Kicking off with finance and mental health, this opening paragraph is designed to captivate and engage the readers, setting the tone scientific with objective tone style that unfolds with each word.

Financial stress can have a profound impact on mental well-being, and understanding the connection between the two is crucial. By addressing financial issues effectively, individuals can experience positive changes in their mental health.

Importance of Addressing Finance and Mental Health

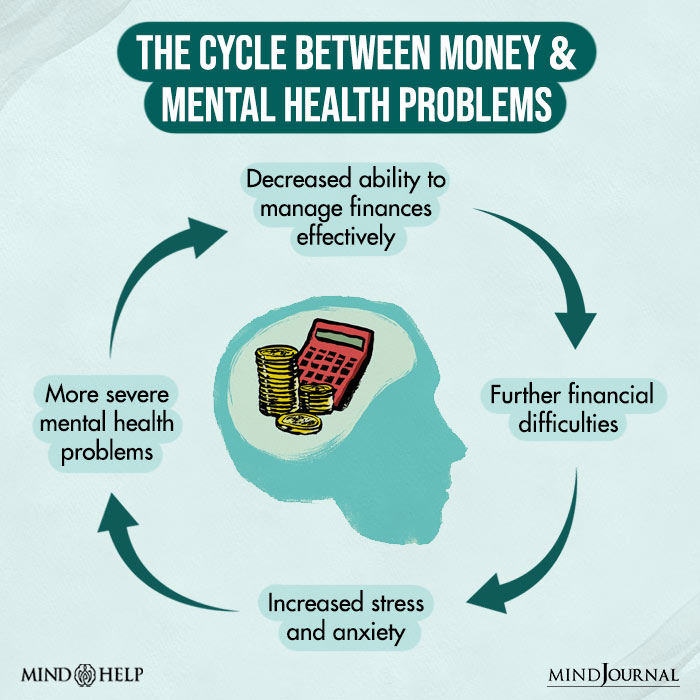

Financial stress can have a significant impact on mental health. The constant worry about money, debt, or financial instability can lead to anxiety, depression, and other mental health issues. This can create a vicious cycle where poor mental health affects financial decision-making and exacerbates the financial stress, further impacting mental well-being.

The connection between financial well-being and mental well-being is undeniable. When individuals are able to effectively manage their finances, they experience reduced stress levels, improved self-esteem, and a greater sense of control over their lives. This, in turn, can lead to better overall mental health and well-being.

Addressing financial issues can positively impact mental health in various ways. For example, creating a budget and sticking to it can reduce financial anxiety and provide a sense of financial security. Seeking professional help for financial planning or debt management can alleviate the burden of financial stress and improve mental well-being. Additionally, setting financial goals and working towards them can boost self-confidence and motivation, leading to a more positive outlook on life.

Strategies for Managing Financial Stress

Financial stress can have a significant impact on mental health, making it crucial to address and manage effectively. Here are some strategies to help you alleviate financial anxiety and improve your overall well-being.

Tips for Budgeting to Reduce Financial Anxiety

- Create a detailed budget outlining your income, expenses, and savings goals. This will help you track where your money is going and identify areas where you can cut back.

- Avoid impulse purchases by setting spending limits and sticking to them. Consider using cash envelopes or budgeting apps to help you stay on track.

- Regularly review and adjust your budget as needed to accommodate any changes in your financial situation. This will help you stay proactive and in control of your finances.

Benefits of Seeking Professional Financial Help

- Financial advisors can provide expert guidance on creating a personalized financial plan tailored to your goals and circumstances.

- Professional help can offer valuable insights on investment opportunities, retirement planning, debt management, and overall financial literacy.

- Working with a financial planner can give you peace of mind knowing that you have a solid financial strategy in place to achieve your long-term objectives.

Ways to Create a Financial Plan to Alleviate Stress

- Set clear financial goals, whether it’s saving for a major purchase, building an emergency fund, or planning for retirement. Having specific targets can help you stay motivated and focused.

- Break down your financial plan into manageable steps with deadlines to measure your progress and celebrate small victories along the way.

- Regularly reassess your financial plan to ensure it aligns with your current priorities and adjust as necessary to adapt to any changes in your life circumstances.

Impact of Mental Health on Financial Decisions

Mental health conditions can significantly impact financial decision-making. Individuals dealing with mental health issues may struggle with impulse control, leading to impulsive spending or risky financial behaviors. Depression and anxiety can also cloud judgment, making it difficult to make sound financial choices. Additionally, mental health issues can affect one’s ability to hold down a job or maintain stable income, further exacerbating financial struggles.

The Importance of Mental Health Awareness in Financial Planning

Awareness of mental health issues is crucial in financial planning to ensure that individuals are making informed and rational decisions regarding their finances. By recognizing the impact of mental health on financial behavior, individuals can take proactive steps to address any underlying issues and seek support when needed. This awareness can help prevent financial crises and ensure long-term financial stability.

Examples of How Seeking Mental Health Support Can Improve Financial Outcomes

- Improved Decision-Making: Seeking mental health support can help individuals manage their mental health conditions effectively, leading to improved decision-making abilities when it comes to finances.

- Stress Reduction: Addressing mental health issues can reduce stress levels, enabling individuals to focus on their financial goals and make clearer financial plans.

- Career Advancement: Mental health support can also help individuals perform better at work, leading to potential career advancement and increased income opportunities.

Resources for Addressing Finance and Mental Health

When facing challenges related to finance and mental health, it is crucial to seek support from organizations and professionals that specialize in providing assistance in these areas. Here are some resources that can help individuals struggling with financial and mental health issues:

Organizations Offering Support

- National Alliance on Mental Illness (NAMI): NAMI offers resources and support for individuals dealing with mental health conditions, including financial stressors that may arise.

- American Association of Suicidology: This organization provides resources for individuals experiencing financial difficulties that may impact mental health and lead to thoughts of suicide.

- Financial Therapy Association: The Financial Therapy Association connects individuals with financial counselors who can provide guidance on managing financial stress and its impact on mental well-being.

Role of Financial Counselors

Financial counselors play a crucial role in improving mental well-being by helping individuals develop healthy financial habits, create effective budgets, and navigate financial challenges that may be contributing to mental health issues. By addressing financial stressors, these professionals can help individuals achieve greater peace of mind and overall well-being.

Self-Help Resources

- Books: Reading self-help books focused on financial management and mental health can provide valuable insights and strategies for overcoming challenges in these areas.

- Online Forums: Participating in online forums and support groups dedicated to finance and mental health can offer a sense of community and valuable advice from individuals facing similar struggles.

- Mental Health Apps: There are various apps available that can help individuals track their mental health symptoms, practice mindfulness, and manage stress, which can in turn positively impact financial decision-making.