Exploring the intricacies of tax filing, this guide delves into the essential aspects of how to file taxes, providing valuable insights and practical tips for a seamless process. From understanding the concept of income tax to maximizing deductions and credits, this comprehensive overview aims to demystify the tax filing process for individuals and businesses alike.

Understanding Taxes

Income tax is a mandatory contribution imposed by the government on individuals and businesses based on their earnings. It is typically calculated as a percentage of the income earned within a specific period.

Types of Taxes

- Income Tax: A tax levied on the income of individuals and businesses.

- Property Tax: A tax based on the value of a person’s assets, such as real estate.

- Sales Tax: A consumption tax imposed on goods and services at the point of purchase.

- Excise Tax: A tax on specific goods, such as alcohol, tobacco, and gasoline.

- Payroll Tax: A tax withheld from an employee’s salary to fund social insurance programs.

Importance of Filing Taxes Accurately

Filing taxes accurately is crucial to avoid penalties and legal consequences. It ensures that individuals and businesses fulfill their civic responsibility, contribute to public services, and maintain compliance with tax laws. Accuracy in tax filing also helps in maximizing eligible deductions and credits, ultimately reducing tax liabilities.

Required Documentation

When it comes to filing taxes, having the necessary documentation is crucial to ensure accuracy and compliance with tax laws. Organizing and gathering the required documents in an orderly manner can streamline the tax filing process and help you avoid potential errors or omissions.

Essential Documents Needed for Filing Taxes

- W-2 forms: These forms are provided by your employer and Artikel your earnings and taxes withheld for the year.

- 1099 forms: If you received income from sources other than an employer, such as freelance work or investments, you will need these forms.

- Income records: Any additional income sources, such as rental income, should be documented and reported.

- Receipts for deductible expenses: Keep records of expenses that may be eligible for deductions, such as medical expenses, charitable contributions, and business expenses.

- Bank statements: Documentation of interest earned, dividends received, and other financial transactions should be included.

- Proof of healthcare coverage: Ensure you have documentation of your health insurance coverage for the year.

Organizing and Gathering Tax-Related Documents

- Create a designated folder or file for all tax-related documents to keep them organized and easily accessible.

- Label each document clearly and categorize them according to income, deductions, investments, and other relevant categories.

- Consider using digital tools or software to scan and store paper documents for easy retrieval and backup.

Significance of Keeping Receipts and Records

- Keeping receipts and records is essential for substantiating income, deductions, and credits claimed on your tax return.

- Documentation serves as evidence in case of an audit or if the IRS requests additional information regarding your tax filing.

- Maintaining accurate records can help you maximize deductions and credits, potentially reducing your tax liability.

Filing Status

When filing your taxes, it is important to determine your filing status as it can impact your tax return. There are various filing statuses recognized by the IRS, each with its own set of rules and implications.

Single

If you are unmarried, divorced, or legally separated according to state law, your filing status would be considered single. This status applies to individuals who do not qualify for any other filing status.

Married Filing Jointly

Married couples have the option to file jointly, combining their incomes and deductions on one tax return. This filing status typically results in lower tax rates and can provide certain tax benefits for couples.

Married Filing Separately

Alternatively, married couples can choose to file separately, keeping their incomes and deductions separate on individual tax returns. This option may be beneficial in certain situations, such as when one spouse has significant deductions or liabilities.

Head of Household

To qualify as head of household, you must be unmarried, have paid more than half the cost of maintaining a home for yourself and a qualifying dependent, and meet certain other criteria. This filing status often offers a lower tax rate than filing as single.

Qualifying Widow(er) with Dependent Child

If your spouse passed away within the last two years, you may be eligible to file as a qualifying widow(er) with a dependent child. This status allows you to use the married filing jointly tax rates for the year of your spouse’s death.

It is important to carefully consider your filing status when preparing your tax return, as it can impact your tax liability, eligibility for certain deductions and credits, and overall financial situation.

