose challenges for investors looking to enter new markets.

Strategies to Manage Risks

- Diversification: Spreading investments across different countries and industries can help reduce the impact of risks in a single market.

- Hedging: Using financial instruments like futures contracts or options can help mitigate currency exchange risks.

- Research and Due Diligence: Conducting thorough research and due diligence on potential markets and investment opportunities can help investors make informed decisions and mitigate risks.

Factors Influencing International Investments

International investments are influenced by a variety of factors that can impact decision-making processes and outcomes. These factors include economic conditions, political stability, regulatory environment, exchange rates, currency fluctuations, and globalization trends. Understanding how these factors interact and shape investment opportunities is crucial for investors looking to expand their portfolios globally.

Economic Conditions

Economic conditions play a significant role in determining the attractiveness of international investments. Factors such as GDP growth, inflation rates, interest rates, and unemployment levels can all impact the performance of investments in foreign markets. Investors need to assess the economic stability and growth potential of a country before committing capital to ensure favorable returns.

Political Stability

Political stability is another critical factor that influences international investment decisions. Countries with stable governments, favorable business environments, and strong rule of law are more likely to attract foreign investors. Political unrest, corruption, and policy uncertainty can deter investors from allocating resources to these regions, increasing risks and reducing potential returns.

Regulatory Environment

The regulatory environment of a country also plays a crucial role in shaping international investment opportunities. Investors need to consider factors such as taxation policies, trade regulations, intellectual property laws, and market access restrictions when evaluating investment prospects. A transparent and business-friendly regulatory framework can enhance investor confidence and encourage capital flows into a country.

Exchange Rates and Currency Fluctuations

Exchange rates and currency fluctuations can have a significant impact on international investments. Fluctuations in exchange rates can affect the value of investments denominated in foreign currencies, leading to potential gains or losses for investors. Hedging strategies and risk management techniques are often employed to mitigate the effects of currency volatility and protect investment portfolios from adverse movements.

Globalization Trends

Globalization has played a major role in shaping international investment trends in recent years. The interconnectedness of global markets, advancements in technology, and the liberalization of trade have facilitated cross-border capital flows and investment opportunities. Investors need to consider the broader implications of globalization on their investment strategies and adapt to the changing dynamics of the global economy to capitalize on emerging trends.