Delving into Financial wellness programs, this introduction immerses readers in a unique and compelling narrative, with scientific with objective tone style that is both engaging and thought-provoking from the very first sentence.

Financial wellness programs play a crucial role in promoting the financial health and stability of employees in the workplace. By providing tools, resources, and education, these programs aim to enhance overall well-being and productivity. In this discussion, we will explore the various aspects of financial wellness programs, including their importance, key components, implementation strategies, and ways to boost employee engagement.

Importance of Financial Wellness Programs

Financial wellness programs play a crucial role in the workplace by helping employees manage their finances effectively. These programs focus on educating individuals about financial planning, budgeting, saving, investing, and managing debt. By offering financial wellness programs, companies can improve the overall well-being and productivity of their employees.

Benefits of Financial Wellness Programs

Financial wellness programs can benefit employees in various ways. Firstly, these programs can help reduce financial stress, which is a common issue affecting employee performance and mental health. By providing tools and resources for financial planning, employees can feel more in control of their finances, leading to increased job satisfaction and motivation.

- Employees can improve their financial literacy and make more informed decisions about their money.

- Financial wellness programs can help employees set and achieve financial goals, such as saving for retirement, buying a home, or paying off debt.

- By offering access to financial advisors or workshops, employees can receive personalized guidance on their financial situations.

Companies with Successful Financial Wellness Programs

Several companies have implemented successful financial wellness programs for their employees. For example, Google offers financial coaching sessions, workshops, and resources to help employees with budgeting, investing, and retirement planning. Another example is Microsoft, which provides online financial education courses and tools to help employees improve their financial well-being.

- IBM offers a comprehensive financial wellness program that includes access to financial advisors, webinars, and tools for retirement planning.

- Prudential Financial has a program called “The Wellness Path” that focuses on financial education, planning, and resources to help employees achieve financial security.

- Walmart has partnered with financial wellness companies to offer personalized financial guidance, tools, and resources to help employees manage their finances effectively.

Components of Effective Financial Wellness Programs

Effective financial wellness programs are crucial in helping individuals attain financial stability and security. These programs are designed to address various aspects of financial well-being, including budgeting, saving, investing, and managing debt. Key components that make a financial wellness program effective include:

Role of Education in Financial Wellness Programs

Education plays a vital role in financial wellness programs as it empowers individuals with the knowledge and skills needed to make informed financial decisions. By providing workshops, seminars, and resources on topics such as budgeting, saving, and investing, individuals can improve their financial literacy and confidence in managing their finances effectively.

Strategies for Designing Engaging Financial Wellness Workshops

Designing engaging financial wellness workshops involves creating interactive and relevant content that resonates with participants. Some strategies to consider include:

- Utilizing real-life examples and case studies to demonstrate financial concepts

- Incorporating hands-on activities and group discussions to encourage participation and learning

- Offering practical tips and tools that individuals can apply to their own financial situations

- Collaborating with financial experts and advisors to provide expert advice and guidance

Implementing Financial Wellness Programs

Implementing a financial wellness program in a company involves careful planning and execution to ensure its effectiveness in improving employees’ financial well-being. It is essential to consider the specific needs and goals of the organization and its employees when designing and implementing such programs.