Income Sources

When filing taxes, it is crucial to accurately report all sources of income to ensure compliance with tax laws. Different types of income have varying tax implications, so it is important to understand how to report income from various sources.

Employment Income

Employment income includes wages, salaries, bonuses, and tips received from an employer. This income is typically reported on Form W-2, provided by the employer, and must be reported on your tax return. It is subject to federal income tax, Social Security tax, and Medicare tax.

Investment Income

Investment income includes interest, dividends, capital gains, and rental income. Interest and dividends are typically reported on Form 1099-INT and Form 1099-DIV, respectively. Capital gains from the sale of investments are reported on Schedule D. Rental income is reported on Schedule E. Each type of investment income may have different tax rates and implications.

Self-Employment Income

Self-employment income includes income from freelance work, independent contracting, or owning a business. This income is reported on Schedule C and is subject to self-employment tax in addition to income tax. Self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

Other Income Sources

Other sources of income that need to be reported include alimony, unemployment benefits, Social Security benefits, and gambling winnings. Each type of income has specific reporting requirements and tax implications.

Tax Implications

Different types of income may be taxed at different rates and may have specific deductions or credits associated with them. Understanding the tax implications of each income source can help taxpayers maximize their deductions and credits to minimize their tax liability.

Deductions and Credits

When filing taxes, deductions and credits play a crucial role in reducing the amount of taxable income and the overall tax liability for individuals. Deductions are expenses that can be subtracted from your taxable income, while credits are direct reductions of the tax you owe.

Difference between Deductions and Credits

Deductions reduce the amount of income that is subject to tax, while credits directly reduce the amount of tax owed. Deductions are typically based on expenses incurred throughout the year, such as mortgage interest, student loan interest, or charitable donations. Credits, on the other hand, are usually based on specific criteria, such as income level, number of dependents, or education expenses.

Common Deductions and Credits

- Mortgage Interest Deduction: Taxpayers can deduct the interest paid on their mortgage loan.

- Student Loan Interest Deduction: Individuals can deduct up to a certain amount of interest paid on qualified student loans.

- Child Tax Credit: A credit available to taxpayers with dependent children under a certain age.

- Earned Income Tax Credit (EITC): A credit for low to moderate-income individuals and families.

Maximizing Tax Savings with Deductions and Credits

To maximize tax savings, individuals should keep track of all eligible expenses for deductions and ensure they meet the criteria for claiming credits. For example, contributing to a retirement account can not only reduce taxable income but also qualify for a tax credit in some cases. By taking advantage of available deductions and credits, taxpayers can lower their tax liability and potentially receive a larger refund.

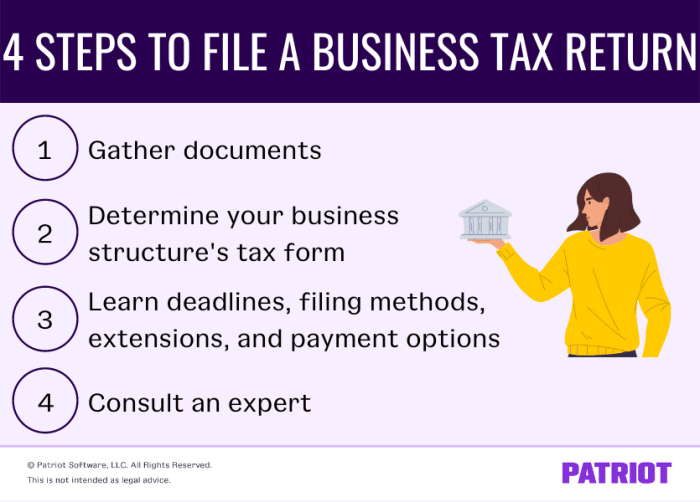

Filing Process

When it comes to filing your taxes, it is essential to follow a step-by-step process to ensure accuracy and compliance with tax laws. Whether you choose to use tax software or seek professional help, understanding the filing process is crucial. Additionally, being aware of important deadlines and extensions can help you avoid penalties and unnecessary stress.

