Exploring the Importance of financial planning, this introductory paragraph aims to provide a compelling overview of why financial planning is essential for individuals seeking financial stability and success. It delves into the key benefits of having a well-structured financial plan and how it aids in achieving both short-term and long-term financial goals. Additionally, it compares the financial outcomes of individuals who do and do not have a financial plan, highlighting the tangible differences it can make in one’s financial journey.

Importance of Financial Planning

Financial planning is the process of setting goals, evaluating resources, and creating a plan to achieve those goals. It is crucial for individuals as it helps in managing income, expenses, and investments effectively to secure their financial future.

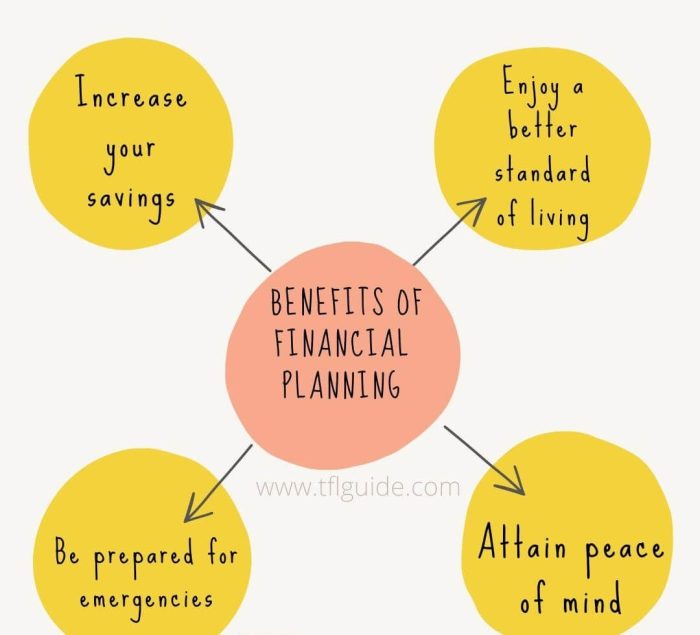

Key Benefits of Financial Planning

- Provides a clear roadmap: A well-thought-out financial plan helps individuals have a clear roadmap of their financial goals and the steps needed to achieve them.

- Ensures financial security: Having a financial plan in place can provide individuals with a sense of financial security, knowing that they are prepared for unexpected expenses or emergencies.

- Helps in wealth accumulation: Financial planning assists individuals in saving and investing wisely, leading to wealth accumulation over time.

Achieving Short-term and Long-term Financial Goals

Financial planning plays a crucial role in achieving both short-term and long-term financial goals. For short-term goals like buying a car or going on a vacation, a financial plan helps in setting aside the necessary funds without disrupting overall financial stability. On the other hand, for long-term goals such as retirement planning or buying a home, financial planning ensures that individuals have a systematic approach to saving and investing over a longer period.

Comparison of Financial Outcomes

Individuals with a financial plan tend to have better financial outcomes compared to those without one. They are more likely to save for retirement, have emergency funds, and make informed investment decisions. On the contrary, individuals without a financial plan may struggle with debt, lack of savings, and inadequate preparation for future financial needs.

Components of a Financial Plan

Financial planning involves several key components that are essential for creating a comprehensive plan to achieve financial stability and meet long-term goals. These components work together to provide a roadmap for managing finances effectively and securing a sound financial future.

Setting Financial Goals

Setting financial goals is a crucial part of a financial plan as it helps individuals identify their priorities and aspirations. By establishing clear and measurable objectives, such as saving for retirement, buying a home, or funding education, individuals can create a roadmap for their financial journey.

- Short-term goals: These are goals that can be achieved within a year, such as building an emergency fund or paying off credit card debt.

- Long-term goals: These goals are typically achieved over several years, such as saving for retirement or purchasing a home.

Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can help individuals stay focused and motivated to achieve their financial objectives.

