Comparison of investment platforms delves into the intricate world of investment options, shedding light on the evolution from traditional methods to modern online platforms. This exploration offers a nuanced understanding of how investors can navigate the dynamic landscape of financial opportunities.

Investment platforms play a crucial role in shaping investment strategies, and understanding their features and differences is key to making informed decisions in the complex realm of finance.

Overview of Investment Platforms

Investment platforms are online tools or applications that allow individuals to invest in various financial instruments such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These platforms provide a convenient way for investors to manage their investments, track performance, and make informed decisions about their portfolios.

Using investment platforms is crucial for managing investments effectively as they offer access to a wide range of investment options, real-time market data, research tools, and educational resources. They also provide users with the ability to automate investment strategies, set financial goals, and monitor their progress towards achieving them.

In comparison to traditional investment methods, such as working with a financial advisor or investing through a brokerage firm, modern online investment platforms offer lower fees, greater transparency, and more control over investment decisions. They also provide a user-friendly interface, making it easier for beginners to start investing with as little as a few dollars.

Types of Investment Platforms

Investment platforms come in various types, each catering to different investment styles and preferences. Understanding these types can help investors choose the platform that best suits their needs.

Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios based on the investor’s risk tolerance and financial goals. These platforms offer a hands-off approach to investing and are suitable for those looking for a passive investment strategy. Examples of popular robo-advisors include Wealthfront, Betterment, and Wealthsimple.

Online Brokerages

Online brokerages are platforms that allow investors to buy and sell securities, such as stocks, bonds, and ETFs, through an online trading interface. They provide access to a wide range of investment options and tools for research and analysis. Some well-known online brokerages include E*TRADE, TD Ameritrade, and Charles Schwab.

Crowdfunding Platforms

Crowdfunding platforms enable individuals to invest in startups, real estate projects, or other ventures in exchange for equity or interest. These platforms offer opportunities for investors to diversify their portfolios and support innovative projects. Examples of crowdfunding platforms include Kickstarter, Indiegogo, and RealtyMogul.

Key Features and Tools

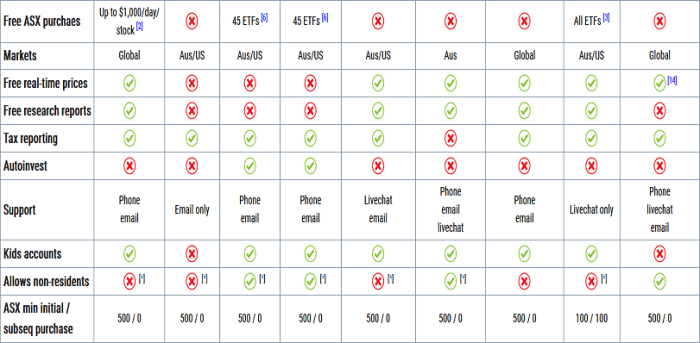

Investors should pay attention to several key features when choosing an investment platform. These features can greatly impact the investing experience and the overall success of their investment strategies. Additionally, tools such as portfolio trackers, investment calculators, and research reports can provide valuable insights and aid in decision-making. Let’s explore these aspects in more detail below.

Essential Features in an Investment Platform

- Security: Ensure the platform has robust security measures in place to protect your personal and financial information.

- Diverse Investment Options: Look for platforms that offer a wide range of investment options such as stocks, bonds, mutual funds, and ETFs.

- User-Friendly Interface: A user-friendly interface makes it easier to navigate the platform and execute trades efficiently.

- Customer Support: Access to responsive customer support can be crucial in case of any issues or queries.

- Educational Resources: Platforms that offer educational resources such as articles, tutorials, and webinars can help investors make informed decisions.

Value of Tools in Investment Platforms

- Portfolio Trackers: Portfolio trackers allow investors to monitor the performance of their investments in real-time and track their progress towards financial goals.

- Investment Calculators: Investment calculators help investors analyze the potential returns and risks of different investment options before making decisions.

- Research Reports: Access to research reports can provide valuable insights and recommendations from experts in the field, helping investors stay informed.

Comparison of User Interfaces

Each investment platform may have a different user interface, impacting ease of use and accessibility for investors. Some platforms may offer a more intuitive design with clear navigation, while others may have a cluttered layout that can be confusing. It’s essential for investors to choose a platform with a user-friendly interface that suits their preferences and needs.

Fees and Pricing Structures

Understanding the fee structures of investment platforms is crucial for investors to make informed decisions about where to invest their money. Different platforms have varying fee models, including commissions, management fees, and other charges, which can impact the overall returns for investors.

Comparison of Fee Structures

- Some investment platforms charge a commission for each trade executed, which can vary based on the type of investment.

- Management fees are another common fee structure, where a percentage of the total assets under management is charged annually.

- Additional charges may include account maintenance fees, transfer fees, and inactivity fees, among others.

Impact on Investors’ Returns

- The pricing models of different platforms can significantly impact investors’ overall returns, as higher fees can eat into profits over time.

- Investors should consider the fee structures of various platforms carefully to ensure that they are not paying more than necessary for the services provided.

- Transparent fee disclosures are essential for investors to understand the true cost of investing and make informed decisions about where to allocate their funds.

Security and Regulation

Investing in financial markets involves risks, and it is crucial for investment platforms to prioritize security measures and regulatory compliance to protect investors’ interests.

Security Protocols of Different Platforms

- Platform A utilizes end-to-end encryption to safeguard sensitive information such as personal data and financial details.

- Platform B implements multi-factor authentication for account access, adding an extra layer of security.

- Platform C employs regular security audits and penetration testing to identify and address potential vulnerabilities.

Regulatory Oversight in Investment Platforms

- Regulatory bodies such as the Securities and Exchange Commission (SEC) play a vital role in overseeing and monitoring investment platforms to ensure compliance with laws and regulations.

- These regulatory bodies set standards for transparency, investor protection, and fair practices within the financial industry.

- Investment platforms are required to adhere to these regulations to maintain credibility and trust among investors.