As decentralized finance (DeFi) takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Decentralized finance (DeFi) revolutionizes traditional financial systems by leveraging blockchain technology to create transparent and secure platforms. This guide delves into the intricacies of DeFi, exploring its benefits, protocols, risks, and challenges.

What is DeFi?

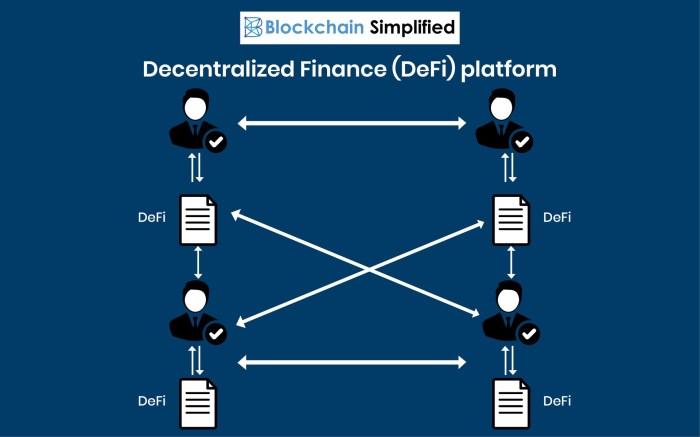

Decentralized finance, or DeFi, refers to a financial system built on blockchain technology that aims to provide open and permissionless access to financial services without the need for traditional intermediaries like banks or brokerages. In DeFi, users can interact directly with smart contracts and decentralized applications (DApps) to borrow, lend, trade, and invest assets in a secure and transparent manner.

How DeFi differs from traditional finance systems

DeFi differs from traditional finance systems in several key ways:

- Decentralization: DeFi platforms operate on decentralized networks, eliminating the need for central authorities and reducing the risk of censorship or control.

- Transparency: Transactions on DeFi platforms are recorded on the blockchain, providing an immutable and transparent ledger of all activities.

- Accessibility: DeFi allows anyone with an internet connection to access financial services, enabling financial inclusion for individuals who may not have access to traditional banking services.

- Interoperability: DeFi protocols are designed to work together seamlessly, enabling users to easily move assets and data across different platforms.

Examples of popular DeFi platforms and applications

Some popular DeFi platforms and applications include:

- Uniswap: A decentralized exchange (DEX) that allows users to swap various tokens directly from their wallets without the need for an intermediary.

- Compound: A lending platform that enables users to lend out their assets and earn interest, or borrow assets by providing collateral.

- Aave: A decentralized lending platform that offers users the ability to borrow and lend assets, as well as earn interest on deposited funds.

- MakerDAO: A decentralized autonomous organization (DAO) that issues the stablecoin DAI, which is collateralized by other crypto assets.

Benefits of DeFi

Decentralized finance (DeFi) offers numerous advantages that have the potential to revolutionize the traditional financial system. From transparency and security to financial inclusivity, DeFi brings a host of benefits to users and the global financial landscape.

Transparency and Security

DeFi platforms operate on blockchain technology, ensuring transparency through publicly available smart contracts. This transparency reduces the risk of fraud and manipulation, as all transactions are recorded on the blockchain for anyone to audit. Additionally, the decentralized nature of DeFi eliminates the need for intermediaries, reducing the risk of data breaches and cyber attacks that often plague centralized financial institutions.

Financial Inclusivity

One of the key advantages of DeFi is its ability to provide financial services to individuals who are underserved or excluded by traditional banking systems. By removing intermediaries such as banks and other financial institutions, DeFi allows anyone with an internet connection to access a wide range of financial products and services. This promotes financial inclusivity and empowers individuals to take control of their financial future.

Impact on the Global Financial Landscape

The rise of DeFi has the potential to reshape the global financial landscape by democratizing access to financial services and promoting financial independence. With DeFi, individuals can participate in a wide range of financial activities, such as lending, borrowing, and trading, without the need for a centralized authority. This shift towards decentralized finance has the potential to make financial services more efficient, affordable, and accessible to a larger population, ultimately challenging the dominance of traditional financial institutions.

DeFi Protocols and Smart Contracts

Smart contracts play a crucial role in decentralized finance (DeFi) protocols by enabling automated and trustless transactions. These self-executing contracts are coded to execute specific actions when predefined conditions are met, ensuring transparency and eliminating the need for intermediaries.

Different DeFi Protocols

- Lending Protocols: Platforms like Compound and Aave allow users to lend their cryptocurrency assets in exchange for interest.

- Decentralized Exchanges (DEX): DEXs such as Uniswap and SushiSwap enable users to trade cryptocurrencies directly with each other without the need for a centralized intermediary.

- Yield Farming: Yield farming involves users providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens.

Role of Smart Contracts in DeFi

Smart contracts ensure trust and automation in DeFi transactions by executing predefined actions without the need for human intervention. When a user interacts with a DeFi protocol, smart contracts enforce the rules and conditions set by the protocol, creating a secure and transparent environment for financial transactions. This trustless system reduces the risk of fraud and manipulation, providing users with greater control over their assets.

Risks and Challenges in DeFi

Decentralized finance (DeFi) offers many benefits, but it also comes with its fair share of risks and challenges. Understanding these potential pitfalls is crucial for users and developers in the DeFi space to mitigate and address them effectively.

Smart Contract Vulnerabilities

Smart contracts are the backbone of DeFi platforms, automating processes and enabling trustless transactions. However, they are also susceptible to bugs and vulnerabilities that can be exploited by malicious actors. One infamous example is the DAO hack in 2016, where a vulnerability in the smart contract led to the theft of millions of dollars worth of Ethereum.

Security Risks in Decentralized Exchanges

Decentralized exchanges (DEXs) are popular in the DeFi ecosystem for their non-custodial nature, allowing users to trade directly from their wallets. However, they are vulnerable to front-running attacks, where traders manipulate transactions before they are added to the blockchain. This can result in unfair advantages and financial losses for users.

Oracle Manipulation

Oracles are third-party services that provide external data to smart contracts, enabling DeFi platforms to interact with real-world information. However, oracles can be manipulated or compromised, leading to inaccurate data inputs that can trigger financial losses or exploits. The manipulation of oracles was notably seen in the flash loan attacks on DeFi protocols like MakerDAO and Compound Finance.

Regulatory Uncertainty

The regulatory landscape surrounding DeFi is still evolving, with regulators around the world grappling to understand and regulate this innovative space. Uncertainty about compliance and legal implications can pose challenges for DeFi projects, potentially leading to regulatory crackdowns or restrictions.

Lack of User Protections

Unlike traditional financial institutions, DeFi platforms do not offer the same level of consumer protections such as insurance, recourse mechanisms, or customer support. Users are responsible for safeguarding their assets and private keys, making them more vulnerable to hacks, scams, and operational risks.