Diving into the realm of Peer-to-peer lending opens up a world of financial opportunities and innovation. From revolutionizing traditional lending models to promoting financial inclusion, this dynamic industry is reshaping the way we think about borrowing and investing.

As we delve deeper into the various aspects of Peer-to-peer lending, a clearer picture emerges of its impact and potential for the future.

Overview of Peer-to-Peer Lending

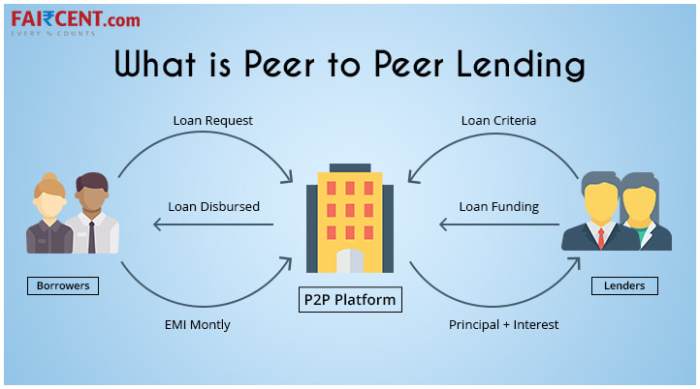

Peer-to-peer lending, often referred to as P2P lending, is a method of debt financing that enables individuals to borrow and lend money without the use of an official financial institution as an intermediary. This form of lending has gained popularity in recent years due to its ability to connect borrowers directly with lenders through online platforms.

Key Players in Peer-to-Peer Lending Platforms

- Borrowers: Individuals or small businesses seeking funds for various purposes.

- Lenders: Individuals or institutional investors looking to earn returns by lending money.

- P2P Platforms: Online companies that facilitate the loan process, including matching borrowers with lenders, conducting credit checks, and managing payments.

Differences from Traditional Lending Models

- Direct Connection: P2P lending eliminates the need for traditional banks, allowing borrowers and lenders to interact directly.

- Lower Fees: P2P platforms typically have lower fees compared to banks, making it a more cost-effective option for borrowers.

- Diverse Lending Options: P2P lending offers a wider range of borrowing and investing options, catering to different risk preferences.

Examples of Successful Peer-to-Peer Lending Platforms

- LendingClub: One of the largest P2P lending platforms in the U.S., connecting borrowers with investors.

- Prosper: Another well-known P2P lending platform that offers personal loans to borrowers.

- Funding Circle: A P2P lending platform focused on small businesses, providing access to business loans.

Benefits of Peer-to-Peer Lending

Peer-to-peer lending offers numerous advantages for both borrowers and investors, promoting financial inclusion and providing an alternative to traditional banking systems.

Advantages for Borrowers

- Access to Funding: Borrowers who may not qualify for loans from traditional financial institutions can access funds through peer-to-peer lending platforms.

- Lower Interest Rates: Peer-to-peer lending often offers lower interest rates compared to traditional banks, making it more affordable for borrowers.

- Quick Approval Process: Borrowers can receive funding faster through peer-to-peer lending platforms due to streamlined processes and less strict requirements.

Benefits for Investors

- Diversification: Investors can diversify their portfolios by investing in multiple loans across different risk profiles, reducing overall risk.

- Potential for Higher Returns: Peer-to-peer lending can offer higher returns compared to traditional investment options like savings accounts or CDs.

- Control and Transparency: Investors have more control over their investments and can choose which loans to fund based on their risk tolerance and preferences.

Financial Inclusion

Peer-to-peer lending plays a crucial role in promoting financial inclusion by providing access to credit for individuals who are underserved by traditional banking systems. This helps bridge the gap and allows more people to participate in the economy.

Comparison with Traditional Banking

- Flexibility: Peer-to-peer lending platforms offer more flexibility in terms of loan terms and rates compared to traditional banks.

- Efficiency: The online nature of peer-to-peer lending allows for quicker loan approval and disbursement processes, benefiting both borrowers and investors.

- Personalized Approach: Peer-to-peer lending platforms often provide a more personalized approach to borrowing and investing, enhancing the overall experience for users.

Risks and Challenges in Peer-to-Peer Lending

Peer-to-peer lending, while offering numerous benefits, also comes with its fair share of risks and challenges that both borrowers and investors need to be aware of.

Risks for Borrowers

- Borrower default: One of the biggest risks for borrowers is the possibility of not being able to repay the loan, leading to default.

- High interest rates: Some peer-to-peer lending platforms may charge high interest rates, making it challenging for borrowers to meet repayment obligations.

- Lack of regulation: Unlike traditional financial institutions, peer-to-peer lending platforms may not be as heavily regulated, exposing borrowers to potential risks.

Challenges for Investors

- Risk of loan defaults: Investors face the risk of borrowers defaulting on their loans, resulting in financial losses.

- Lack of diversification: Investing in peer-to-peer lending can be risky if investors do not diversify their portfolios across different loans to mitigate risks.

- Liquidity constraints: Unlike traditional investments, peer-to-peer lending investments may not be easily liquidated, making it challenging for investors to access their funds when needed.

Regulatory Issues and Challenges

- Regulatory uncertainty: The peer-to-peer lending industry is still relatively new, leading to regulatory challenges as authorities strive to catch up with the evolving landscape.

- Compliance requirements: Peer-to-peer lending platforms need to navigate complex regulatory frameworks, adding to operational costs and potential legal risks.

- Consumer protection: Ensuring that borrowers and investors are adequately protected from fraud and misconduct remains a key regulatory challenge in the industry.

Examples of Fraud or Scams

- False identity: Some borrowers may provide false information to obtain loans, leading to fraudulent activities on peer-to-peer lending platforms.

- Phishing scams: Investors may fall victim to phishing scams where their personal and financial information is compromised, posing a risk to their investments.

- Ponzi schemes: There have been instances of fraudulent schemes disguised as legitimate peer-to-peer lending opportunities, deceiving investors and causing financial harm.

Future Trends in Peer-to-Peer Lending

Peer-to-peer lending is constantly evolving, and several emerging technologies are shaping its future. Let’s delve into some key trends that are likely to impact the industry.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize peer-to-peer lending by providing a decentralized and secure platform for transactions. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code, can automate the lending process and reduce the need for intermediaries. This can lead to lower costs, increased transparency, and enhanced security for borrowers and lenders alike.

AI and Machine Learning

The integration of artificial intelligence and machine learning algorithms in peer-to-peer lending platforms can improve credit scoring models, risk assessment, and fraud detection. By analyzing vast amounts of data, AI can help lenders make more informed decisions and provide personalized loan offers to borrowers. This can result in faster loan approvals, reduced default rates, and overall efficiency in the lending process.

Evolution of Peer-to-Peer Lending

In the coming years, peer-to-peer lending is expected to continue expanding globally, attracting more investors and borrowers. The industry may see increased regulation to ensure consumer protection and mitigate risks. Additionally, the rise of niche lending platforms catering to specific sectors or demographics could provide more options for borrowers seeking funding. Overall, peer-to-peer lending is poised to become a mainstream alternative to traditional banking services, offering competitive rates and innovative solutions to meet the financial needs of individuals and small businesses.