As Understanding inflation rates takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Inflation is a complex economic phenomenon that affects individuals, businesses, and governments worldwide. It is crucial to comprehend the various aspects of inflation rates to make informed decisions and understand the broader economic landscape.

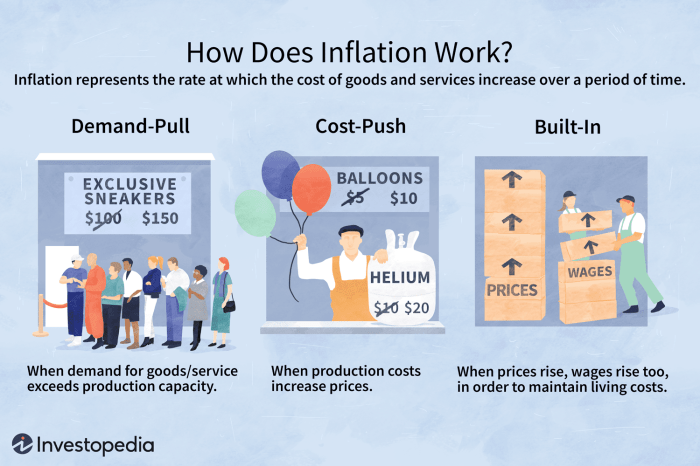

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, resulting in a decrease in purchasing power. This means that over time, each unit of currency buys fewer goods or services.

Inflation impacts the economy in various ways. It can erode the value of money, leading to a decrease in real wages and savings. It can also affect interest rates, investment decisions, and overall economic growth.

Causes of Inflation

- 1. Demand-Pull Inflation: This occurs when aggregate demand exceeds aggregate supply, leading to an increase in prices.

- 2. Cost-Push Inflation: When production costs increase, businesses pass on these costs to consumers through higher prices.

- 3. Built-In Inflation: This results from expectations of future inflation, leading to higher wages and prices to compensate.

Effects of Inflation on Consumers and Businesses

- 1. Consumers: Inflation reduces the purchasing power of consumers, meaning they can buy fewer goods and services with the same amount of money. This can lead to a decrease in the standard of living.

- 2. Businesses: Inflation can impact businesses by increasing their costs of production, which may result in lower profit margins. Additionally, uncertainty about future inflation can make planning and investment decisions more challenging.

Types of Inflation

Inflation can occur due to various factors, leading to different types of inflation with distinct characteristics and consequences.

Demand-Pull Inflation

Demand-pull inflation happens when the demand for goods and services exceeds the available supply, causing prices to rise. This type of inflation is often associated with a strong economy and increased consumer spending. As demand outstrips supply, businesses may increase prices to balance the market, leading to inflation. An example of demand-pull inflation can be observed during holiday seasons when consumers increase their purchasing, driving up prices.

Cost-Push Inflation

Cost-push inflation occurs when the production costs of goods and services increase, leading to higher prices for consumers. This can be caused by factors such as rising wages, higher raw material costs, or increased taxes. When businesses face higher production costs, they may pass on these expenses to consumers through price hikes, resulting in inflation. An example of cost-push inflation is the increase in oil prices leading to higher transportation costs, affecting various industries.

Structural Inflation

Structural inflation is a long-term phenomenon resulting from structural issues within an economy. This type of inflation is caused by factors like inefficient production processes, supply chain disruptions, or regulatory barriers. Structural inflation can persist over time, impacting the overall price levels in an economy. An example of structural inflation is when a country experiences persistent supply shortages due to inadequate infrastructure, leading to price increases.

Hyperinflation

Hyperinflation is an extreme form of inflation characterized by rapidly increasing prices and a devaluation of the currency. This type of inflation usually occurs when there is a loss of confidence in the currency or the government’s ability to manage the economy. Hyperinflation can have devastating effects on an economy, leading to a breakdown of the monetary system. A well-known example of hyperinflation is the situation in Zimbabwe in the late 2000s, where prices doubled every day, causing economic chaos.

Factors Influencing Inflation Rates

Inflation rates are influenced by a variety of factors that can impact the overall price levels in an economy. Understanding these factors is essential in predicting and managing inflation effectively.

Government Policies

Government policies play a crucial role in influencing inflation rates. Central banks often use monetary policy tools such as interest rates to control inflation. By adjusting interest rates, the government can influence borrowing, spending, and investment, which in turn affects the overall demand for goods and services.

Supply and Demand Dynamics

The basic economic principle of supply and demand also affects inflation rates. When the demand for goods and services exceeds supply, prices tend to rise, leading to inflation. Conversely, when supply outstrips demand, prices may fall, causing deflation.

External Factors

External factors, such as global events, can have a significant impact on inflation rates. For example, natural disasters, geopolitical tensions, or pandemics can disrupt the supply chain, leading to shortages and price increases. Changes in exchange rates and global commodity prices can also affect inflation by influencing the cost of imports and exports.

