Embark on a journey towards financial freedom with our detailed guide on how to reduce debt. From understanding the nature of debt to practical strategies for repayment, this article covers all aspects of managing and reducing debt effectively.

As we delve into the intricacies of debt reduction, you’ll gain valuable insights and actionable tips to take control of your financial situation and pave the way towards a debt-free future.

Understanding Debt

Debt is an obligation or liability that one party owes to another. It can come in various forms, such as credit card debt, student loans, mortgages, or personal loans.

Types of Debt

- Consumer Debt: This includes credit card debt, personal loans, and auto loans.

- Student Loans: Loans taken out to finance education expenses.

- Mortgage Debt: Loans used to purchase a home or real estate property.

- Business Debt: Debt incurred by businesses to finance operations or growth.

Benefits and Drawbacks of Debt

Debt can be beneficial when used responsibly to finance investments that have the potential to increase wealth, such as buying a home or starting a business. However, excessive debt can lead to financial stress, high-interest payments, and long-term financial instability.

Common Reasons for Getting into Debt

- Unplanned Expenses: Sudden medical bills, car repairs, or other emergencies.

- Lack of Budgeting: Not having a budget or overspending beyond one’s means.

- Job Loss or Income Reduction: Loss of income can lead to reliance on credit to cover expenses.

- Desire for Instant Gratification: Using credit to purchase items without considering long-term consequences.

Assessing Your Debt Situation

To effectively reduce debt, it is crucial to first assess your current financial situation. This involves calculating your total debt, tracking spending habits, and understanding the interest rates on your debts.

Calculating Total Debt

Calculating your total debt involves adding up all outstanding balances on loans, credit cards, mortgages, and any other forms of debt. To do this, make a list of all your debts, including the total amount owed and the interest rates.

Total Debt = Sum of all outstanding balances on loans, credit cards, mortgages, etc.

Tracking Spending and Identifying Patterns

Tracking your spending is essential to identify patterns and areas where you can cut back. Use budgeting tools or apps to categorize your expenses and see where your money is going each month. Look for trends in your spending habits and pinpoint areas where you can reduce unnecessary expenses.

Knowing Interest Rates on Debts

Understanding the interest rates on your debts is crucial in prioritizing which debts to pay off first. High-interest debts, such as credit card debt, can quickly accumulate and become a significant financial burden. Make a list of all your debts along with their corresponding interest rates to determine which ones are costing you the most in interest payments.

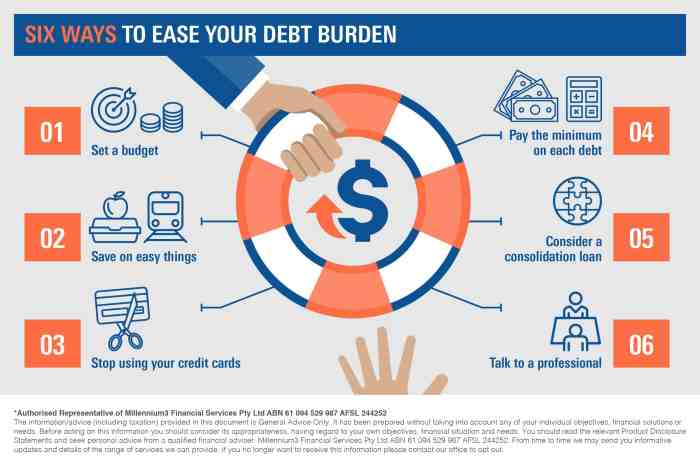

Creating a Budget

Creating a budget is a crucial step in reducing debt as it allows individuals to track their income and expenses, identify areas where they can cut back, and allocate funds specifically towards debt repayment.

Setting up a Realistic Budget

Creating a realistic budget involves listing all sources of income and categorizing expenses into fixed (such as rent, utilities) and variable (like groceries, entertainment). Here are tips for setting up a realistic budget:

- Track your spending: Keep a record of all expenses to understand where your money is going.

- Set financial goals: Determine how much you want to allocate towards debt repayment each month.

- Differentiate between needs and wants: Prioritize essential expenses over discretionary spending.

- Include a buffer: Account for unexpected expenses by setting aside a small amount for emergencies.

Prioritizing Debt Payments within a Budget

When creating a budget to reduce debt, it’s important to prioritize debt payments to pay off high-interest debts first. Here are ways to prioritize debt payments within a budget:

- Identify high-interest debts: List all debts and prioritize paying off those with the highest interest rates first.

- Consider the snowball method: Start by paying off the smallest debt first to build momentum and then move on to larger debts.

- Automate payments: Set up automatic payments for minimum amounts on all debts to avoid late fees.

- Allocate extra funds: Once minimum payments are covered, allocate any extra funds towards the debt with the highest interest rate.

