Understanding how to read a stock quote is essential for any investor looking to navigate the complex world of stock markets. From deciphering stock symbols to interpreting market trends, the process can seem daunting at first. However, with the right knowledge and guidance, reading stock quotes can become a valuable skill in making informed investment decisions. This guide will break down the key components of a stock quote and provide insights into how to make sense of the numbers and symbols that drive financial markets.

Overview of a Stock Quote

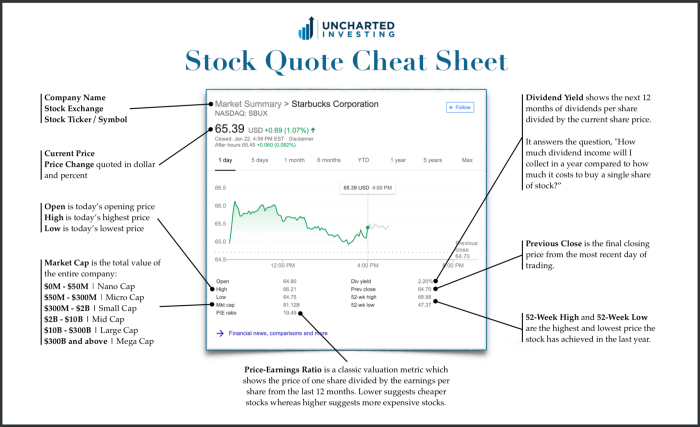

A stock quote is a snapshot of a company’s stock price at a specific point in time. It provides information on the current market value of a stock and allows investors to track the performance of a particular company. Stock quotes typically include the following components:

– Ticker Symbol: A unique combination of letters assigned to a particular stock for trading purposes.

– Stock Price: The current price at which the stock is trading in the market.

– Volume: The total number of shares traded during a specific period.

– High and Low Prices: The highest and lowest prices at which the stock has traded during the day.

– Previous Close: The price of the stock at the end of the previous trading day.

– Market Capitalization: The total value of a company’s outstanding shares in the market.

Understanding stock quotes is crucial for investors as it helps them make informed decisions about buying or selling stocks. By analyzing stock quotes, investors can track market trends, assess the performance of a company, and determine the best time to enter or exit a trade.

Examples of Popular Stock Exchanges

Some of the most popular stock exchanges where stock quotes are commonly found include:

– New York Stock Exchange (NYSE): One of the largest and most well-known stock exchanges in the world, trading a wide range of companies.

– NASDAQ: A technology-heavy stock exchange known for listing many high-profile tech companies.

– London Stock Exchange (LSE): One of the oldest stock exchanges in the world, trading a diverse range of international companies.

– Tokyo Stock Exchange (TSE): The largest stock exchange in Japan, trading a variety of Japanese and international companies.

– Shanghai Stock Exchange (SSE): One of the largest stock exchanges in Asia, trading a significant number of Chinese companies.

These stock exchanges provide a platform for buying and selling stocks, and investors can access stock quotes for companies listed on these exchanges to monitor their investments and make informed decisions.

Stock Symbol and Company Name

When looking at a stock quote, one of the key pieces of information displayed is the stock symbol. This symbol is a unique combination of letters assigned to a particular company traded on the stock market. It serves as a shorthand way to identify a specific company amidst the thousands of companies listed on various stock exchanges.

The relationship between the stock symbol and the company name is direct and specific. The stock symbol is usually derived from the name of the company or its business activities, making it easier for investors and traders to recognize and remember. For example, Apple Inc. is known by the stock symbol “AAPL,” which reflects the name of the company in a concise format.

Examples of Well-Known Companies and Their Stock Symbols

- Apple Inc. – AAPL

- Microsoft Corporation – MSFT

- Amazon.com Inc. – AMZN

- Alphabet Inc. (Google) – GOOGL

- Facebook, Inc. – FB

Price and Volume Information

When looking at a stock quote, the price and volume information are crucial components that provide insights into market activity and investor sentiment.

Interpreting Price and Volume

Price refers to the current value of a stock, representing the market’s perception of the company’s worth. Volume, on the other hand, indicates the number of shares traded in a given period. Together, price and volume can reveal valuable information about market trends and investor behavior.

- High trading volume accompanied by a rising stock price may indicate strong investor interest and optimism in the company’s performance. This could suggest a bullish trend in the market.

- Conversely, a decrease in stock price coupled with high volume might signal negative sentiment and a potential downtrend in the market.

Impact on Investor Decisions

Investors often analyze price and volume information to make informed decisions about buying or selling stocks. For example:

“A sudden spike in volume without a significant price movement could suggest a potential price reversal, prompting investors to reevaluate their positions.”

- Increased volume during a price breakout may confirm a valid trend, encouraging investors to capitalize on the momentum.

- Low volume during a price increase might indicate a lack of conviction in the market rally, prompting cautious decision-making.

Highs and Lows

When looking at a stock quote, the high and low prices represent the highest and lowest prices at which a stock has traded within a specific period, usually a day, week, month, year, or even all-time.

Significance of Highs and Lows for Investors

The highs and lows in a stock quote provide valuable information to investors:

- Highs indicate the maximum price investors were willing to pay for the stock during the specified period, reflecting positive market sentiment or potential resistance levels.

- Lows represent the lowest price at which the stock traded, showing the lowest level of investor confidence or support levels.

- Investors can use this information to gauge the volatility and potential price range of the stock, helping them make informed decisions about buying or selling.

- Highs and lows can also indicate trends or patterns that investors can analyze to predict future price movements.

Market Cap and Dividend Yield

Market capitalization, or market cap, is the total value of a company’s outstanding shares of stock. It is calculated by multiplying the current stock price by the total number of outstanding shares. Market cap is important for investors as it provides an indication of a company’s size and value in the market. Companies with higher market caps are generally considered more stable and less volatile compared to those with lower market caps.

Dividend yield, on the other hand, represents the ratio of the annual dividend payment per share to the stock’s current price. It is calculated by dividing the annual dividend per share by the current stock price and multiplying the result by 100 to get a percentage. Dividend yield is a crucial metric for income investors as it shows how much a company pays out in dividends relative to its stock price.

Examples of Market Caps and Dividend Yields

- Company A: Market Cap – $100 billion, Dividend Yield – 2%

- Company B: Market Cap – $10 billion, Dividend Yield – 3.5%

- Company C: Market Cap – $1 billion, Dividend Yield – 1.5%