Labor Market Dynamics

The labor market dynamics, including wages and employment levels, can also influence inflation rates. When wages rise faster than productivity, it can lead to higher production costs, which are often passed on to consumers in the form of higher prices.

Consumer Expectations

Consumer expectations about future price levels can also impact inflation rates. If consumers anticipate that prices will continue to rise, they may adjust their spending habits, leading to increased demand and ultimately higher inflation.

Measuring Inflation

Inflation is a key economic indicator that affects consumers, businesses, and policymakers. Measuring inflation accurately is crucial for making informed decisions regarding monetary policy, wage adjustments, and investment strategies. There are several common methods used to measure inflation, including the Consumer Price Index (CPI) and the Producer Price Index (PPI).

Consumer Price Index (CPI)

The Consumer Price Index is a widely used measure of inflation that tracks the average change in prices paid by consumers for a basket of goods and services over time. This index is based on a representative sample of goods and services that are purchased by urban consumers, providing a snapshot of inflation from the perspective of the average household. The CPI is calculated by comparing the current cost of the basket of goods and services to a base period.

- The CPI is a valuable tool for assessing changes in the cost of living for consumers and is used to adjust wages, benefits, and tax brackets to account for inflation.

- One limitation of the CPI is that it may not accurately reflect the inflation experienced by all individuals, as spending patterns vary across different income groups and regions.

- Additionally, the CPI may not fully capture changes in quality or new products, leading to potential biases in the inflation rate.

Producer Price Index (PPI)

The Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. This index provides insights into inflationary pressures at the wholesale level, offering valuable information for businesses and policymakers.

- The PPI can serve as an early indicator of inflationary trends in the economy, as changes in producer prices may eventually be passed on to consumers.

- However, the PPI does not directly reflect the inflation experienced by consumers, as it focuses on prices at the producer level and may not capture changes in distribution and retail costs.

- Like the CPI, the PPI has limitations related to quality adjustments and coverage of all sectors of the economy.

Effects of Inflation

Inflation can have significant impacts on various aspects of the economy, including purchasing power, savings, interest rates, and investment decisions.

Impact on Purchasing Power and Savings

Inflation erodes the purchasing power of money over time, meaning that the same amount of money will buy fewer goods and services in the future. As a result, individuals may find that their savings are worth less in real terms, leading to a decrease in overall wealth.

Relationship between Inflation and Interest Rates

Inflation and interest rates are closely related. Central banks often raise interest rates to combat high inflation by reducing the amount of money circulating in the economy. Conversely, during periods of low inflation, central banks may lower interest rates to stimulate economic growth.

Influence on Investment Decisions

Inflation can impact investment decisions in various ways. For example, investors may seek assets that provide returns above the inflation rate to preserve the real value of their investments. Additionally, rising inflation can lead to higher costs for businesses, affecting profitability and investment opportunities.

Strategies to Combat Inflation

Inflation can have detrimental effects on an economy, such as reducing the purchasing power of the currency and leading to economic instability. Governments and central banks implement various strategies to combat inflation and maintain price stability.

Tightening Monetary Policy

One common strategy to combat inflation is through tightening monetary policy. Central banks raise interest rates to reduce the money supply in the economy. By making borrowing more expensive, consumers and businesses are less likely to spend, which can help slow down inflationary pressures.

Supply-Side Policies

Supply-side policies focus on increasing the efficiency and productivity of the economy. This can involve measures such as investing in infrastructure, reducing regulations that hinder production, and promoting competition in markets. By increasing the capacity of the economy to produce goods and services, supply-side policies can help alleviate inflationary pressures.

Wage and Price Controls

In some cases, governments may implement wage and price controls to directly limit the increase in wages and prices. While this can provide temporary relief from inflation, it can also distort market mechanisms and lead to shortages or surpluses in certain goods and services.

Indexing

Indexing refers to adjusting wages, prices, or interest rates automatically in response to changes in a specific price index, such as the consumer price index (CPI). This can help prevent inflation from eroding purchasing power and provide a more stable environment for economic transactions.

Communication and Transparency

Central banks can also combat inflation by effectively communicating their inflation targets and policy actions to the public. By maintaining transparency and credibility, central banks can influence expectations and help anchor inflation at desired levels.

Pros and Cons of Anti-Inflation Policies

– Pros: Anti-inflation policies can help maintain price stability, preserve the value of money, and promote long-term economic growth.

– Cons: However, some anti-inflation measures may lead to higher unemployment, reduced consumer spending, and potential distortions in the economy.

Historical Effectiveness of Anti-Inflation Measures

Throughout history, various countries have implemented different anti-inflation measures with varying degrees of success. For example, the Volcker Shock in the United States in the 1980s successfully reduced high inflation but also led to a period of economic downturn. It is essential to carefully assess the effectiveness and potential consequences of anti-inflation policies before implementation.