Step-by-Step Process

- Gather all necessary documentation, including W-2 forms, 1099 forms, receipts, and any other relevant information.

- Determine your filing status, whether it’s single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Calculate your total income, including wages, salaries, tips, interest, dividends, and any other sources of income.

- Claim any deductions and credits you are eligible for, such as student loan interest, mortgage interest, charitable contributions, and education expenses.

- Fill out the appropriate tax forms, either electronically or by mail, ensuring all information is accurate and complete.

- Submit your tax return by the deadline, which is usually April 15th, unless an extension has been granted.

Using Tax Software or Seeking Professional Help

- Tax software can streamline the filing process by guiding you through each step and checking for errors or missing information.

- If you have a complex tax situation or feel overwhelmed by the process, seeking professional help from a tax preparer or accountant can ensure accuracy and compliance.

- Consider the cost and benefits of using tax software versus hiring a professional to assist with your tax return.

Important Deadlines and Extensions

- The deadline for filing your federal tax return is typically April 15th, unless it falls on a weekend or holiday, in which case it may be extended.

- If you need more time to file your taxes, you can request an extension until October 15th, but remember that this extension only applies to filing your return, not paying any taxes owed.

- Failing to file your taxes by the deadline can result in penalties and interest charges, so it’s crucial to file on time or request an extension if needed.

Tax Refunds and Payments

When it comes to tax refunds and payments, it is essential to understand how the process works and the different options available to taxpayers.

Tax Refunds

Tax refunds are the amount of money that the government returns to a taxpayer when they have paid more taxes than they owe. This typically occurs when the taxpayer has had too much money withheld from their paychecks throughout the year. The excess amount is then refunded to the taxpayer after they file their tax return.

- Taxpayers have the option to receive their tax refunds through direct deposit into their bank account, which is the fastest and most secure method.

- Alternatively, taxpayers can choose to receive a physical check in the mail, but this method usually takes longer to process.

Tax Payments

When taxpayers owe money to the government, they are required to make tax payments to cover the amount owed. There are several payment methods available for taxpayers to fulfill their tax obligations.

- Taxpayers can make payments online using the IRS’s Electronic Federal Tax Payment System (EFTPS), which allows for secure and convenient payments.

- Another option is to pay by credit or debit card, although there may be additional fees associated with this method.

- Taxpayers can also choose to pay by check or money order and mail it to the IRS, ensuring that the payment is postmarked by the due date.

Tax Planning

Tax planning is a crucial aspect of managing your finances effectively throughout the year to optimize your tax outcomes. By strategically planning ahead, you can take advantage of various opportunities to minimize your tax liability and maximize your savings.

Tips for Tax Planning Throughout the Year

- Keep track of your income and expenses regularly to have a clear understanding of your financial situation.

- Review your investment portfolio and consider tax-efficient investment strategies to reduce taxable income.

- Stay informed about changes in tax laws and regulations that may impact your tax situation.

- Consult with a tax professional or financial advisor to develop a comprehensive tax planning strategy tailored to your specific needs.

Strategies to Reduce Taxable Income Legally

- Contribute to retirement accounts such as a 401(k) or IRA to lower your taxable income and save for the future.

- Take advantage of tax deductions and credits available for education expenses, charitable contributions, and healthcare costs.

- Consider tax-loss harvesting to offset capital gains with capital losses in your investment portfolio.

- Explore tax-deferred investment options like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to reduce taxable income.

Adjusting Withholdings for Better Tax Outcomes

- Review your W-4 form regularly to ensure that your withholdings align with your tax liability and financial goals.

- Consider adjusting your withholdings if you experience major life changes such as marriage, divorce, or the birth of a child.

- Use the IRS withholding calculator to determine the appropriate amount of taxes to be withheld from your paycheck.

- Seek guidance from a tax professional to optimize your withholdings for better tax outcomes.