Financial hedging strategies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the intricate world of financial hedging, we uncover the mechanisms behind risk management and explore the diverse strategies employed by businesses to safeguard their financial interests.

In this exploration, we will analyze common hedging techniques, understand the relationship between risk management and hedging, delve into factors influencing hedging decisions, and examine real-world examples of successful hedging practices.

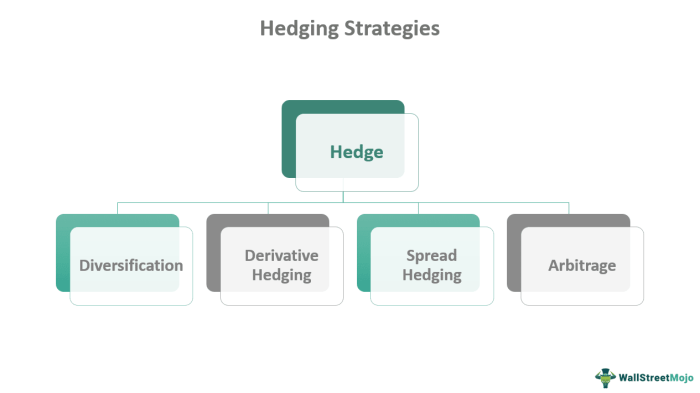

Overview of Financial Hedging Strategies

Financial hedging is a risk management strategy used by individuals, corporations, and financial institutions to offset potential losses from adverse movements in the price of assets or liabilities. By utilizing various financial instruments, hedging strategies aim to minimize the impact of market volatility on investment portfolios and cash flows.

Implementing hedging strategies in financial management is crucial to protect against unforeseen risks and uncertainties in the market. It allows entities to mitigate potential losses and stabilize financial performance, especially in volatile market conditions. By hedging against unfavorable price movements, businesses can safeguard their profits and maintain financial stability.

Types of Financial Instruments Used for Hedging

Different types of financial instruments are employed for hedging purposes, each serving specific risk management objectives:

- Options: Financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain time frame.

- Forwards and Futures: Contracts that lock in the price of an asset for future delivery, allowing parties to hedge against price fluctuations.

- Swaps: Agreements between two parties to exchange cash flows based on predetermined variables, such as interest rates or currencies, reducing exposure to fluctuations.

- Insurance: Risk transfer mechanisms that provide protection against specific perils, such as property damage or liability claims, minimizing financial losses.

Common Hedging Techniques

When it comes to managing financial risks, there are several common hedging techniques that are widely used in the market. These techniques help individuals and organizations protect themselves against adverse movements in asset prices, interest rates, or exchange rates. Let’s explore some popular hedging strategies such as futures, options, forwards, and swaps.

Futures

Futures contracts are agreements to buy or sell a specific asset at a predetermined price on a future date. By using futures, investors can hedge against price fluctuations in commodities, currencies, or financial instruments. For example, a corn producer can use futures contracts to lock in a price for their crop before it is harvested, protecting them from price volatility in the market.

Options

Options give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. This flexibility allows investors to hedge their positions while still benefiting from favorable price movements. For instance, a company can purchase put options to protect against a decline in the value of its stock holdings without limiting the potential for gains if the stock price increases.

Forwards

Forward contracts are similar to futures but are customized agreements between two parties to buy or sell an asset at a specified price on a future date. Unlike futures, forwards are not traded on exchanges, making them more flexible but also less standardized. Businesses often use forwards to hedge against currency risk when engaging in international trade to lock in exchange rates and protect against unfavorable movements.

Swaps

Swaps involve the exchange of cash flows between two parties based on predetermined terms. Common types of swaps include interest rate swaps and currency swaps, which allow participants to manage exposure to fluctuations in interest rates or exchange rates. For example, a company with a variable-rate loan can enter into an interest rate swap to convert its payments to a fixed rate, reducing uncertainty and managing interest rate risk.

By comparing and contrasting these hedging techniques, investors can choose the most suitable strategy based on their risk tolerance, investment objectives, and market conditions. Each technique has its advantages and limitations, so it’s essential to carefully evaluate the effectiveness of different hedging approaches in managing financial risks.

Risk Management and Hedging

When it comes to financial markets, risk management plays a crucial role in ensuring the stability and profitability of investments. Financial hedging is a key strategy used by companies to mitigate various types of risks that can impact their financial performance.

Relationship between Risk Management and Financial Hedging

Hedging is a risk management strategy that involves taking an offsetting position in a related security or asset to minimize potential losses. By using hedging techniques, companies can protect themselves from adverse market movements and volatility, ultimately reducing the overall risk exposure in their portfolios.

Hedging Strategies for Mitigating Financial Risks

- Forward Contracts: Companies can use forward contracts to lock in a future exchange rate or commodity price, protecting themselves from fluctuations in the market.

- Options: Options give companies the right, but not the obligation, to buy or sell an asset at a predetermined price. This allows them to hedge against potential downside risk while still benefiting from favorable market movements.

- Swaps: Swaps involve exchanging cash flows with another party to manage interest rate or currency risks. This can help companies reduce their exposure to fluctuations in interest rates or exchange rates.

Real-world Examples of Companies Using Hedging for Risk Management

Companies like Boeing and Southwest Airlines have successfully used hedging strategies to mitigate risks associated with fluctuating fuel prices. By entering into futures contracts or options, these companies were able to lock in prices for jet fuel, protecting themselves from unexpected cost increases and ensuring more stable operating margins.

Companies in the agricultural sector, such as Cargill and Archer Daniels Midland, also use hedging techniques to manage risks related to commodity price fluctuations. Through futures contracts and options, these companies can secure pricing for their crops or raw materials, safeguarding their profits against market uncertainties.

Overall, financial hedging plays a vital role in risk management for companies across various industries, enabling them to navigate volatile market conditions and protect their bottom line.

Factors Influencing Hedging Decisions

When making decisions regarding hedging strategies, several key factors come into play that can significantly impact the outcome. These factors include market conditions, volatility levels, exposure to risk, financial goals, risk tolerance, and macroeconomic influences.

Market Conditions and Volatility

Market conditions play a crucial role in determining the need for hedging. During periods of uncertainty or instability, such as economic downturns or geopolitical events, companies may face increased risks that warrant the use of hedging strategies. Similarly, high volatility in financial markets can lead to unpredictable price movements, making hedging essential to mitigate potential losses.

Financial Goals and Risk Tolerance

The financial goals of a company or investor are fundamental in shaping their hedging decisions. Different organizations may have varying objectives, such as protecting profits, minimizing downside risk, or ensuring a stable cash flow. Risk tolerance also plays a significant role, as some entities may be more willing to accept risks in exchange for higher returns, while others prefer a more conservative approach through hedging.

Macroeconomic Factors

Macroeconomic factors, including interest rates, inflation, exchange rates, and economic growth, can impact the effectiveness of hedging decisions. Changes in these variables can influence the overall market environment and the level of risk faced by businesses. For instance, a sudden shift in exchange rates can expose companies to currency risk, necessitating appropriate hedging strategies to safeguard against potential losses.