Strategies for saving money sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Get ready to dive into the world of financial savvy with these tips and tricks to secure your future and reach your goals.

Importance of Saving Money

Saving money is crucial for financial security as it allows individuals to build a safety net for unexpected expenses, achieve long-term goals, and secure a stable future.

Building Emergency Fund

One of the key benefits of saving money is the ability to create an emergency fund. This fund can be used to cover unexpected expenses such as medical emergencies, car repairs, or job loss without going into debt.

Long-Term Goals

Saving money helps individuals achieve long-term goals such as buying a house, starting a business, or retiring comfortably. By consistently saving and investing, individuals can work towards these milestones and secure their financial future.

Financial Well-Being

Not saving money can have a significant impact on individuals’ financial well-being. Without savings, individuals may struggle to cover basic expenses, face financial stress, and have limited options in times of need. This can lead to a cycle of debt and financial instability.

Setting Financial Goals

Setting financial goals is crucial when it comes to saving money. By having clear objectives in mind, you can stay motivated and focused on your saving journey. Here are some key points to consider:

Types of Financial Goals

- Emergency Fund: Saving up for unexpected expenses like medical bills or car repairs.

- Debt Repayment: Paying off credit card debt or student loans.

- Big Purchases: Saving for a new car, house, or dream vacation.

- Retirement: Building a nest egg for your golden years.

Importance of SMART Goals

Setting SMART goals for saving money is essential for success. These goals are:

- Specific: Clearly define what you want to achieve.

- Measurable: Set targets that you can track and quantify.

- Achievable: Make sure your goals are realistic and within reach.

- Relevant: Ensure that your goals align with your financial priorities.

- Time-bound: Set deadlines to keep yourself accountable and on track.

Prioritizing Financial Goals

When you have multiple financial goals, it’s important to prioritize them to make the most of your savings. Here are some tips:

- Assess your current financial situation and identify your most pressing needs.

- Rank your goals based on their urgency and importance.

- Consider the long-term impact of each goal on your overall financial well-being.

- Allocate a portion of your savings towards each goal, focusing on high-priority ones first.

Creating a Budget

Creating a budget is crucial when it comes to saving money effectively. It allows you to track your income, expenses, and savings, helping you to make informed financial decisions.

Steps to Create a Budget

- Track Your Income: Begin by calculating your total monthly income from all sources, including your salary, bonuses, and any other earnings.

- Identify Your Expenses: List out all your monthly expenses, such as rent, groceries, utilities, transportation, and entertainment.

- Determine Your Savings Goals: Decide how much you want to save each month and set specific goals to achieve them.

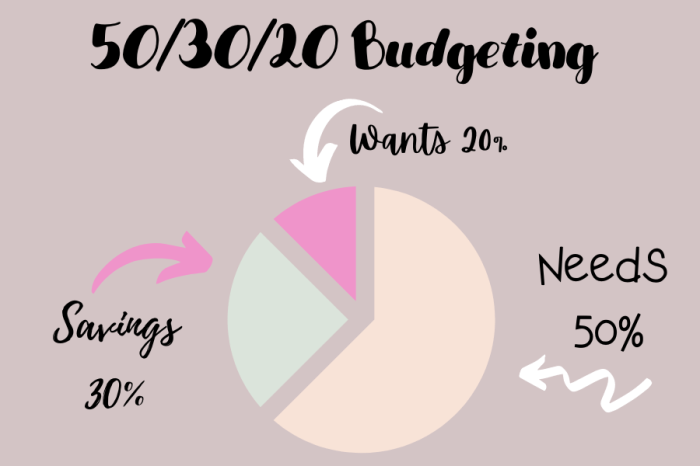

- Create Categories: Allocate your income to different categories like needs, wants, and savings to prioritize your spending.

- Monitor and Adjust: Regularly track your expenses and income to ensure you are staying within your budget. Make adjustments as needed.

Tools and Apps for Budgeting

- Mint: A popular app that helps you track your spending, create a budget, and set financial goals.

- YNAB (You Need A Budget): Focuses on giving every dollar a job, helping you to budget effectively and save more.

- PocketGuard: Automatically tracks your spending, categorizes expenses, and helps you find ways to save.

- GoodBudget: Uses the envelope system to allocate money to different spending categories, keeping you on track with your budget.

Cutting Expenses

Managing your expenses is key to saving money and improving your financial situation. By identifying areas where you can cut costs, you can free up more funds to put towards your savings goals.

Groceries

When it comes to groceries, consider buying store brands instead of name brands, using coupons, and shopping for items on sale. Planning your meals ahead of time and making a shopping list can also help you avoid unnecessary purchases.

Utilities

To save money on utilities, try to reduce your energy consumption by turning off lights and unplugging electronics when not in use. You can also consider switching to energy-efficient appliances and light bulbs to lower your electricity bill.

