Beginning with Strategies for paying off debt, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Debt is a common financial burden that many individuals face, impacting their financial health and overall well-being. In this guide, we will delve into the importance of paying off debt, strategies for prioritizing different types of debt, creating a budget for debt repayment, various debt payoff methods, ways to increase income for faster debt repayment, and seeking professional help for effective debt management.

Importance of Paying Off Debt

Paying off debt is crucial for maintaining financial health as it helps individuals avoid falling into a cycle of debt that can lead to long-term financial struggles. When debt accumulates, it can have negative impacts on various aspects of one’s financial well-being.

Negative Impacts of Carrying High Levels of Debt

- High levels of debt can lead to financial stress and anxiety, affecting overall mental health and well-being.

- Carrying a significant amount of debt can result in higher interest payments, reducing the amount of money available for savings or investments.

- Debt can limit financial freedom and flexibility, making it challenging to achieve financial goals or respond to unexpected expenses.

- Failure to manage debt effectively can lead to damaged credit scores, making it harder to qualify for loans or obtain favorable interest rates in the future.

Reducing Debt to Improve Credit Scores and Financial Stability

- By reducing debt, individuals can lower their credit utilization ratio, which plays a significant role in determining credit scores.

- Improving credit scores through debt reduction can lead to better access to credit, lower interest rates, and improved financial opportunities.

- Paying off debt in a timely manner demonstrates financial responsibility to creditors and can help build a positive credit history over time.

- Reducing debt can free up additional funds that can be redirected towards savings, investments, or other financial goals, leading to increased financial stability.

Types of Debt to Prioritize

When it comes to paying off debt, it’s essential to prioritize which debts to tackle first. Different types of debt require different strategies to manage effectively. Understanding the concept of high-interest debt versus low-interest debt can help you make informed decisions on where to focus your efforts.

Credit Card Debt

Credit card debt typically carries high-interest rates, making it one of the most expensive types of debt. Prioritizing credit card debt can help you save money in the long run and improve your overall financial health. Strategies such as the debt snowball method or debt avalanche method can be effective in paying off credit card debt efficiently.

Student Loans

Student loans are often considered “good debt” due to relatively low-interest rates and potential tax benefits. However, they can still be a significant financial burden. Prioritizing student loan debt based on interest rates and repayment terms can help you manage this type of debt more effectively.

Mortgage Debt

Mortgage debt is typically considered “good debt” as it allows you to build equity in a home. However, falling behind on mortgage payments can have serious consequences, including foreclosure. Prioritizing mortgage debt to ensure timely payments is crucial to maintaining homeownership and financial stability.

Car Loans

Car loans may have varying interest rates depending on the lender and your credit score. While not as high-interest as credit card debt, prioritizing car loan payments can help you avoid repossession and maintain reliable transportation. Considering the impact of interest rates and the value of the vehicle can help you determine the best approach to paying off car loans.

Other Debts

Other types of debt, such as personal loans or medical bills, should also be considered when prioritizing debt repayment. Understanding the terms of these debts and their impact on your overall financial situation can help you create a comprehensive debt payoff plan.

Creating a Budget for Debt Repayment

Creating a budget specifically for paying off debt is crucial in achieving financial stability and becoming debt-free. By carefully planning your finances, you can allocate resources effectively towards reducing your debt burden and ultimately achieving your financial goals.

Importance of Tracking Expenses and Income

Tracking your expenses and income is essential for effective debt repayment. By understanding where your money is going and how much you are earning, you can identify areas where you can cut back on spending and allocate more towards paying off debt. This level of awareness is key to creating a realistic and achievable budget for debt repayment.

- Utilize budgeting apps or software: There are various budgeting tools available that can help you track your expenses, set financial goals, and monitor your progress towards debt repayment. Apps like Mint, YNAB, or EveryDollar can provide valuable insights into your spending habits and help you stay on track with your budget.

- Implement the 50/30/20 rule: This budgeting method suggests allocating 50% of your income towards needs, 30% towards wants, and 20% towards savings and debt repayment. By following this guideline, you can ensure that a significant portion of your income goes towards paying off debt while still allowing for discretionary spending.

- Create a detailed spreadsheet: If you prefer a more hands-on approach, you can create a budget spreadsheet to track your income, expenses, and debt payments. This method allows for customization and a clear overview of your financial situation.

Debt Payoff Strategies

When it comes to paying off debt, there are various strategies that individuals can employ to effectively reduce and eliminate their financial obligations. Two popular methods include the snowball and avalanche method, each with its own unique approach to debt repayment.

