Building a diversified investment portfolio sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Diving into the intricacies of asset allocation strategies, risk management techniques, and investment options, this topic delves into the scientific aspects of creating a well-rounded investment portfolio.

Importance of a Diversified Portfolio

Building a diversified investment portfolio is crucial for investors looking to mitigate risk and optimize returns. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of volatility in any single investment on the overall portfolio.

Risk Management through Diversification

Diversification helps manage risk by spreading investments across a variety of assets that may react differently to the same event. For example, during a market downturn, while stocks may decline, bonds or real estate investments may remain stable or even increase in value. This helps cushion the overall impact on the portfolio and reduces the potential for significant losses.

- Diversification reduces the risk of significant losses: By not putting all your eggs in one basket, you are less exposed to the risk of a single investment underperforming.

- It smoothens out volatility: Different assets classes have different risk-return profiles, so by diversifying, you can achieve a more stable overall return.

- It provides exposure to different growth opportunities: Investing in various sectors and regions allows you to capitalize on different economic conditions and growth trends.

Benefits of Diversification in Returns and Stability

Diversification can offer potential benefits in terms of both returns and stability. While it does not guarantee profits or protect against losses, a well-diversified portfolio can help investors achieve a balance between risk and reward.

- Enhanced returns: Diversification can potentially increase overall returns by capturing growth opportunities across various assets.

- Reduced volatility: By spreading investments, diversification can help smooth out the ups and downs in the market, providing a more stable investment experience.

- Protection against correlation risk: Correlation risk occurs when assets in a portfolio move in the same direction. Diversification can help reduce this risk by including assets that have low or negative correlations.

Asset Allocation Strategies

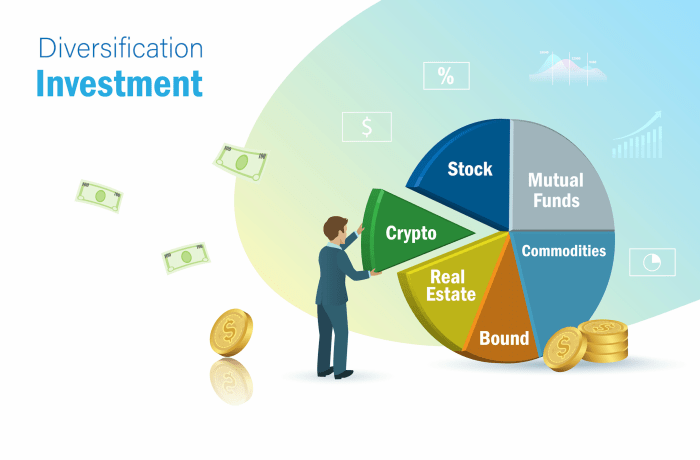

Asset allocation is a crucial component of building a diversified investment portfolio. It involves dividing your investments among different asset classes to manage risk and optimize returns. Let’s explore the different asset classes that can be included in a diversified portfolio and compare various asset allocation strategies.

Types of Asset Classes

- Equities: Stocks represent ownership in a company and offer the potential for high returns but come with higher volatility.

- Bonds: Fixed-income securities issued by governments or corporations provide regular interest payments and stability to a portfolio.

- Real Estate: Investing in properties or real estate investment trusts (REITs) can offer diversification and potential income through rental payments.

- Commodities: Investing in physical goods like gold, silver, oil, or agricultural products can provide a hedge against inflation and economic uncertainty.

- Alternative Investments: Hedge funds, private equity, and venture capital offer unique investment opportunities with potentially higher returns but also higher risk.

Asset Allocation Strategies

- Aggressive: An aggressive asset allocation strategy involves a higher allocation to equities and alternative investments, aiming for maximum growth but with increased risk.

- Moderate: A moderate strategy balances equities, bonds, and possibly some real estate or commodities to achieve a mix of growth and stability.

- Conservative: A conservative approach focuses on preserving capital by allocating more to bonds and less to equities, with minimal exposure to alternative investments.

Rebalancing and Its Significance

Rebalancing is the process of realigning your portfolio back to its target asset allocation. It involves selling assets that have performed well and buying more of those that have underperformed to maintain the desired risk-return profile. Rebalancing ensures that your portfolio stays diversified and aligned with your investment goals, preventing overexposure to any single asset class and controlling risk levels over time.

Risk Management Techniques

Risk management is a crucial aspect of building a diversified investment portfolio to protect against potential losses. By employing various techniques, investors can assess their risk tolerance, understand the correlation among assets, and use diversification to mitigate specific types of risks.

Assessing Risk Tolerance

When constructing a diversified investment portfolio, it is essential to evaluate your risk tolerance. This involves understanding how much volatility or potential loss you are willing to endure in exchange for potential returns. Investors can assess their risk tolerance by considering factors such as their investment goals, time horizon, financial situation, and psychological disposition towards risk.

Role of Correlation Among Assets

Correlation among assets plays a significant role in risk management within a diversified portfolio. Assets that are highly correlated tend to move in the same direction, increasing the overall risk of the portfolio. On the other hand, assets with low or negative correlation can help reduce the overall risk. By diversifying across assets with different correlations, investors can lower the portfolio’s volatility and enhance risk-adjusted returns.

Mitigating Specific Types of Risks through Diversification

Diversification can help mitigate various types of risks that investors face, including market risk and sector-specific risk. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of a single event on their portfolio. For example, during a market downturn, assets with low correlation may perform differently, providing a cushion against losses in one sector.

- Diversification can mitigate market risk by spreading investments across asset classes such as stocks, bonds, and commodities.

- Sector-specific risk can be reduced by investing in multiple industries to avoid overexposure to the performance of a single sector.

- Geographic diversification can protect against country-specific risks, such as political instability or economic downturns in a particular region.

Investment Options for Diversification

Diversifying an investment portfolio beyond traditional stocks and bonds is essential to manage risk and enhance potential returns. Alternative investment options offer unique benefits and considerations that can complement a well-rounded portfolio.

Real Estate

Investing in real estate can provide diversification by offering a different risk-return profile compared to stocks and bonds. Real estate investments can generate rental income and potential appreciation in property value, acting as a hedge against inflation. Considerations include property management, liquidity constraints, and market volatility.

Commodities

Including commodities, such as gold, silver, oil, or agricultural products, in a portfolio can provide a hedge against inflation and currency devaluation. Commodities tend to have low correlation with traditional assets, making them a valuable diversification tool. However, commodity prices can be volatile, influenced by factors like supply and demand dynamics and geopolitical events.

Alternative Assets

Alternative assets, such as private equity, hedge funds, or venture capital, offer access to unique investment opportunities not available in traditional markets. These investments can provide high returns but typically come with higher risk and lower liquidity. Due diligence and understanding the investment strategy are crucial when incorporating alternative assets into a portfolio.

Geographic Diversification

Geographic diversification involves investing in assets across different regions or countries to reduce concentration risk. It can help mitigate the impact of local economic downturns or geopolitical events on a portfolio. Achieving geographic diversification can be done through global mutual funds, exchange-traded funds (ETFs), or direct investment in foreign markets.