With Financial tools for budgeting at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling scientific with objective tone style filled with unexpected twists and insights.

The content of the second paragraph that provides descriptive and clear information about the topic

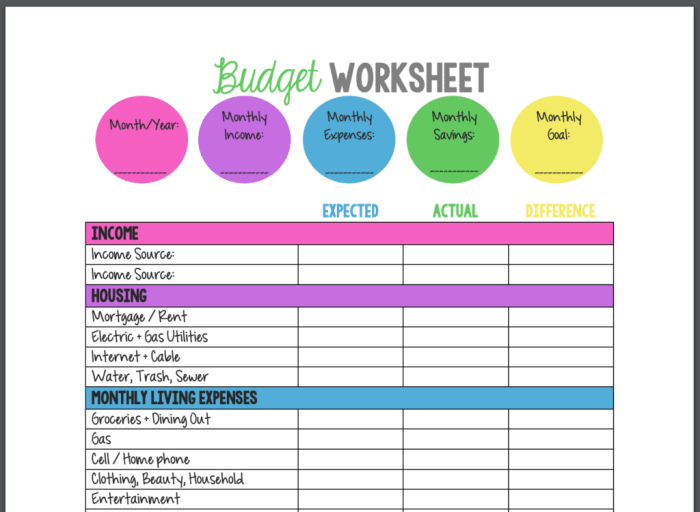

Types of Financial Budgeting Tools

Financial budgeting tools are essential for managing personal finances effectively. There are various types of budgeting tools available, each offering unique features and functionalities to help individuals track their income, expenses, and savings. Let’s explore some popular budgeting tools used for personal finance:

Spreadsheets

Spreadsheets are versatile tools that allow users to create customized budgets based on their specific financial goals. Popular spreadsheet software like Microsoft Excel or Google Sheets offer templates and formulas for budgeting purposes. Users can input their income, expenses, and savings goals to track their financial progress over time.

Mobile Apps

Mobile apps have become increasingly popular for budgeting due to their convenience and accessibility. Apps like Mint, YNAB (You Need A Budget), and Personal Capital offer features such as expense tracking, budget categorization, bill reminders, and goal setting. These apps sync with users’ bank accounts to provide real-time updates on their financial transactions.

Online Financial Platforms

Online financial platforms like Quicken and QuickBooks provide comprehensive tools for budgeting, financial planning, and investment tracking. These platforms offer features such as cash flow analysis, budget forecasting, investment portfolio management, and tax planning. Users can access their financial data from any device with an internet connection.

Envelope System

The envelope system is a traditional budgeting method that involves allocating cash into different envelopes for various spending categories. This tangible approach helps individuals visualize their budget and limit overspending in each category. While not a digital tool, the envelope system is effective for those who prefer a hands-on approach to budgeting.

Automated Budgeting Tools

Automated budgeting tools like Tiller Money or PocketGuard streamline the budgeting process by automatically categorizing transactions, tracking spending patterns, and providing insights into financial habits. These tools save time and effort by eliminating the need for manual data entry and calculations.

Each type of financial budgeting tool offers unique features and benefits, catering to different preferences and financial management styles. It’s essential to choose a tool that aligns with your budgeting goals and helps you stay on track with your financial plans.

Features and Functionalities

Financial tools for budgeting come with a variety of key features and functionalities to help individuals or businesses manage their finances effectively. These features are designed to streamline the budgeting process, provide insights into spending habits, and ultimately help users achieve their financial goals.

Automation in Budgeting Tools

Automation plays a crucial role in budgeting tools by allowing users to link their accounts, track expenses, and categorize transactions automatically. This eliminates the need for manual data entry and ensures that budgets are always up to date. By automating repetitive tasks, users can save time and focus on making informed financial decisions based on real-time data.

- Automatic expense tracking: Budgeting tools can automatically categorize expenses, track recurring payments, and provide insights into spending patterns.

- Bill reminders and alerts: Users can set up notifications for upcoming bills, payments, or budget targets to stay on top of their financial obligations.

- Integration with financial accounts: Tools that can sync with bank accounts, credit cards, and investment accounts provide a comprehensive overview of financial health.

- Goal tracking: Automation features can help users set financial goals, track progress, and adjust budgets accordingly to meet their objectives.

Customization Options in Budgeting Tools

Customization options are essential in budgeting tools to accommodate different financial goals, preferences, and lifestyles. Users should be able to personalize their budgets, categories, and reports to align with their specific needs and priorities.

- Flexible budget templates: Tools should offer a range of budget templates or allow users to create custom budgets based on their income, expenses, and savings goals.

- Category customization: Users should have the ability to create, edit, or delete budget categories to tailor their budgeting experience to their unique spending habits.

- Goal setting and tracking: Customization features enable users to set personalized financial goals, timelines, and milestones to stay motivated and focused on achieving them.

- Report customization: Tools that offer customizable reporting options allow users to generate detailed financial reports, graphs, or charts that reflect their financial progress and performance.

Integration with Financial Institutions

Seamless integration with bank accounts and financial institutions is crucial for budgeting tools to provide users with a comprehensive view of their financial status.

When budgeting tools integrate with sensitive financial data, they must implement robust security measures to protect users’ information from unauthorized access and cyber threats.

Security Measures in Budgeting Tools

- Encryption: Budgeting tools use encryption techniques to secure data transmission between the user’s device and the financial institution.

- Multi-factor authentication: Users are required to provide multiple forms of verification to access their financial accounts through the budgeting tool.

- Regular security updates: Budgeting tools constantly update their security protocols to stay ahead of emerging threats.

Examples of Budgeting Tools with Integration

- Mint: Mint offers seamless integration with various financial accounts, including banks, credit cards, and investment accounts, providing users with a holistic view of their finances.

- Personal Capital: Personal Capital integrates with over 14,000 financial institutions, allowing users to track their accounts, investments, and net worth in one place.

- You Need a Budget (YNAB): YNAB syncs with bank accounts to import transactions automatically, making it easier for users to categorize and track their spending.

Tracking and Reporting Capabilities

Tracking expenses and income through budgeting tools is crucial for maintaining financial health. By monitoring where money is being spent and earned, individuals can identify areas of overspending, potential savings, and opportunities for increasing income. This data-driven approach allows for a more informed decision-making process when it comes to managing finances.

Budgeting tools offer robust reporting capabilities that enable users to analyze financial trends effectively. These reports provide insights into spending patterns, income sources, and overall financial performance over time. By visualizing this data, individuals can easily identify areas that need improvement, set realistic financial goals, and track progress towards achieving them.

Visual Representations in Budgeting Tools

Budgeting tools often utilize various visual representations to help users interpret financial data more effectively. Some common examples include:

- Bar graphs: Displaying monthly expenses and income in a visually appealing format, making it easy to compare spending habits over time.

- Pie charts: Illustrating the percentage breakdown of expenses by category, helping users understand where their money is going at a glance.

- Trend lines: Showing the trajectory of income and expenses over a specified period, highlighting patterns and fluctuations that may require attention.