Insurance policy comparisons set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the realm of insurance policies, we uncover the intricacies of comparing them to make informed decisions that suit individual needs and circumstances.

Introduction to Insurance Policy Comparisons

Insurance policy comparisons involve analyzing and evaluating different insurance plans to determine their features, coverage, and costs.

Comparing insurance policies is essential to ensure that individuals get the most suitable coverage for their needs at the best possible price. By comparing policies, individuals can make informed decisions based on their specific requirements and budget.

The Importance of Comparing Insurance Policies

- Helps individuals understand the coverage options available in the market.

- Allows individuals to assess the premiums, deductibles, and limits of different policies.

- Enables individuals to identify any gaps in coverage or potential overlaps.

How Comparing Policies Can Help Individuals Make Informed Decisions

- Provides a clear overview of the benefits and limitations of each policy.

- Allows individuals to weigh the costs against the coverage provided.

- Empowers individuals to choose a policy that aligns with their specific needs and financial goals.

Factors to Consider When Comparing Insurance Policies

When comparing insurance policies, it is essential to consider various factors to ensure you select the most suitable coverage for your needs. Key factors to consider include coverage, premiums, deductibles, and additional benefits.

Coverage

Coverage refers to the extent of protection provided by an insurance policy. It is crucial to evaluate the coverage offered by different policies to ensure it aligns with your specific needs. For example, when comparing health insurance policies, consider the range of medical services covered, including doctor visits, hospitalization, prescription drugs, and preventive care.

Premiums

Premiums are the amount you pay for an insurance policy. It is important to compare premiums across different policies to find an affordable option that fits your budget. Keep in mind that lower premiums may come with higher deductibles or limited coverage, so it is essential to strike a balance between cost and coverage.

Deductibles

Deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. When comparing policies, consider the deductible amount and how it may impact your overall costs. A higher deductible typically means lower premiums but requires you to pay more upfront in the event of a claim.

Personal Needs and Circumstances

Your personal needs and circumstances play a significant role in the insurance policy comparison process. Consider factors such as your health condition, lifestyle, financial situation, and future goals when evaluating different policies. For example, if you have a pre-existing medical condition, you may prioritize coverage for specialized treatments in a health insurance policy.

By carefully evaluating these key factors and considering your individual needs, you can make an informed decision when comparing insurance policies to ensure you choose the best coverage for your unique situation.

Methods for Comparing Insurance Policies

When it comes to comparing insurance policies, there are several methods available to consumers. Each method has its own set of pros and cons, so it’s important to understand how they work in order to make an informed decision.

Using Online Comparison Tools

- Pros:

- Convenient and easy to use.

- Provides a wide range of options in one place.

- Allows for quick side-by-side comparisons.

- Cons:

- May not always show all available options.

- Some tools may be biased towards certain insurers.

- Limited ability to customize search criteria.

Working with Brokers

- Pros:

- Brokers have in-depth knowledge of the insurance market.

- Can provide personalized recommendations based on individual needs.

- Assistance in understanding complex policy details.

- Cons:

- May be limited to the insurers they work with.

- Broker fees or commissions may affect overall cost.

- Process may take longer compared to online tools.

Tips for Effective Comparison

- Clearly define your insurance needs and budget constraints before starting the comparison process.

- Utilize multiple methods for comparison to ensure a comprehensive view of available options.

- Pay attention to coverage details, exclusions, and any additional benefits offered by each policy.

- Consider factors like customer reviews, claim processing time, and company reputation when making a decision.

- Seek clarification from insurers or brokers on any terms or conditions that are unclear to you.

Types of Insurance Policies That Are Commonly Compared

When individuals compare insurance policies, they often focus on common types such as auto insurance, health insurance, and life insurance. Each type has its own specific considerations and nuances that need to be taken into account when comparing them.

Auto Insurance

Auto insurance policies vary based on coverage limits, deductibles, and additional features such as roadside assistance. When comparing auto insurance policies, individuals should consider factors like premium costs, coverage options, and customer service ratings. For example, comparing quotes from different insurers can help find the best balance between cost and coverage.

Health Insurance

Health insurance policies differ in terms of network coverage, co-pays, deductibles, and coverage for prescription drugs. When comparing health insurance policies, it’s important to consider factors like network size, out-of-pocket costs, and coverage for specific medical needs. For instance, comparing different health insurance plans can help individuals find a policy that meets their healthcare needs and budget.

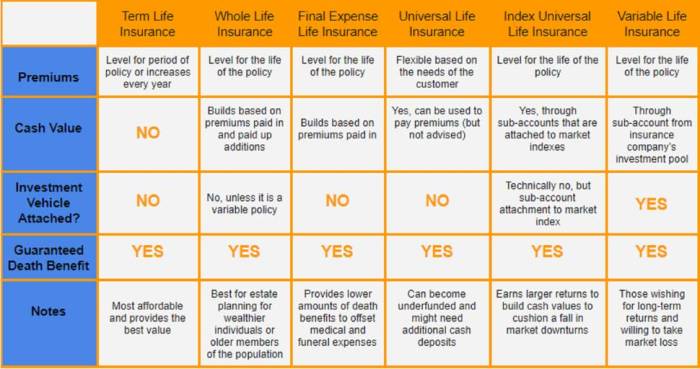

Life Insurance

Life insurance policies come in various forms such as term life, whole life, and universal life insurance. When comparing life insurance policies, individuals should look at factors like coverage amount, premium costs, and policy duration. For example, comparing quotes for different types of life insurance can help individuals choose a policy that provides adequate financial protection for their loved ones.