Delving into investing in index funds, this introduction immerses readers in a comprehensive exploration of the topic. Index funds are a type of investment vehicle that tracks a specific market index, providing investors with a diversified portfolio and potentially lower fees. This overview will highlight the benefits, risks, and considerations associated with investing in index funds, offering valuable insights for both novice and experienced investors.

What are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that is designed to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, which aim to outperform the market, index funds seek to replicate the performance of the index they are tied to.

Passive investing is the strategy employed by index funds, where the fund manager simply buys and holds the same stocks or securities that are included in the underlying index. This approach eliminates the need for extensive research and analysis, as the fund’s goal is to mirror the market index rather than beat it.

Examples of Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX): This index fund tracks the performance of the CRSP US Total Market Index, which includes nearly all publicly traded stocks in the U.S. market.

- iShares Core S&P 500 ETF (IVV): This ETF seeks to match the performance of the S&P 500 index, which consists of 500 of the largest U.S. companies.

- Schwab International Equity ETF (SCHF): This fund follows the FTSE Developed ex-US Index, providing exposure to large and mid-cap stocks in developed international markets outside the U.S.

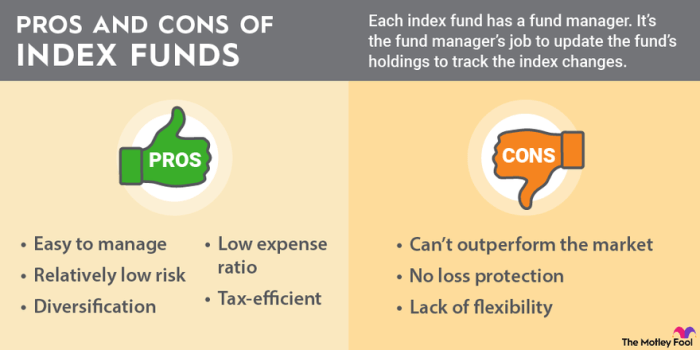

Benefits of Investing in Index Funds

Index funds offer several advantages over actively managed funds, making them an attractive option for many investors. One of the key benefits of investing in index funds is their ability to provide diversification to investors. This means that by investing in an index fund, you are essentially investing in a wide range of stocks or bonds, which helps spread out risk and minimize the impact of volatility in any single investment.

Lower Fees

Index funds typically have lower fees compared to other investment options, such as actively managed funds. This is because index funds are passively managed and aim to replicate the performance of a specific market index, rather than relying on expensive research and analysis conducted by fund managers. As a result, investors can benefit from lower expenses, allowing them to keep more of their investment returns.

Risks and Considerations

When considering investing in index funds, it is essential to be aware of potential risks and factors that could impact your investment decisions.

Potential Risks Associated with Investing in Index Funds

- Market Risk: Index funds are subject to market volatility, which can lead to fluctuations in the value of your investment. Economic downturns or market crashes can result in significant losses.

- Tracking Error: While index funds aim to replicate the performance of a specific index, they may not always perfectly match the index due to tracking errors. These errors can impact the returns of the fund.

- Concentration Risk: Some index funds may have a heavy concentration in specific sectors or industries, making them more susceptible to downturns in those areas.

- Liquidity Risk: In times of market stress, selling index fund shares could be challenging if there is a lack of liquidity in the underlying securities.

Factors to Consider When Choosing an Index Fund to Invest In

- Expense Ratios: Lower expense ratios can help maximize returns as they reduce the fees charged by the fund.

- Tracking Error: Look for index funds with minimal tracking error to ensure they closely follow the performance of the underlying index.

- Diversification: Consider the level of diversification offered by the index fund to reduce concentration risk.

- Performance History: Evaluate the past performance of the index fund to gauge its ability to deliver consistent returns.

Impact of Market Volatility on Index Fund Investments

Market volatility can have a significant impact on index fund investments, as the value of the fund can be influenced by rapid and unpredictable market movements. During periods of high volatility, index fund investors may experience increased fluctuations in the value of their investments. It is important for investors to consider their risk tolerance and investment goals when navigating through market volatility.

How to Invest in Index Funds

Investing in index funds can be a straightforward way to build a diversified portfolio and benefit from the overall growth of the market. Here are the steps involved in investing in index funds:

Choosing a Platform or Broker

When investing in index funds, investors have several options for platforms or brokers to purchase these funds. Some popular platforms include Vanguard, Fidelity, Charles Schwab, and TD Ameritrade. These platforms offer a variety of index funds with different expense ratios and investment minimums, allowing investors to choose the one that best suits their financial goals and risk tolerance.

Building a Diversified Portfolio

One of the key benefits of index funds is their ability to provide instant diversification across a wide range of assets. To build a diversified portfolio using index funds, investors should consider investing in funds that track different market segments, such as large-cap, mid-cap, and small-cap stocks, as well as bonds and international markets. By spreading investments across various index funds, investors can reduce risk and increase the potential for long-term returns.

Tips for Investing in Index Funds

– Determine your investment goals and risk tolerance before selecting index funds.

– Consider the expense ratio and investment minimums of each fund to ensure they align with your financial objectives.

– Regularly review and rebalance your portfolio to maintain diversification and adjust for market changes.

– Take advantage of dollar-cost averaging by investing a fixed amount regularly to reduce the impact of market volatility.

– Consider tax implications when investing in index funds, especially in taxable accounts.

By following these steps and tips, investors can effectively invest in index funds and build a diversified portfolio that aligns with their financial goals and risk tolerance.