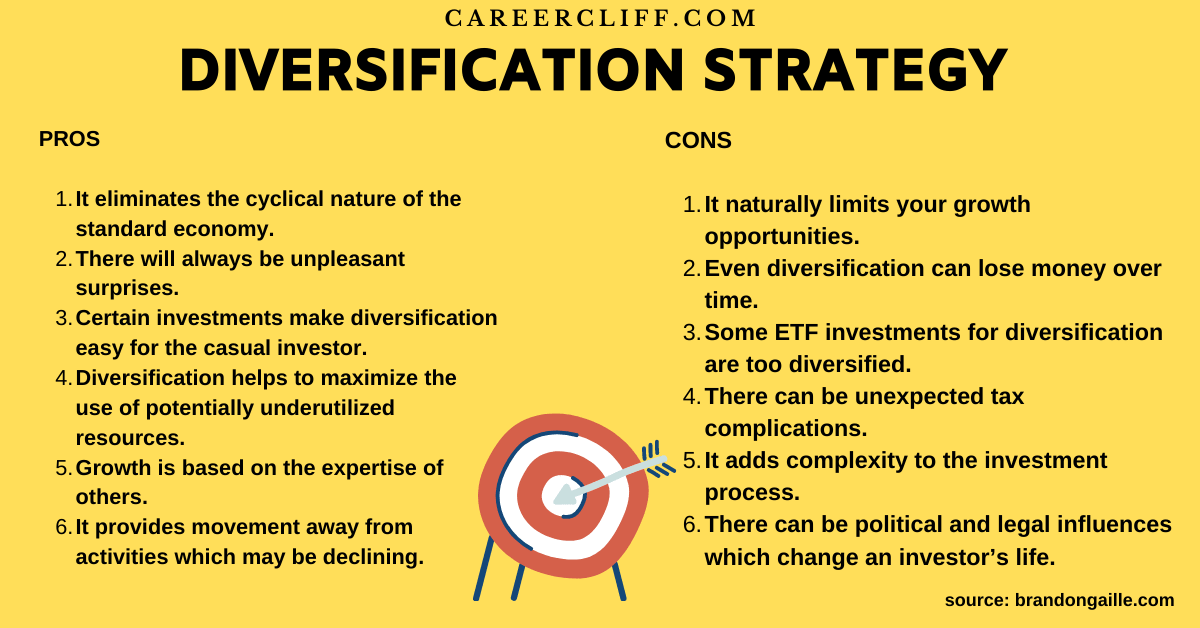

Delving into the Importance of diversification, this introduction immerses readers in a unique and compelling narrative, providing an overview of why diversification is crucial in the realm of investing. It explores how diversification can reduce risks, the benefits across various asset classes, and its role in achieving long-term financial goals.

It also touches upon the different types of diversification, strategies for implementation, and challenges faced in maintaining a diversified portfolio.

Importance of Diversification

Diversification is a crucial concept in investing as it involves spreading out investments across different assets to reduce risk. By diversifying a portfolio, investors can potentially minimize the impact of a decline in one particular asset or market segment.

Reducing Risk through Diversification

One of the key benefits of diversification is its ability to reduce risk in a portfolio. For example, if an investor only holds stocks in a single sector and that sector experiences a downturn, the entire portfolio could suffer significant losses. However, by diversifying across multiple sectors or asset classes, the impact of a downturn in one area can be mitigated.

Benefits in Different Asset Classes

Diversification can also provide benefits across different asset classes such as stocks, bonds, real estate, and commodities. Each asset class reacts differently to market conditions, so having a mix of these assets can help balance out a portfolio’s overall performance. For instance, during times of economic uncertainty, bonds tend to be less volatile compared to stocks, providing a buffer against market fluctuations.

Achieving Long-Term Financial Goals

Furthermore, diversification plays a crucial role in helping investors achieve their long-term financial goals. By spreading investments across various assets, investors can potentially capture different growth opportunities while minimizing the impact of market downturns. This long-term approach can help build a more resilient and stable portfolio over time.

Types of Diversification

Diversification is a key strategy for minimizing risk and maximizing returns in an investment portfolio. There are several types of diversification that investors can utilize to achieve a well-rounded and balanced investment approach. These include asset class, sector, geographic, and currency diversification.