Tools and Strategies in Financial Planning

There are various tools and strategies used in financial planning to help individuals manage their finances effectively and make informed decisions. Some common tools include budgeting, saving, investing, and risk management.

- Budgeting: Creating a budget helps individuals track their income and expenses, identify areas for saving, and allocate funds towards their financial goals.

- Saving: Setting aside a portion of income regularly for emergencies, short-term goals, and long-term objectives is essential for building financial security.

- Investing: Investing in assets like stocks, bonds, mutual funds, or real estate can help individuals grow their wealth over time and achieve long-term financial goals.

- Risk Management: Assessing and managing risks, such as health emergencies, job loss, or market fluctuations, is crucial for protecting assets and ensuring financial stability.

Role of Budgeting, Saving, Investing, and Risk Management

Budgeting, saving, investing, and risk management are integral components of a financial plan that work together to help individuals achieve their financial goals and build wealth over time.

- Budgeting allows individuals to track their spending, prioritize expenses, and allocate funds towards savings and investments.

- Saving helps individuals build an emergency fund, achieve short-term goals, and secure their financial future.

- Investing enables individuals to grow their wealth, generate passive income, and achieve long-term financial objectives.

- Risk management involves identifying potential risks, such as market volatility or unexpected expenses, and implementing strategies to mitigate these risks.

Building Wealth through Financial Planning

Effective financial planning plays a crucial role in wealth accumulation as it helps individuals set specific financial goals, create a roadmap to achieve those goals, and make informed decisions about saving, investing, and spending.

The Role of Compounding Interest and Investment Growth

Compounding interest and investment growth are key drivers of wealth creation. Compounding interest allows individuals to earn interest on their principal investment as well as on the interest that has already been earned. Over time, this can lead to exponential growth of wealth. By regularly contributing to investment accounts and reinvesting dividends, individuals can take advantage of compounding interest to grow their wealth significantly.

Examples of Leveraging Financial Planning

One way individuals can leverage financial planning to build a sustainable financial future is by creating a diversified investment portfolio. By spreading investments across different asset classes, individuals can reduce risk and maximize returns. Additionally, setting aside a portion of income for savings and investments, regularly reviewing and adjusting investment strategies based on financial goals and market conditions, and seeking professional advice when needed are all ways to effectively build wealth through financial planning.

Importance of Regularly Reviewing and Adjusting Financial Plans

Regularly reviewing and adjusting a financial plan is essential to maximize wealth-building opportunities. Economic conditions, personal circumstances, and financial goals can change over time, necessitating adjustments to investment strategies, savings targets, and risk management techniques. By staying proactive and flexible in managing their financial plans, individuals can adapt to changing circumstances and capitalize on opportunities for wealth accumulation.

Financial Planning for Different Life Stages

In life, financial needs and goals evolve as individuals progress through various stages such as starting a career, getting married, having children, and eventually retiring. It is crucial to adapt financial plans to changing circumstances and goals to ensure financial security and success. Here are some tips on tailoring financial planning strategies to meet specific life stage requirements and the importance of early financial planning for a secure future.

Starting a Career

- Focus on building an emergency fund to cover unexpected expenses.

- Invest in professional development and education to increase earning potential.

- Start saving for retirement early to take advantage of compounding interest.

Getting Married

- Combine finances with your partner and create joint financial goals.

- Consider purchasing life insurance to protect your partner financially.

- Update your will and beneficiaries to reflect your new marital status.

Having Children

- Start a college fund for your children’s education expenses.

- Increase your life insurance coverage to provide for your children in case of unexpected events.

- Create a budget that accounts for additional expenses related to raising children.

Retirement

- Maximize contributions to retirement accounts such as 401(k) or IRA.

- Create a retirement income plan that considers your desired lifestyle and expenses.

- Review and adjust your investment portfolio to align with your retirement timeline and risk tolerance.