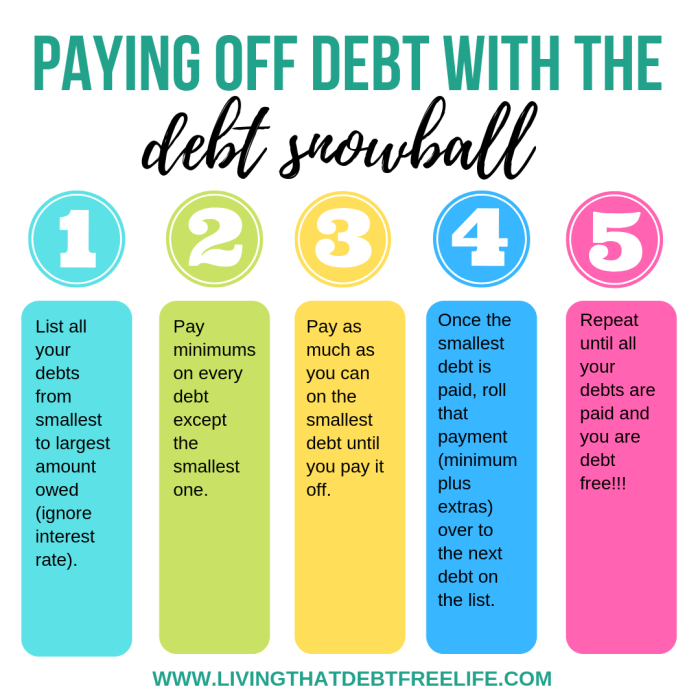

Snowball Method

The snowball method involves prioritizing debts from smallest to largest regardless of interest rate. The idea behind this strategy is to pay off the smallest debt first, then snowball the payments towards the next smallest debt, and so on. The main advantage of the snowball method is the psychological boost individuals experience from paying off smaller debts quickly, which can motivate them to continue tackling larger debts. However, one drawback is that it may result in paying more in interest over time compared to the avalanche method.

Avalanche Method

Contrary to the snowball method, the avalanche method prioritizes debts based on interest rates from highest to lowest. By focusing on the debt with the highest interest rate first, individuals can save money on interest payments in the long run. While the avalanche method may not provide the immediate gratification of the snowball method, it is a more cost-effective approach to paying off debt.

Success Stories

Many individuals have successfully used the snowball or avalanche method to pay off significant amounts of debt. For example, John, a recent college graduate, utilized the snowball method to pay off his student loans and credit card debt within two years. By prioritizing his debts strategically and sticking to a budget, John was able to achieve financial freedom and start saving for the future.

Increasing Income to Accelerate Debt Repayment

When it comes to paying off debt faster, increasing your income can be a powerful strategy to reach your financial goals more quickly. By finding ways to boost your earnings, you can allocate more funds towards debt repayment and expedite the process of becoming debt-free.

Side Hustle Ideas and Investment Opportunities

Exploring side hustle ideas or investment opportunities can provide you with additional streams of income to put towards paying off your debts. Here are some options to consider:

- Start a freelance business or offer services in your area of expertise.

- Invest in the stock market or real estate to generate passive income.

- Monetize a hobby or skill by selling products or services online.

- Take on part-time work or gigs to supplement your regular income.

Allocating Additional Income Towards Debt Repayment

Once you have increased your income through side hustles or investments, it is crucial to allocate these additional funds strategically towards debt repayment. Here are some tips on how to effectively use your extra income to accelerate debt payoff:

- Identify high-interest debts to prioritize for repayment.

- Create a budget specifically for your additional income to ensure it goes towards debt repayment.

- Consider making extra payments towards your debts each month to reduce interest costs over time.

- Avoid lifestyle inflation and instead channel extra income directly towards debt repayment.

Seeking Professional Help for Debt Management

When facing overwhelming debt, it may be beneficial to seek assistance from a financial advisor or credit counselor. These professionals can provide expert guidance on creating a personalized debt management plan, budgeting effectively, and exploring debt consolidation options to help you pay off your debts efficiently.

Debt Consolidation Options and Benefits

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage and pay off. This strategy can help simplify your finances, reduce the total amount of interest paid, and potentially lower your monthly payments. However, it’s essential to carefully consider the terms and fees associated with debt consolidation to ensure it’s the right choice for your financial situation.

Finding Reputable Professionals for Debt Management

When seeking help with debt management, it’s crucial to find reputable professionals or agencies. Look for certified financial advisors or credit counselors who have expertise in debt management and a track record of helping clients successfully overcome debt. Consider checking reviews, asking for recommendations from trusted sources, and verifying credentials to ensure you’re working with a trustworthy professional.