Transportation

When it comes to transportation costs, consider carpooling, using public transportation, biking, or walking whenever possible to save money on gas and maintenance. If you have multiple vehicles, think about whether you really need them all and if selling one could help you save on insurance and upkeep costs.

Distinguishing Needs vs. Wants

It’s important to distinguish between needs and wants when cutting expenses. While it’s essential to cover your basic needs like food, shelter, and transportation, it’s also crucial to differentiate between necessary expenses and frivolous spending. By prioritizing your needs over your wants, you can make more informed decisions about where to cut costs and save money.

Increasing Income

In order to save more money, it’s crucial to explore different ways to increase your income. Whether through side hustles, freelancing, or investment opportunities, finding additional sources of income can help you reach your financial goals faster.

Side Hustles

- Consider starting a side hustle like driving for a ride-sharing service, selling handmade goods online, or offering freelance services in your area of expertise.

- Side hustles can provide a flexible way to earn extra income outside of your regular job.

Freelancing

- Explore freelancing opportunities in your field, whether it’s writing, graphic design, photography, or web development.

- Freelancing allows you to work on projects on a contract basis, giving you the chance to earn more based on your skills and experience.

Investment Opportunities

- Consider investing in stocks, real estate, or other assets to generate passive income over time.

- Research different investment options and seek advice from financial experts to make informed decisions.

Negotiating a Salary Raise

- Prepare a strong case for why you deserve a salary raise, highlighting your accomplishments, skills, and contributions to the company.

- Schedule a meeting with your supervisor to discuss your request for a salary increase and be ready to negotiate terms.

Automating Savings

Automating savings is a smart way to stay disciplined with your finances and ensure a consistent approach to saving money. By setting up automatic transfers to your savings or investment accounts, you can make saving a priority without having to think about it constantly.

Benefits of Automating Savings

- Eliminates the temptation to spend: By automating your savings, you remove the temptation to spend the money before saving it.

- Consistent saving habit: Automation helps you build a consistent saving habit by ensuring that a portion of your income goes directly into savings every time you get paid.

- Reach your financial goals faster: With automated savings, you can make steady progress towards your financial goals without the risk of forgetting to save.

Setting up Automatic Transfers

- Choose a specific amount or percentage to save: Decide on a fixed amount or percentage of your income that you want to save regularly.

- Set up recurring transfers: Work with your bank to set up recurring transfers from your checking account to your savings or investment account on a specific schedule, such as monthly or bi-weekly.

- Monitor and adjust as needed: Regularly review your automated savings plan to ensure it aligns with your financial goals and make adjustments as necessary.

Consistency with Saving Money

- Automatic deposits: Ensure that your paycheck is automatically deposited into your checking account to facilitate seamless transfers to your savings or investment accounts.

- Emergency fund contributions: Automate contributions to your emergency fund to build a financial safety net for unexpected expenses.

- Investment contributions: Set up automated transfers to your investment accounts to grow your wealth over time and take advantage of compound interest.

Emergency Funds

Having an emergency fund is crucial for unexpected expenses that may arise, such as medical emergencies, car repairs, or job loss. It provides a financial safety net and peace of mind during challenging times.

Guidelines for Saving in an Emergency Fund

It is recommended to save at least 3 to 6 months’ worth of living expenses in an emergency fund. However, the exact amount can vary based on individual circumstances, such as income stability, expenses, and financial goals.

- Calculate your average monthly expenses, including rent, utilities, groceries, and other essential costs.

- Multiply your monthly expenses by the recommended number of months (3 to 6) to determine your emergency fund goal.

- Regularly contribute a portion of your income to your emergency fund until you reach your target amount.

Emergency Fund vs. Regular Savings

An emergency fund is specifically designated for unforeseen expenses or financial emergencies, while regular savings are typically used for planned expenses or future goals, such as vacations or major purchases.

It is essential to keep your emergency fund separate from your regular savings to ensure that it is easily accessible when needed most.

Investment Strategies

Investing is a crucial part of saving money for long-term growth. By putting your money into various investment options, you have the potential to earn higher returns compared to traditional savings accounts. It allows your money to work for you and grow over time.

Different Investment Options

- Stocks: Investing in individual stocks means buying ownership in a specific company. Stock prices can fluctuate based on company performance and market conditions.

- Bonds: Bonds are debt securities issued by governments or corporations. Investors lend money in exchange for interest payments over time.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate: Investing in real estate involves buying properties to generate rental income or for potential appreciation in value.

Tips for Diversifying Investments

- Spread your investments across different asset classes to reduce risk. Diversification helps protect your portfolio from the impact of a single investment performing poorly.

- Consider your risk tolerance and investment goals when choosing where to allocate your money. High-risk investments may offer higher returns but come with greater volatility.

- Regularly review and rebalance your portfolio to ensure it aligns with your financial objectives and risk tolerance.