As budget spreadsheet templates take center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Budget spreadsheet templates are essential tools for managing finances effectively. From personal budgets to project budgets, these templates offer a range of features and functionalities to suit various needs. In this guide, we will explore different types of budget spreadsheet templates, customization options, best practices for usage, and the differences between free and paid templates.

Types of Budget Spreadsheet Templates

When it comes to budgeting, there are various types of spreadsheet templates available to cater to different needs and purposes. Each type comes with unique features and functionalities to help individuals or businesses manage their finances effectively.

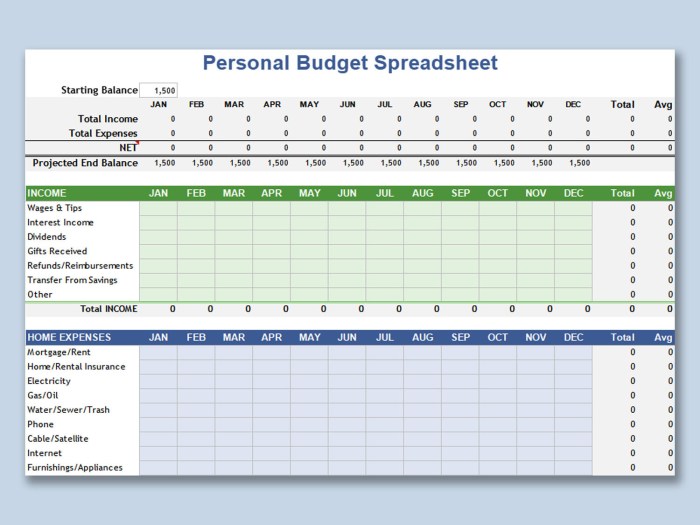

Personal Budget

Personal budget spreadsheet templates are designed for individuals to track their income, expenses, savings, and investments. These templates typically include categories such as housing, transportation, food, entertainment, and more. Users can input their financial data and monitor their budget to ensure they are staying within their financial goals.

Business Budget

Business budget spreadsheet templates are tailored for companies to manage their finances, monitor cash flow, and track expenses. These templates often include sections for revenue, expenses, payroll, marketing, and other business-related categories. Businesses can analyze their financial performance and make informed decisions based on the data provided by the budget template.

Project Budget

Project budget spreadsheet templates are used to estimate and track the costs associated with a specific project. These templates typically include sections for labor, materials, equipment, overhead costs, and other project expenses. Project managers can use these templates to create detailed budgets, monitor spending, and ensure the project stays within budget constraints.

In summary, personal, business, and project budget spreadsheet templates serve different purposes and cater to specific financial management needs. It’s essential to choose the right type of template based on your requirements to effectively track and manage your finances.

Customization Options

When using budget spreadsheet templates, users have the flexibility to customize them according to their specific financial needs. This customization allows individuals to tailor the template to their unique income, expenses, and financial goals.

Adding New Categories

Users can add new categories to the budget spreadsheet template to align with their specific spending habits. For example, if someone wants to track their gym membership expenses separately from their general health and wellness category, they can easily add a new category for “Gym Membership” in the spreadsheet.

Adjusting Formulas

Another common customization option is adjusting formulas within the budget spreadsheet template. Users can modify formulas to calculate savings goals, debt repayment strategies, or any other financial calculations that are important to them. For example, individuals can adjust the formula for calculating monthly savings contributions based on their desired savings rate.

Personalizing Descriptions

To effectively personalize a budget spreadsheet template, users can customize descriptions for each category or expense item. By providing clear and detailed descriptions, individuals can better track and understand their spending patterns. For instance, instead of a generic category like “Utilities,” users can specify “Electricity Bill” or “Water Bill” to provide more clarity.

Formatting Preferences

Users can also personalize the formatting of the budget spreadsheet template to suit their preferences. This includes customizing colors, fonts, and layouts to make the budgeting process more visually appealing and user-friendly. By making the spreadsheet visually engaging, individuals may be more motivated to consistently update and review their financial information.

Integration with Financial Apps

For individuals who use financial apps or software to track their expenses, customizing the budget spreadsheet template to integrate with these tools can streamline the budgeting process. Users can export data from financial apps and import it into the spreadsheet, ensuring that all financial information is consolidated in one place for comprehensive budget management.

Best Practices for Using Budget Spreadsheet Templates

When it comes to using budget spreadsheet templates effectively, there are several best practices to keep in mind to ensure accurate tracking of expenses and income, as well as to maximize the efficiency of the budgeting process.

Tips for Maintaining and Updating Budget Spreadsheet Templates Regularly

Regular maintenance and updates are crucial to keep your budget spreadsheet templates relevant and effective. Here are some tips to help you stay on track:

- Set a regular schedule for updating your budget spreadsheet, whether it’s weekly, bi-weekly, or monthly.

- Review and adjust your budget categories as needed to reflect any changes in your financial situation.

- Keep detailed records of all transactions to ensure accuracy in your budget calculations.

- Backup your budget spreadsheet regularly to prevent data loss.

How to Track Expenses and Income Accurately Using Budget Spreadsheet Templates

Accurate tracking of expenses and income is essential for effective budgeting. Here’s how you can ensure precision in your budget spreadsheet:

- Categorize your expenses and income clearly to easily identify where your money is going and coming from.

- Enter transactions promptly to avoid missing any important data.

- Regularly reconcile your budget spreadsheet with bank statements to catch any discrepancies.

- Utilize formulas and functions in your spreadsheet to automate calculations and reduce errors.

Strategies for Maximizing the Efficiency of Budget Spreadsheet Templates

To make the most out of your budget spreadsheet templates and streamline your budgeting process, consider implementing the following strategies:

- Use color-coded categories to visually differentiate between different types of expenses and income.

- Set financial goals and track your progress within the budget spreadsheet to stay motivated and focused.

- Utilize budgeting tools and apps that can sync with your spreadsheet for added convenience and accuracy.

- Regularly analyze your budget data to identify areas where you can cut costs or increase savings.

Free vs. Paid Templates

When it comes to budget spreadsheet templates, users often have the option to choose between free or paid versions. Each type comes with its own set of advantages and disadvantages, catering to different needs and preferences.

Features and Quality

- Free Templates:

- May have basic features and functionalities.

- Often come with generic designs and limited customization options.

- Quality may vary depending on the source or creator.

- Paid Templates:

- Usually offer more advanced features and robust functionalities.

- Come with professional designs and extensive customization options.

- Higher quality and reliability compared to free templates.

Advantages and Disadvantages

- Free Templates:

- Advantages:

- Cost-effective solution for basic budgeting needs.

- Accessible to a wider audience without financial constraints.

- Disadvantages:

- Limited features and customization options.

- Potential lack of support or updates.

- Advantages:

- Paid Templates:

- Advantages:

- Advanced features for complex budgeting requirements.

- Professional design and customization options for personalized use.

- Regular updates and customer support for assistance.

- Disadvantages:

- Cost involved in purchasing the template.

- May not be necessary for simple budgeting tasks.

- Advantages:

When to Invest in a Paid Template

Consider investing in a paid budget spreadsheet template when:

- You have complex budgeting needs that require advanced features.

- You prefer a professional and customizable design for your budgeting tool.

- You value regular updates and support for your template.