Increasing Income Sources

Increasing your income is a crucial step in tackling debt effectively. By exploring various income sources, you can generate additional funds to pay off your debts faster. This can help you achieve financial stability and reduce the burden of debt over time.

Side Hustles and Part-time Jobs

One way to increase your income is by taking on side hustles or part-time jobs. These opportunities can provide you with extra cash that can be dedicated towards paying off your debts. Some examples of side hustles include freelance writing, tutoring, pet sitting, or driving for a ride-sharing service. Part-time jobs in retail, hospitality, or online work platforms can also be beneficial in boosting your income.

Passive Income Streams

Passive income streams are another avenue to consider when looking to increase your income. These sources of income require initial effort to set up but can generate revenue with minimal ongoing work. Examples of passive income streams include rental properties, dividend-paying stocks, creating and selling digital products, or investing in peer-to-peer lending platforms. By diversifying your income streams with passive sources, you can build a more stable financial foundation and accelerate debt repayment.

Cutting Expenses

Reducing unnecessary expenses is a crucial step towards managing and reducing debt. By cutting back on non-essential costs, individuals can free up more funds to allocate towards debt repayment. Additionally, negotiating bills and recurring payments can lead to potential savings, further aiding in debt reduction. It is important to distinguish between wants and needs to prioritize essential expenses and avoid unnecessary spending.

Strategies to Reduce Unnecessary Expenses

- Track and categorize expenses to identify areas where spending can be reduced.

- Avoid impulse purchases and stick to a shopping list when making purchases.

- Consider cheaper alternatives or DIY solutions for products or services.

- Limit dining out and prioritize cooking meals at home.

- Cancel subscriptions or services that are not regularly used.

Tips on Negotiating Bills and Recurring Payments

- Research competitors’ prices and leverage this information when negotiating with service providers.

- Contact service providers to inquire about discounts, promotions, or loyalty rewards.

- Consolidate services or bundle packages to potentially receive discounted rates.

- Ask for a lower interest rate or fee waiver on credit cards or loans to reduce overall costs.

Importance of Distinguishing Between Wants and Needs

- Identify essential expenses such as housing, utilities, and groceries, and prioritize these payments.

- Avoid unnecessary purchases that fulfill wants rather than needs to prevent overspending.

- Consider the long-term impact of expenses and prioritize financial goals over instant gratification.

- Create a budget that reflects essential expenses and limits discretionary spending to manage debt effectively.

Debt Repayment Strategies

When it comes to repaying debt, there are various strategies that individuals can employ to effectively manage and eliminate their outstanding balances. Two popular methods are the snowball and avalanche approaches, each with its own set of pros and cons. It’s essential to understand these strategies in detail to choose the most suitable one based on individual circumstances.

Snowball Method

The snowball method involves paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is cleared, the freed-up funds are directed towards the next smallest debt, creating a snowball effect. This approach provides a psychological boost as debts are eliminated one by one, motivating individuals to continue the repayment process.

- Pros:

- Offers a sense of accomplishment by clearing smaller debts quickly.

- Provides motivation to stay on track with debt repayment.

- Cons:

- May result in paying more interest over time compared to other methods.

- Not necessarily the most cost-effective approach.

Avalanche Method

In contrast, the avalanche method focuses on paying off debts with the highest interest rates first, while maintaining minimum payments on other debts. By tackling high-interest debts upfront, individuals can save money on interest charges over the long run. This method is financially efficient but may require more discipline and patience compared to the snowball approach.

- Pros:

- Reduces overall interest payments, saving money in the long term.

- Makes financial sense by targeting high-cost debts first.

- Cons:

- May take longer to see tangible progress compared to the snowball method.

- Requires strong discipline to stick to the plan.

It’s important for individuals to assess their financial situation, including the amount of debt, interest rates, and personal preferences, to determine which repayment strategy aligns best with their goals and capabilities.

Seeking Professional Help

Seeking help from financial advisors can be beneficial when dealing with overwhelming debt. These professionals can provide expert guidance and personalized strategies to help individuals regain control of their finances.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify repayment by reducing the number of monthly payments and potentially lowering overall interest costs.

- By consolidating debt, individuals may be able to secure a fixed interest rate, making it easier to budget for payments.

- Debt consolidation can also help improve credit scores by reducing the utilization of available credit.

- However, it is important to carefully consider the terms of the consolidation loan and ensure that it will result in overall savings.

Credit Counseling Services

Credit counseling services offer assistance with debt management and budgeting. These non-profit organizations work with individuals to create a plan for repaying debt and improving financial literacy.

- Credit counselors can negotiate with creditors to lower interest rates or waive fees, making repayment more manageable.

- They can also provide education on topics such as budgeting, saving, and responsible credit card use.

- It is essential to choose a reputable credit counseling agency that is accredited by organizations like the National Foundation for Credit Counseling (NFCC).