How to track expenses is a crucial aspect of financial management, providing insights into one’s spending habits and aiding in budgeting. This guide delves into various methods and strategies for effective expense tracking, offering valuable tips and advice for individuals seeking to improve their financial health.

Importance of Tracking Expenses

Tracking expenses is a crucial aspect of financial management as it provides valuable insights into your spending habits and patterns. By keeping detailed records of your expenses, you can gain a better understanding of where your money is going and identify areas where you can potentially cut back or save.

Benefits of Keeping Detailed Records

- Helps in identifying unnecessary expenses: By tracking your expenses, you can pinpoint areas where you are overspending and make necessary adjustments to your budget.

- Allows for better budgeting: With a clear picture of your expenses, you can create a realistic budget that aligns with your financial goals.

- Enables you to save money: Tracking expenses helps you become more mindful of your spending, leading to increased savings over time.

How Tracking Expenses Aids in Budgeting and Saving Money

- Provides a clear overview: Tracking expenses gives you a comprehensive view of your financial situation, making it easier to plan for the future.

- Helps in setting financial goals: By knowing how much you are spending, you can set realistic savings goals and work towards achieving them.

- Encourages responsible spending: When you track your expenses, you are more likely to think twice before making impulsive purchases, ultimately helping you save money.

Methods for Tracking Expenses

Tracking expenses is crucial for maintaining financial health. There are various methods available to help individuals keep a record of their spending habits. Each method has its own advantages and disadvantages, so it is essential to choose the most suitable one based on individual preferences.

Using Expense Tracking Apps

Using expense tracking apps is a popular and convenient method for monitoring expenses. These apps allow users to input their expenses easily, categorize them, and generate reports. Some advantages of using expense tracking apps include:

- Convenience: Users can track expenses on-the-go using their smartphones.

- Automation: Apps can automatically categorize expenses based on predefined rules.

- Analysis: Apps provide insights into spending patterns and trends.

However, there are also some disadvantages to consider:

- Cost: Some apps may require a subscription fee for advanced features.

- Privacy concerns: Users may be wary of sharing financial information with third-party apps.

- Technical issues: Apps may experience bugs or compatibility issues with devices.

When choosing an expense tracking app, consider factors like user interface, features, and security measures to find the most suitable one for your needs.

Using Spreadsheets

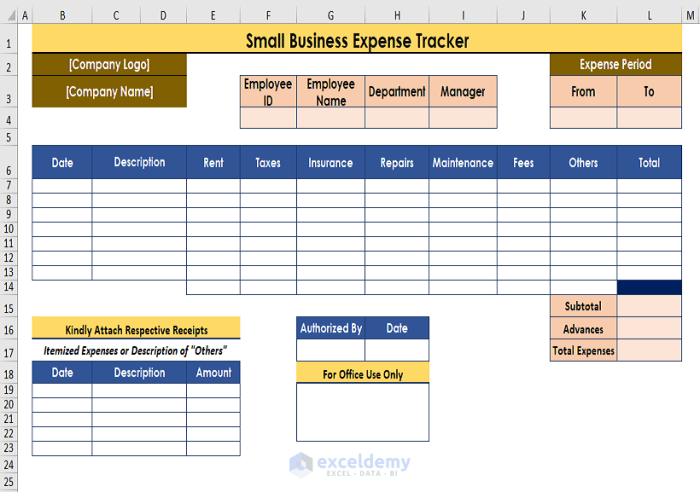

Spreadsheets are a traditional but effective method for tracking expenses. Users can create their own expense tracking sheet using software like Microsoft Excel or Google Sheets. Some advantages of using spreadsheets include:

- Customization: Users can tailor the spreadsheet to their specific needs and preferences.

- Data control: Users have full control over their data and can easily manipulate it for analysis.

- No cost: Spreadsheets are usually free to use and readily available.

However, there are also disadvantages to consider:

- Manual input: Users need to manually enter each expense, which can be time-consuming.

- Lack of automation: Spreadsheets do not offer automated categorization or analysis features.

