How to calculate net worth sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide delves into the intricacies of determining one’s financial standing through the calculation of net worth.

Introduction to Net Worth Calculation

Net worth is a key financial metric that reflects an individual’s overall financial position by subtracting liabilities from assets. It is an essential indicator of financial health and provides insights into an individual’s financial standing.

Components of Net Worth Calculation

Calculating net worth involves considering various components that contribute to an individual’s financial worth:

- Assets: These include cash, investments, real estate, vehicles, and other valuable possessions owned by an individual.

- Liabilities: Debts, mortgages, loans, and other financial obligations that an individual owes are subtracted from their assets to determine net worth.

- Income and Expenses: Understanding one’s income sources and expenses is crucial in assessing how they contribute to overall financial well-being.

- Investments and Retirement Accounts: Savings, investments, and retirement funds play a significant role in determining an individual’s net worth over time.

Assets Calculation

When calculating net worth, it is crucial to consider all assets that contribute to an individual’s overall financial value. Assets can come in various forms and each type plays a significant role in determining one’s net worth.

Determining the value of assets such as real estate, investments, vehicles, and personal belongings requires a thorough evaluation process to ensure accuracy in the net worth calculation. Here are some key points to consider when assessing the worth of different types of assets:

Types of Assets:

- Real Estate: This includes properties such as homes, land, commercial buildings, and rental properties. The value of real estate can be determined through appraisals, recent sales of similar properties in the area, or online valuation tools.

- Investments: Investments encompass stocks, bonds, mutual funds, retirement accounts, and other financial instruments. The value of investments fluctuates based on market conditions and can be assessed by reviewing account statements or consulting with a financial advisor.

- Vehicles: Assets like cars, motorcycles, boats, and RVs should be included in the net worth calculation. The value of vehicles can be estimated using resources like Kelley Blue Book or similar valuation websites.

- Personal Belongings: Items such as jewelry, art, collectibles, and other valuable possessions contribute to one’s net worth. Evaluating the worth of personal belongings may require professional appraisal or research on similar items sold in the market.

Tips for Accurate Evaluation:

- Regularly update asset values to reflect current market conditions and changes in value over time.

- Consider seeking professional assistance, such as appraisers or financial advisors, for complex assets or items with uncertain value.

- Be thorough in documenting and categorizing all assets to ensure nothing is overlooked in the net worth calculation.

- Use multiple sources of information to cross-validate asset values and ensure accuracy in the overall assessment.

Liabilities Calculation

When calculating net worth, it is crucial to consider not only your assets but also your liabilities. Liabilities are financial obligations or debts that you owe to others, and they play a significant role in determining your overall financial health.

Types of Liabilities

- Credit card debt: Any outstanding balances on credit cards that need to be repaid.

- Loans: Including personal loans, student loans, car loans, or any other borrowed funds.

- Mortgages: The amount you owe on your mortgage for your home or property.

- Medical bills: Any unpaid medical expenses that need to be settled.

- Other financial obligations: Such as outstanding bills, taxes, or any other debts.

Accounting for Liabilities

When calculating your net worth, it is essential to subtract your total liabilities from your total assets. This calculation gives you a clearer picture of your financial standing and helps you understand how much you truly own after settling all debts and obligations.

Importance of Subtracting Liabilities

Subtracting liabilities from assets allows you to determine your net worth, which is a crucial indicator of your financial stability and progress towards your financial goals. By accounting for all your debts and financial obligations, you can make informed decisions about managing your finances and planning for the future.

Net Worth Calculation Formula

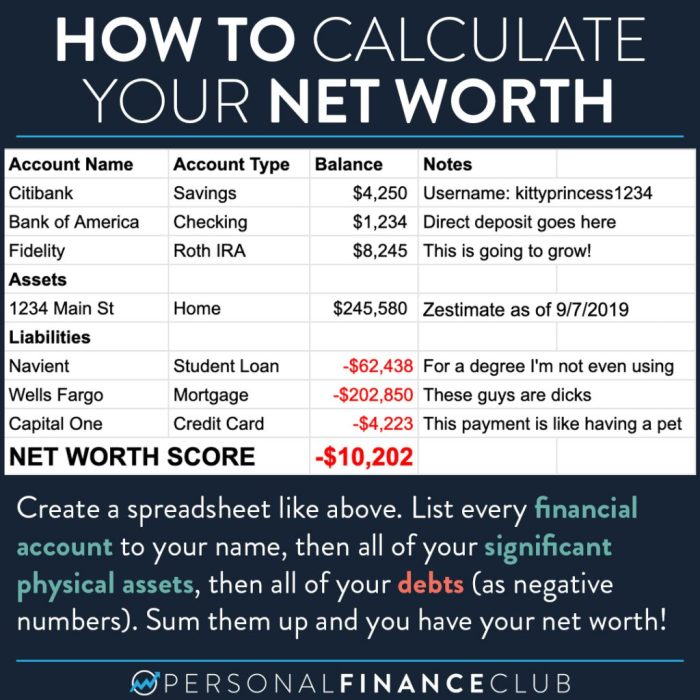

Calculating net worth involves subtracting total liabilities from total assets. The formula for net worth is:

Net Worth = Assets – Liabilities

Step-by-Step Guide for Net Worth Calculation

Here is a step-by-step guide on how to accurately calculate your net worth:

- List down all your assets, including cash, investments, real estate, and personal property.

- Calculate the total value of your assets.

- List down all your liabilities, such as mortgages, loans, credit card debt, and any other outstanding payments.

- Calculate the total value of your liabilities.

- Subtract the total liabilities from the total assets to get your net worth.

Examples of Net Worth Calculations

Let’s look at a couple of scenarios to better understand how to calculate net worth:

| Scenario | Assets | Liabilities | Net Worth |

|---|---|---|---|

| Scenario 1 | $500,000 | $200,000 | $300,000 |

| Scenario 2 | $1,000,000 | $400,000 | $600,000 |

Monitoring and Improving Net Worth

Tracking changes in net worth over time is crucial for financial health and planning. By monitoring your net worth regularly, you can assess your progress towards financial goals and identify areas for improvement.

Strategies for Tracking Changes in Net Worth

- Regularly update your asset and liability values to reflect any changes in your financial situation.

- Use net worth tracking tools or apps to automate the calculation process and visualize your progress.

- Compare your net worth to benchmarks or goals to evaluate your financial performance.

Ways to Increase Assets or Decrease Liabilities

- Invest in income-generating assets such as stocks, real estate, or bonds to grow your asset base.

- Reduce unnecessary expenses and debts to free up resources that can be used to increase assets or pay off liabilities.

- Consider increasing your income through side hustles or additional streams of revenue to boost your asset accumulation.

Advice on Setting Financial Goals based on Net Worth Calculations

- Set specific and measurable financial goals that are aligned with your net worth and overall financial situation.

- Break down your goals into smaller milestones to track progress and stay motivated.

- Regularly review and adjust your financial goals based on changes in your net worth and life circumstances.