Asset Class Diversification

Asset class diversification involves investing in different categories of assets, such as stocks, bonds, real estate, and commodities. By spreading investments across various asset classes, investors can reduce the impact of volatility in any single asset class. This type of diversification is effective in managing risk and optimizing overall portfolio performance.

Sector Diversification

Sector diversification entails investing in various sectors of the economy, such as technology, healthcare, finance, and consumer goods. By diversifying across sectors, investors can mitigate the impact of downturns in specific industries. This approach helps to protect against sector-specific risks and ensures a more resilient portfolio.

Geographic Diversification

Geographic diversification involves investing in different regions and countries around the world. By spreading investments geographically, investors can reduce exposure to country-specific risks, political instability, and economic downturns. This type of diversification provides a global perspective and allows investors to capitalize on growth opportunities in diverse markets.

Currency Diversification

Currency diversification involves holding investments denominated in different currencies. By diversifying currency exposure, investors can hedge against exchange rate fluctuations and reduce the impact of currency devaluation on their portfolio returns. This type of diversification is particularly important for international investors and those with exposure to foreign markets.

Overall, each type of diversification offers unique advantages in terms of risk management and portfolio optimization. However, it is essential for investors to carefully assess their investment goals, risk tolerance, and time horizon when implementing diversification strategies. By combining different types of diversification effectively, investors can build a well-diversified portfolio that is positioned for long-term success.

Strategies for Diversification

Diversification is a crucial aspect of investment portfolio management, as it helps reduce risk and increase potential returns by spreading investments across different asset classes. There are various strategies for implementing diversification effectively.

Correlation and its Influence on Diversification Strategies

Correlation refers to the relationship between the price movements of different assets in a portfolio. Understanding correlation is essential in diversification, as it helps in selecting assets that do not move in the same direction under similar market conditions. By investing in assets with low or negative correlations, investors can achieve better diversification benefits.

Effective Management of a Diversified Investment Portfolio

To effectively manage a diversified investment portfolio, it is important to regularly review and rebalance the allocations based on the overall investment objectives and risk tolerance. Monitoring the performance of each asset class and making adjustments as needed can help maintain the desired level of diversification.

- Regularly assess the performance of each asset class and rebalance the portfolio to maintain the desired allocation.

- Consider the impact of market trends and economic conditions on different asset classes to make informed decisions.

- Stay informed about changes in the investment landscape and adjust the portfolio strategy accordingly.

- Seek professional advice or use tools like asset allocation models to optimize diversification based on individual risk tolerance levels.

Sample Diversified Portfolio Based on Risk Tolerance Levels

Designing a sample diversified portfolio involves allocating investments across various asset classes such as stocks, bonds, real estate, and commodities based on an investor’s risk tolerance. For example, a conservative investor may have a higher allocation to fixed-income securities, while an aggressive investor may have a larger exposure to equities.

| Asset Class | Allocation (%) |

|---|---|

| Stocks | 60% |

| Bonds | 30% |

| Real Estate | 5% |

| Commodities | 5% |

Challenges and Considerations

When it comes to diversification, there are several challenges and considerations that investors need to keep in mind to effectively manage their portfolios.

Common Challenges or Misconceptions Related to Diversification

- One common misconception is that owning a large number of assets automatically leads to diversification. However, if those assets are highly correlated, the benefits of diversification may be limited.

- Another challenge is the tendency of investors to overlook certain asset classes or regions, leading to an imbalanced portfolio.

- Some investors may also struggle with the concept of rebalancing their portfolios regularly to maintain diversification.

Importance of Periodic Portfolio Rebalancing

Rebalancing a portfolio involves adjusting the asset allocation to bring it back to the desired mix. This is crucial to maintain diversification as market conditions change over time. Without periodic rebalancing, the risk levels of the portfolio may shift, potentially exposing the investor to higher levels of risk than intended.

Impact of Changing Market Conditions on Diversification

Market conditions such as economic downturns, geopolitical events, or sector-specific changes can affect the effectiveness of diversification. During times of market volatility, correlations between assets may increase, reducing the benefits of diversification. It is essential for investors to monitor these changes and adjust their portfolios accordingly.

Adapting Diversification Strategies in Response to Economic Trends

In response to economic trends, investors may need to adjust their diversification strategies. For example, during periods of economic growth, certain sectors or asset classes may outperform others. Investors may consider reallocating their assets to capitalize on these trends while still maintaining a diversified portfolio. It is important to stay informed and be flexible in adapting diversification strategies to changing economic conditions.