Delving into the realm of 401(k) withdrawal penalties sheds light on the intricacies of financial planning and retirement savings. As we navigate through the complex maze of penalties and regulations, a deeper understanding emerges, guiding us towards informed decisions and optimal financial outcomes.

Exploring the nuances of early withdrawals, penalties, and exceptions unveils a world where financial prudence and future security intersect.

Overview of 401(k) Withdrawal Penalties

401(k) withdrawal penalties are charges imposed on individuals who withdraw funds from their 401(k) retirement accounts before reaching the specified age or meeting certain criteria. These penalties are designed to discourage early withdrawals and ensure that individuals use their retirement savings for their intended purpose.

Examples of situations where 401(k) withdrawal penalties may apply include:

– Withdrawing funds before the age of 59 ½ without a qualifying reason.

– Using the funds for non-qualified expenses such as luxury purchases or vacations.

– Failing to meet specific criteria for hardship withdrawals.

The purpose of imposing penalties on early withdrawals from a 401(k) account is to encourage individuals to save for retirement and discourage them from using these funds for short-term financial needs. By penalizing early withdrawals, the government aims to promote long-term financial security and ensure that individuals have sufficient savings to support themselves during retirement.

Types of 401(k) Withdrawal Penalties

When it comes to 401(k) withdrawal penalties, there are two main types: early withdrawal penalties and penalties for non-qualified distributions. These penalties can vary based on the age of the account holder and certain exceptions or special circumstances may apply where penalties could be waived.

Early Withdrawal Penalties

Early withdrawal penalties are incurred when funds are taken out of a 401(k) account before the account holder reaches the age of 59 ½. In such cases, the IRS imposes a penalty of 10% on the amount withdrawn, in addition to any applicable income tax. This penalty is designed to discourage individuals from tapping into their retirement savings prematurely.

Penalties for Non-Qualified Distributions

Penalties for non-qualified distributions refer to withdrawals that do not meet the specific criteria set by the IRS for accessing 401(k) funds without penalty. These criteria typically include events such as disability, death, or certain financial hardships. If a distribution does not fall under these qualifying circumstances, a penalty of 10% may be applied along with income tax.

Variations Based on Age

The penalties for early withdrawals can vary based on the age of the account holder. For example, if an individual withdraws funds from their 401(k) between the ages of 55 and 59 ½, they may be exempt from the 10% penalty in certain situations, such as separating from their employer. However, if withdrawals are made before the age of 55, the penalty is typically enforced.

Exceptions and Waivers

There are some exceptions or special circumstances where penalties for early withdrawals may be waived. These exceptions can include situations such as disability, medical expenses exceeding a certain percentage of income, or court-ordered distributions. Additionally, first-time home purchases or qualified higher education expenses may also qualify for penalty waivers under certain conditions.

Calculation of 401(k) Withdrawal Penalties

When it comes to early withdrawal penalties from a 401(k) account, it’s essential to understand how these penalties are calculated. The penalties are designed to discourage individuals from withdrawing funds before reaching retirement age and are imposed to ensure the long-term growth of retirement savings.

Formula for Calculating Early Withdrawal Penalties

Early withdrawal penalties from a 401(k) account are typically calculated as a percentage of the amount withdrawn. The specific formula used to calculate these penalties can vary depending on the circumstances, but a common method is to apply a penalty of 10% to the amount withdrawn.

Examples of Penalty Calculation

- If an individual withdraws $10,000 from their 401(k) account before reaching the age of 59 ½, they would incur a penalty of $1,000 (10% of $10,000).

- In another scenario, if someone withdraws $20,000 early, the penalty would amount to $2,000 (10% of $20,000).

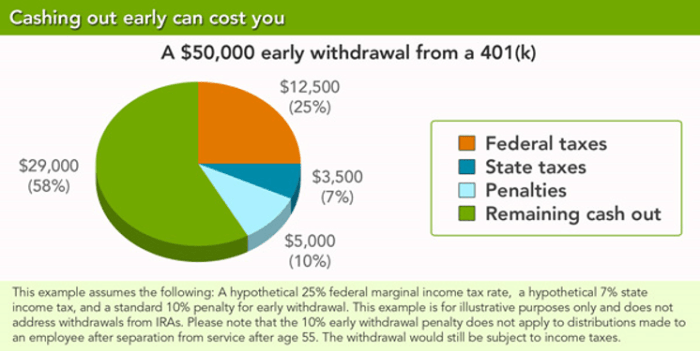

Impact of Penalties on Withdrawn Amount

The imposition of early withdrawal penalties can significantly reduce the overall amount that an individual receives when they withdraw funds from their 401(k) account prematurely. It’s important for individuals to consider these penalties carefully and explore alternative options to avoid unnecessary financial losses in the long run.

Strategies to Minimize 401(k) Withdrawal Penalties

When it comes to withdrawing from your 401(k), it is essential to consider strategies that can help minimize penalties and protect your retirement savings. Here are some tips to help you navigate the process effectively.

Implications of Hardship Withdrawals versus Loans

Hardship withdrawals and loans from your 401(k) can have different implications on penalty amounts. Hardship withdrawals are typically subject to a 10% early withdrawal penalty if you are under the age of 59 ½, in addition to income tax. On the other hand, loans from your 401(k) are not subject to the same penalties, but you will need to repay the loan with interest. It is crucial to weigh the pros and cons of each option and consider the long-term impact on your retirement savings.

Long-Term Consequences of Frequent Withdrawals

Frequent withdrawals from your 401(k) can have significant long-term consequences on your retirement savings. Not only do you risk depleting your account balance and missing out on potential growth, but you may also incur hefty penalties and taxes. It is essential to only withdraw from your 401(k) as a last resort and explore other financial options to avoid jeopardizing your retirement goals. Consider consulting with a financial advisor to develop a comprehensive strategy that aligns with your financial objectives.