With Trends in financial technology (fintech) at the forefront, get ready to ride the wave of innovation and disruption in the financial world. From cutting-edge technologies to regulatory challenges, this topic is a rollercoaster of excitement and change.

Let’s explore the ins and outs of fintech and how it’s reshaping the way we think about money and transactions.

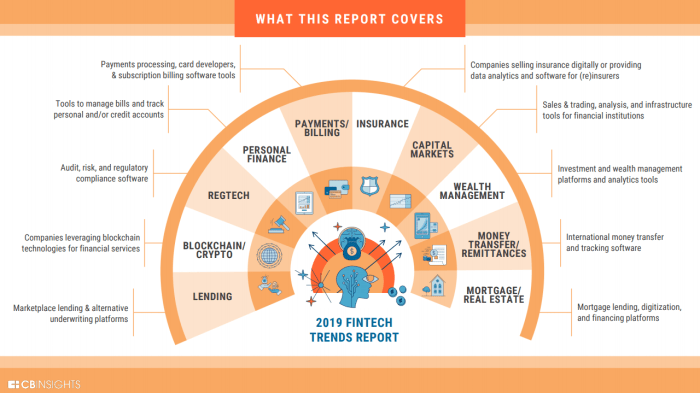

Overview of Fintech Trends

Fintech, short for financial technology, is revolutionizing the way we handle money and financial transactions. It encompasses a wide range of innovations and technologies that are disrupting traditional financial services. From mobile payments to blockchain technology, fintech is reshaping the financial industry as we know it.

Key Areas of Rapid Growth in Fintech, Trends in financial technology (fintech)

- Mobile Payments: With the rise of smartphones, mobile payment solutions like Apple Pay and Google Pay are becoming increasingly popular, allowing users to make transactions with just a tap of their phone.

- Blockchain and Cryptocurrency: The decentralized nature of blockchain technology and the emergence of cryptocurrencies like Bitcoin are challenging traditional banking systems and offering new ways to store and transfer value.

- Robo-Advisors: Automated investment platforms are gaining traction, providing affordable and accessible investment advice to individuals through algorithms and artificial intelligence.

- Peer-to-Peer Lending: Platforms like Lending Club and Prosper are connecting borrowers directly with lenders, cutting out the middleman and offering competitive interest rates.

Impact of Fintech Trends on Traditional Financial Institutions

- Competition: Fintech startups are challenging traditional banks and financial institutions by offering innovative and user-friendly services that cater to the digital-savvy consumer.

- Efficiency: Fintech solutions are streamlining processes and reducing costs for traditional financial institutions, forcing them to adapt and improve their own services to stay competitive.

- Cybersecurity: With the increase in digital transactions and data sharing, cybersecurity has become a top priority for both fintech companies and traditional financial institutions to protect sensitive information from cyber threats.

Emerging Technologies in Fintech

The fintech industry is constantly evolving with the emergence of new technologies that are reshaping the way financial services are delivered. Technologies such as blockchain, artificial intelligence (AI), machine learning, Internet of Things (IoT), and biometrics are playing a crucial role in transforming the fintech landscape.

Blockchain

Blockchain technology, known for its decentralized and secure nature, is revolutionizing the way financial transactions are conducted. It enables secure, transparent, and tamper-proof record-keeping, making it ideal for applications like smart contracts, cross-border payments, and digital identity verification.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being used in fintech to analyze vast amounts of data quickly and accurately. These technologies are powering chatbots for customer service, fraud detection systems, personalized financial advice, and risk assessment models.

Internet of Things (IoT) and Biometrics

IoT devices and biometric authentication methods are enhancing security and convenience in financial services. IoT devices like wearables and sensors enable seamless payment transactions, while biometric authentication methods such as fingerprint scanning and facial recognition add an extra layer of security to digital payments.

Fintech Regulation and Compliance

In the fast-paced world of financial technology (fintech), companies often face numerous regulatory challenges that can impact their operations and growth. It is crucial for fintech firms to navigate the complex regulatory landscape to ensure compliance and maintain security and stability in their operations.

Regulatory Challenges Faced by Fintech Companies

- One of the main challenges faced by fintech companies is the lack of standardized regulations across different jurisdictions. This often leads to confusion and uncertainty regarding which regulations apply to their specific business activities.

- Another challenge is the evolving nature of technology, which can outpace regulatory frameworks. Fintech companies must constantly adapt to new technologies while ensuring they comply with existing regulations.

- Fintech firms also face challenges related to data privacy and protection, as handling sensitive financial data requires strict compliance with data protection regulations.

Examples of Regulatory Frameworks Impacting Fintech Globally

- In the United States, fintech companies must comply with regulations such as the Bank Secrecy Act (BSA) and the Anti-Money Laundering (AML) regulations enforced by the Financial Crimes Enforcement Network (FinCEN).

- In the European Union, fintech firms are subject to the General Data Protection Regulation (GDPR) which governs the processing and protection of personal data.