- Complexity: Users with limited spreadsheet skills may find it challenging to set up and maintain.

When using spreadsheets, ensure you have a clear structure and organization to make tracking expenses more efficient.

Using Notebooks or Journals

For those who prefer a more tactile approach, using notebooks or journals to track expenses can be a viable option. Some advantages of this method include:

- Tangible record: Users can physically write down their expenses, making it easier to remember and track.

- No technical issues: Notebooks do not require any technical expertise or devices to use.

- Customization: Users can personalize their tracking system based on their preferences.

However, there are also disadvantages to consider:

- Lack of analysis: Notebooks do not offer advanced analysis or reporting features.

- Risk of loss: Notebooks can be misplaced or damaged, leading to loss of expense data.

- Limited scalability: Tracking expenses in notebooks may become cumbersome as the volume of expenses increases.

When using notebooks or journals, ensure you have a consistent recording system to maintain accuracy and organization in tracking expenses.

Creating Categories for Expenses

![]()

When it comes to tracking expenses, categorizing them plays a crucial role in gaining a clear understanding of where your money is going. By creating specific categories for expenses, you can easily analyze your spending habits, identify areas where you may be overspending, and make informed decisions to improve your financial situation.

Importance of Categorizing Expenses

Categorizing expenses allows you to organize your financial data in a meaningful way. It helps you see the bigger picture of your spending habits and allows for better budgeting and planning. Moreover, categorization enables you to easily track trends over time and make adjustments to your budget accordingly.

- Examples of common expense categories:

| Expense Category | Examples |

|---|---|

| Groceries | Food items, household supplies |

| Utilities | Electricity, water, gas |

| Transportation | Gasoline, public transportation fares |

| Housing | Rent/mortgage, property taxes |

| Entertainment | Movie tickets, dining out |

Identifying Spending Patterns through Categorization

By categorizing expenses, you can easily identify spending patterns and trends. For example, you may notice that a significant portion of your income goes towards dining out or entertainment. This awareness can help you make conscious decisions to cut back on certain expenses and reallocate those funds towards savings or debt repayment. Categorization also allows you to set specific budget limits for each category, making it easier to track your progress and stay within your financial goals.

Setting Budgets and Goals

Setting realistic budgets based on tracked expenses is crucial for effective financial management. By analyzing your spending habits, you can identify areas where you may be overspending and make necessary adjustments to stay within your financial limits. Here are the steps for setting realistic budgets:

Steps for Setting Realistic Budgets

- Review your tracked expenses over a specific period to understand your spending patterns.

- Identify areas where you can reduce expenses or cut back on unnecessary purchases.

- Allocate a specific amount for essential expenses such as rent, utilities, groceries, and transportation.

- Set aside a portion of your income for savings and emergencies.

- Establish a realistic budget for discretionary spending, such as entertainment, dining out, and shopping.

Significance of Setting Financial Goals Alongside Budgets

Setting financial goals alongside budgets provides you with a clear roadmap for achieving your desired outcomes. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having specific financial goals can help you stay motivated and focused on your financial journey. By aligning your budgets with your goals, you can track your progress and make adjustments as needed to ensure you stay on track.

Tips for Adjusting Budgets and Goals

- Regularly review your budgets and expenses to identify any deviations from your initial plan.

- Be flexible and willing to make adjustments based on changes in your income or expenses.

- Prioritize your financial goals and allocate resources accordingly to achieve them effectively.

- Celebrate small victories along the way to stay motivated and committed to your financial goals.

Analyzing Expense Trends

Tracking expenses over time allows individuals to analyze expense trends and gain valuable insights into their spending habits. By identifying patterns and fluctuations in expenses, individuals can make informed decisions on where to cut costs and optimize their budget.

Identifying Spending Patterns

One method for analyzing expense trends is to categorize expenses by type (e.g. groceries, utilities, entertainment) and track the total amount spent in each category over a specific time period, such as monthly or annually. This can help identify areas where expenses are consistently high or increasing.