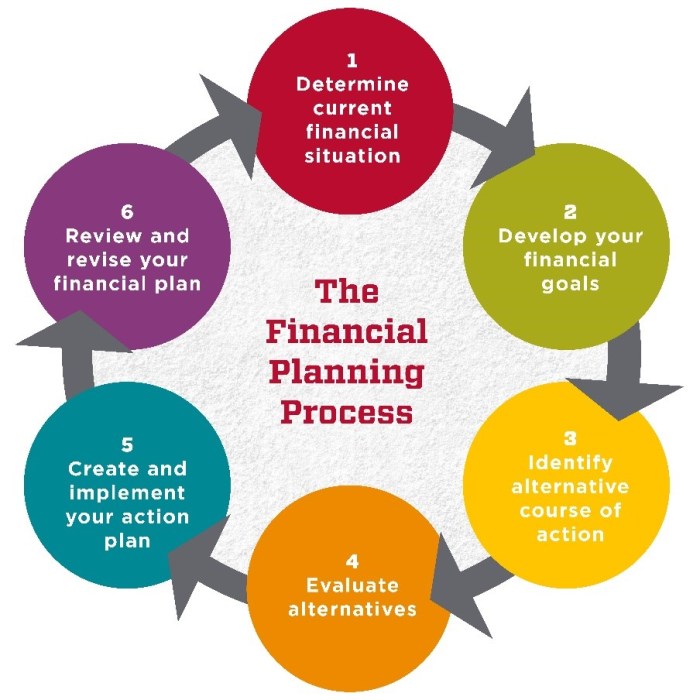

Steps for Implementing a Financial Wellness Program

- Conduct a needs assessment: Identify the financial challenges and concerns faced by employees through surveys, interviews, or focus groups.

- Develop a tailored program: Based on the needs assessment, create a financial wellness program that addresses the specific financial issues identified.

- Provide financial education: Offer workshops, seminars, or online resources to educate employees on topics such as budgeting, saving, investing, and debt management.

- Offer one-on-one counseling: Provide employees with access to financial advisors or counselors who can offer personalized guidance and support.

- Evaluate and adjust: Continuously monitor the program’s effectiveness through feedback, surveys, and financial metrics, and make adjustments as needed to ensure its success.

Importance of Measuring the Effectiveness of Financial Wellness Programs

Measuring the effectiveness of financial wellness programs is crucial to determine their impact on employees’ financial well-being and overall job satisfaction. By tracking key metrics such as participation rates, financial behaviors, and employee feedback, organizations can evaluate the program’s success and make informed decisions on future improvements.

Tips for Overcoming Common Challenges When Implementing Financial Wellness Programs

- Gain leadership buy-in: Secure support from upper management to ensure the program receives adequate resources and attention.

- Communicate effectively: Clearly communicate the benefits of the program to employees and address any concerns or misconceptions they may have.

- Provide ongoing support: Offer regular reminders, incentives, and follow-up sessions to encourage employee engagement and participation.

- Promote a culture of financial wellness: Integrate financial well-being into the company’s overall wellness initiatives and encourage a supportive environment for employees to discuss and address financial issues.

- Evaluate and adjust: Regularly review the program’s effectiveness and make necessary adjustments based on feedback and outcomes to ensure continued success.

Employee Engagement in Financial Wellness Programs

Employee engagement plays a crucial role in the success of financial wellness programs within organizations. When employees actively participate in these programs, they are more likely to improve their financial well-being, reduce financial stress, and increase productivity at work. Encouraging and incentivizing employee engagement is essential for the overall effectiveness of financial wellness initiatives.

Ways to Encourage Employee Participation

- Provide educational resources and workshops on financial literacy to empower employees with knowledge and skills.

- Offer one-on-one financial counseling sessions to address individual financial concerns and goals.

- Organize interactive challenges or competitions related to financial wellness, such as savings goals or budgeting exercises.

- Integrate financial wellness into company culture by promoting open discussions and support networks among employees.

Impact of Employee Engagement on Success

Employee engagement directly influences the success of financial wellness programs by driving participation rates, adoption of healthy financial habits, and overall program satisfaction. Engaged employees are more likely to take ownership of their financial well-being and actively seek out resources and support provided by the organization.

Incentives to Increase Employee Engagement

- Financial incentives such as bonuses, rewards, or matching contributions to retirement accounts for achieving financial goals.

- Flexible work arrangements or additional paid time off for attending financial wellness workshops or counseling sessions.

- Recognition and public acknowledgment of employees who demonstrate positive financial behaviors or improvements.

- Access to exclusive perks or discounts on financial products and services for active participation in financial wellness programs.