- In Asia, countries like Singapore have established regulatory sandboxes to allow fintech companies to test innovative products and services within a controlled environment before full compliance is required.

Importance of Compliance in Ensuring Fintech Security and Stability

- Compliance with regulatory requirements is essential for fintech companies to build trust with customers and partners. It demonstrates a commitment to transparency and accountability in their operations.

- Failure to comply with regulations can result in hefty fines, legal penalties, and reputational damage for fintech companies, potentially leading to business failure.

- Ensuring compliance also helps fintech firms mitigate risks associated with financial crimes such as money laundering and fraud, contributing to the overall stability of the financial ecosystem.

Fintech Adoption and User Behavior

As financial technology continues to reshape the way we interact with money, understanding the factors influencing its adoption and user behavior becomes crucial. Let’s delve into how fintech companies are navigating this changing landscape.

Factors Influencing Fintech Adoption

- Convenience: One of the primary drivers behind the adoption of fintech solutions is the convenience they offer. Users can access banking services, make payments, and manage investments from the comfort of their own homes.

- Cost-effectiveness: Fintech companies often provide services at a lower cost compared to traditional financial institutions, making them an attractive option for budget-conscious consumers.

- Security: With advanced encryption and authentication technologies, fintech companies prioritize the security of user data, instilling trust among consumers.

Changing User Behavior towards Digital Banking

- Mobile-first Approach: The shift towards mobile banking has been significant, with users preferring to conduct financial transactions on their smartphones due to the convenience and accessibility it offers.

- Personalization: Users now expect personalized experiences when interacting with financial services, prompting fintech companies to tailor their offerings to individual preferences.

- Emphasis on Financial Education: Fintech companies are focusing on educating users about financial literacy, empowering them to make informed decisions and manage their money effectively.

Adapting to User Demands

- Enhanced User Experience: Fintech companies are constantly innovating to enhance the user experience, whether through intuitive interfaces, AI-driven chatbots, or seamless integration with other digital services.

- Expansion of Services: To meet the evolving needs of users, fintech companies are expanding their service offerings beyond basic banking to include investment management, insurance, and even cryptocurrency services.

- Regulatory Compliance: Fintech companies are proactively ensuring compliance with regulations to build trust with users and maintain a secure financial ecosystem.

Investment and Funding in Fintech: Trends In Financial Technology (fintech)

Investment and funding in the fintech sector play a crucial role in driving innovation and growth. Understanding the trends in this area can provide valuable insights into the future of financial technology.

Trends in Investment and Funding

- Venture capital continues to be a major source of funding for fintech startups, with investors looking for high-growth opportunities in this rapidly evolving industry.

- Strategic investments from traditional financial institutions are increasing as they seek to collaborate with fintech companies to enhance their services and remain competitive.

- Initial Coin Offerings (ICOs) and crowdfunding platforms have emerged as alternative methods for fintech startups to raise capital, offering new opportunities for investors.

Key Players in Fintech Investment

- Major venture capital firms such as Sequoia Capital, Andreessen Horowitz, and Accel Partners are actively investing in fintech startups, providing not only funding but also valuable expertise and networks.

- Private equity firms like Blackstone and KKR are also making significant investments in established fintech companies, fueling their growth and expansion.

Impact of Venture Capital and Private Equity

- Venture capital investments enable early-stage fintech startups to develop their products, scale their operations, and reach a wider market, driving innovation in the industry.

- Private equity investments provide growth capital to established fintech companies, helping them expand into new markets, acquire complementary businesses, and strengthen their competitive position.

Fintech Partnerships and Collaborations

Fintech partnerships and collaborations play a crucial role in driving innovation and growth within the financial technology industry. By teaming up with traditional financial institutions, fintech firms can leverage their expertise, resources, and customer base to create mutually beneficial relationships.

Importance of Partnerships

- Access to a larger customer base: Fintech startups can reach a wider audience by partnering with established financial institutions that already have a large customer base.

- Enhanced credibility: Collaborating with well-known banks or financial organizations can boost the credibility and trustworthiness of fintech companies in the eyes of consumers.

- Combining strengths: Traditional financial institutions bring industry experience and regulatory knowledge, while fintech firms offer innovation and agility, creating a powerful partnership.

Successful Collaborations

- Stripe and Visa: Stripe partnered with Visa to provide innovative payment solutions, benefiting from Visa’s extensive network and global reach.

- Square and JPMorgan Chase: Square collaborated with JPMorgan Chase to offer small business loans, combining Square’s technology with JPMorgan’s lending capabilities.

- Plaid and Goldman Sachs: Plaid partnered with Goldman Sachs to enable secure financial data sharing, enhancing both companies’ services and offerings.

Benefits for Startups and Established Firms

- Accelerated growth: Fintech startups can scale more quickly by partnering with established firms that provide resources and support.

- Market expansion: Traditional financial institutions can tap into new markets and customer segments through collaborations with fintech companies.

- Innovation and agility: Established firms can benefit from the innovative technologies and approaches of fintech startups, staying competitive in a rapidly evolving industry.