Detecting Fluctuations

Monitoring fluctuations in expenses, such as unexpected spikes in spending, can provide insights into irregular or one-time expenses that may need to be accounted for in future budgets. This can help individuals prepare for unforeseen expenses and adjust their budget accordingly.

Comparing Trends

Comparing expense trends over different time periods, such as year-over-year or quarter-over-quarter, can reveal long-term spending habits and patterns. This can help individuals assess whether their spending is increasing, decreasing, or remaining relatively stable over time.

Identifying Areas for Optimization

By analyzing expense trends, individuals can pinpoint areas where expenses can be reduced or optimized. This could involve identifying unnecessary expenses, negotiating better deals with service providers, or finding alternative ways to save money in certain categories.

Tracking Cash Expenses

When it comes to tracking expenses, cash transactions can present a unique challenge compared to digital transactions. Cash expenses can easily be forgotten or overlooked, making it crucial to have effective strategies in place to track them accurately.

Strategies for Tracking Cash Expenses

- Keep a dedicated notebook or app specifically for recording cash transactions. Make it a habit to jot down every expense as soon as it occurs.

- Save receipts and store them in an organized manner for future reference. This can help in cross-referencing and verifying expenses later on.

- Use a separate envelope or wallet compartment to store cash designated for specific categories, making it easier to track where the money is being spent.

- Regularly review and reconcile cash expenses with digital records to ensure nothing is missed or duplicated.

Challenges of Tracking Cash Expenses

- Cash transactions do not leave a digital trail, making it harder to track and categorize expenses accurately.

- It is easy to lose track of small cash purchases or forget to record them, leading to discrepancies in the overall expense tracking system.

- Cash expenses are more susceptible to theft or loss compared to digital transactions, adding another layer of complexity to tracking them effectively.

Tips for Integrating Cash Expenses

- Allocate a specific budget for cash expenses and stick to it to avoid overspending.

- Regularly transfer cash expenses into the digital tracking system to ensure all expenses are accounted for.

- Consider using a cash tracking app or software to streamline the process and make it easier to track cash expenditures alongside digital transactions.

- Set reminders or alerts to prompt you to record cash expenses promptly and avoid missing any transactions.

Incorporating Receipts and Invoices

Keeping receipts and invoices is crucial for accurate expense tracking as they provide detailed information about the amount spent, the date of the transaction, and the items purchased. Here are some tips on how to effectively incorporate receipts and invoices into your expense tracking process:

Organizing and Storing Receipts

- Designate a specific place to store all your receipts and invoices to ensure they are not misplaced or lost.

- Consider using a physical folder or envelope labeled with different categories such as groceries, utilities, entertainment, etc.

- Alternatively, opt for digital storage solutions like scanning receipts or using expense tracking apps to store receipts electronically.

Digital Tools for Recording Receipts

- Explore expense tracking apps like Expensify, Mint, or QuickBooks that allow you to easily capture and categorize receipts using your smartphone camera.

- Utilize cloud storage services such as Google Drive or Dropbox to upload and store digital copies of your receipts for quick access and organization.

- Take advantage of email receipts by creating a separate folder in your email account to easily retrieve and categorize online purchase receipts.

Reviewing and Reflecting on Expenses

Regularly reviewing tracked expenses is crucial for financial management. It allows individuals to gain insights into their spending habits, identify areas where adjustments can be made, and make informed decisions about future financial goals.

Importance of Regularly Reviewing Tracked Expenses

- Helps in identifying unnecessary expenditures

- Allows for tracking progress towards financial goals

- Provides a clear picture of where money is being allocated

- Enables individuals to make proactive changes to their spending habits

Reflecting on Spending Habits and Making Adjustments

- Look for patterns in spending to identify areas of overspending

- Consider if purchases align with personal values and long-term financial goals

- Set realistic budgets based on the review of past expenses

- Make necessary adjustments to ensure financial stability and progress

How Reviewing Expenses Leads to Better Financial Decisions

- Helps in prioritizing spending on necessities over wants

- Encourages mindful spending and conscious decision-making

- Allows for reallocating funds to savings or investments for future growth

- Provides a sense of control over finances and reduces financial stress