Get ready to dive into the world of Mutual funds vs. ETFs, where financial decisions can make or break your investment game. Brace yourself for a rollercoaster ride of comparisons and contrasts between these two popular options.

As we unravel the differences and similarities between mutual funds and ETFs, you’ll gain a deeper understanding of how to navigate the complex world of investments.

Introduction

Mutual funds and ETFs are popular investment options for individuals looking to diversify their portfolios. Mutual funds are professionally managed investment funds that pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. On the other hand, ETFs (Exchange-Traded Funds) are similar to mutual funds but trade on the stock exchanges like individual stocks.

Basic Differences

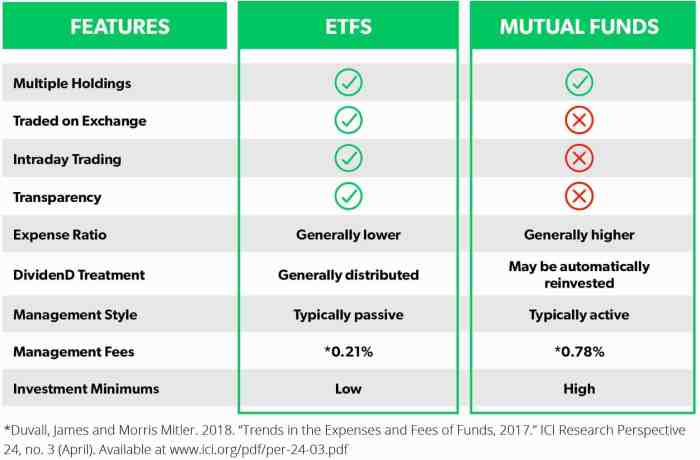

- Mutual funds are actively managed by a fund manager who makes decisions on buying and selling securities, while ETFs typically follow a passive investment strategy by tracking a specific index.

- Mutual funds are priced at the end of the trading day, while ETFs are traded throughout the day on the stock exchange.

- ETFs often have lower expense ratios compared to mutual funds, making them a cost-effective option for investors.

Brief History

The concept of mutual funds dates back to the 18th century, but modern mutual funds as we know them today began in the 1920s with the creation of the Massachusetts Investors Trust. ETFs, on the other hand, were introduced in the early 1990s with the launch of the first ETF tracking the S&P 500 index. Since then, both mutual funds and ETFs have gained popularity among investors for their ease of access and diversification benefits.

Structure and Management

When it comes to the structure and management of mutual funds and ETFs, there are some key differences to consider. Let’s break it down for you:

Mutual Funds Management

Mutual funds are actively managed by professional fund managers who make decisions on buying and selling securities within the fund. These managers analyze market trends, company performance, and other factors to try and maximize returns for investors. They also make decisions on when to buy or sell assets based on the fund’s objectives.

Structure of ETFs vs. Mutual Funds

ETFs, or exchange-traded funds, are structured differently from mutual funds. While mutual funds are priced once a day at the end of trading hours, ETFs are traded throughout the day on the stock exchange like individual stocks. This means that the price of an ETF can fluctuate during trading hours based on supply and demand.

Role of Fund Managers

In mutual funds, fund managers play a crucial role in actively managing the fund’s portfolio to achieve the investment objectives. On the other hand, ETFs are typically passively managed, meaning they aim to replicate the performance of a specific index or asset class. This difference in management style can impact the fees and performance of the investment vehicle.

Cost Comparison

Investing in mutual funds and ETFs involves different costs that investors should consider. While both options have their own advantages, it’s essential to understand the cost comparison between them.

Expense Ratios:

One of the key cost differences between mutual funds and ETFs is the expense ratio. Mutual funds tend to have higher expense ratios compared to ETFs. The expense ratio represents the percentage of a fund’s assets that go towards covering operating expenses. Mutual funds typically have higher management fees, administrative costs, and other expenses, resulting in a higher expense ratio.

Hidden Fees:

Investors should also be aware of any hidden fees or charges associated with investing in mutual funds or ETFs. These fees may include sales loads, redemption fees, account maintenance fees, or trading costs. Mutual funds, in particular, may have additional fees that can impact returns over time. On the other hand, ETFs are known for their transparency and lower fees, making them a cost-effective option for many investors.

Overall, when comparing the costs of investing in mutual funds versus ETFs, it’s important to consider the expense ratios and potential hidden fees that can impact investment returns.

Liquidity and Trading

When it comes to liquidity and trading, mutual funds and ETFs have some key differences that investors should be aware of.

Liquidity of Mutual Funds and ETFs

Mutual funds are typically less liquid than ETFs. This is because mutual funds are only priced once a day after the market closes, based on the net asset value (NAV) of the fund. Investors can only buy or sell mutual fund shares at that price. On the other hand, ETFs trade on an exchange throughout the day, just like stocks, allowing investors to buy and sell shares at market prices. This makes ETFs generally more liquid than mutual funds.

Trading Process of Mutual Funds and ETFs

When trading mutual funds, investors place orders with the fund company or through a broker, and the trade is executed at the NAV price at the end of the trading day. In contrast, trading ETFs involves buying and selling shares on a stock exchange through a brokerage account. This means that ETF investors can place limit orders, stop orders, and short sell shares, just like with individual stocks.

Intraday Trading of ETFs vs. Mutual Funds

One of the key advantages of ETFs over mutual funds is the ability to trade intraday. This means that investors can react quickly to market changes throughout the trading day by buying or selling ETF shares. In contrast, mutual fund investors can only place orders to buy or sell at the end of the trading day, which may result in missing out on intraday opportunities or reacting too late to market trends.

Tax Efficiency

Investing in mutual funds and ETFs can have different tax implications based on how they are structured and managed. Let’s take a closer look at the tax efficiency of these two investment options.

Capital Gains Distribution

When it comes to mutual funds, capital gains are distributed to investors based on the fund’s trading activity throughout the year. This means that investors may be subject to capital gains taxes even if they did not sell any shares of the mutual fund themselves. On the other hand, ETFs are structured in a way that allows for more tax-efficient trading. Since ETFs typically have lower portfolio turnover compared to mutual funds, they are less likely to distribute capital gains to investors, resulting in potentially lower tax liabilities.

Tax Advantages of ETFs

ETFs offer several potential tax advantages over mutual funds. One key advantage is the ability to control when capital gains are realized. Because ETFs are traded on an exchange like a stock, investors have more control over when they buy and sell shares. This flexibility can help investors strategically manage their tax liabilities by choosing when to realize capital gains. Additionally, ETFs are structured to be more tax-efficient overall, with fewer capital gains distributions compared to mutual funds. This can lead to lower tax costs for investors holding ETFs in their portfolios.

Performance and Returns

When comparing the historical performance of mutual funds and ETFs, it is important to consider factors such as the fund’s investment strategy, the market conditions at the time, and the overall management of the fund. These factors can greatly impact the returns generated by each type of investment.

Market Conditions and Performance

In times of economic growth and stability, both mutual funds and ETFs tend to perform well as stock prices rise. However, during market downturns or periods of volatility, the performance of these investments can vary. Mutual funds may be impacted by higher fees and lower liquidity, while ETFs may offer more flexibility and potentially better performance due to their lower costs.

Calculating Returns

Returns for mutual funds and ETFs are typically calculated based on the change in the fund’s net asset value (NAV) over a specific period. This calculation takes into account factors such as dividends, capital gains, and expenses. For mutual funds, returns are often reported as the fund’s total return, which includes both price appreciation and reinvested dividends. ETF returns, on the other hand, are based on the market price of the fund’s underlying assets.