As Investment research tools take center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Investment research tools play a crucial role in helping investors navigate the complex landscape of financial markets, providing them with valuable insights and data to make informed decisions.

Overview of Investment Research Tools

Investment research tools are essential resources that provide investors with the necessary information and analysis to make informed decisions about their investments. These tools help investors assess the risks and potential returns of various investment opportunities, ultimately guiding them in building a well-diversified portfolio.

Purpose of Investment Research Tools

Investment research tools serve the primary purpose of helping investors gather and analyze data related to financial markets, specific securities, and economic trends. By utilizing these tools, investors can evaluate the performance of different assets, assess market conditions, and identify potential investment opportunities. Ultimately, the goal is to make well-informed decisions that align with their investment objectives and risk tolerance.

- Financial News Platforms: Websites and applications that provide real-time updates on market news, economic indicators, and company announcements.

- Stock Screeners: Tools that allow investors to filter stocks based on specific criteria such as market capitalization, price-earnings ratio, and dividend yield.

- Financial Analysis Software: Programs that enable investors to conduct in-depth financial analysis of companies, including ratio analysis, financial statement evaluations, and forecasting.

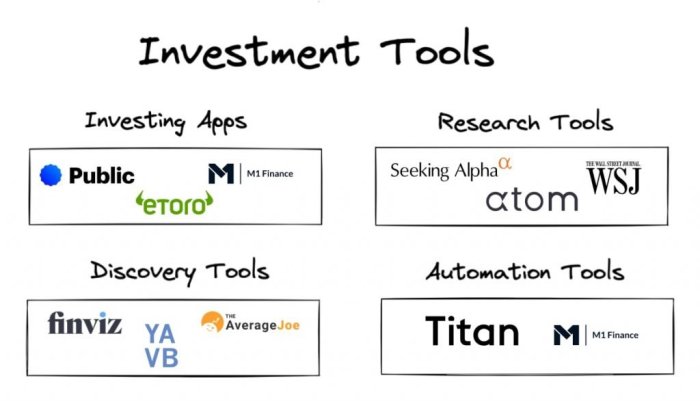

Examples of Popular Investment Research Tools

- Yahoo Finance: A comprehensive platform offering financial news, stock quotes, portfolio management tools, and research reports.

- Morningstar: Known for its extensive mutual fund and ETF analysis, providing investors with performance data, risk metrics, and fund ratings.

- Bloomberg Terminal: A professional-grade software offering real-time market data, news, and analytics for various asset classes.

Types of Investment Research Tools

Investment research tools can be categorized into different types based on their functions and features. Two main categories include fundamental analysis tools and technical analysis tools, each serving a unique purpose in investment decision-making. Additionally, data visualization tools play a crucial role in simplifying complex data sets for better analysis and decision-making. Furthermore, the rise of automated trading platforms has revolutionized the investment landscape, offering a more efficient and systematic approach compared to traditional research tools.

Fundamental Analysis Tools vs. Technical Analysis Tools

Fundamental analysis tools focus on evaluating the financial health and performance of a company by examining its financial statements, management team, industry trends, and economic indicators. This type of analysis helps investors determine the intrinsic value of a stock and make informed investment decisions based on the company’s fundamentals.

On the other hand, technical analysis tools rely on historical price and volume data to forecast future price movements. Traders using technical analysis tools analyze charts, patterns, and trading signals to identify potential entry and exit points in the market. While fundamental analysis is more long-term oriented, technical analysis is often used for short-term trading strategies.

Importance of Data Visualization Tools in Investment Research

Data visualization tools play a crucial role in investment research by transforming complex data sets into visual representations such as charts, graphs, and dashboards. These tools help investors quickly identify trends, patterns, and correlations within the data, enabling them to make better-informed investment decisions. By visualizing data, investors can easily spot opportunities and risks in the market, leading to more effective portfolio management.

Automated Trading Platforms vs. Traditional Research Tools

Automated trading platforms utilize algorithms and computer programs to execute trades automatically based on predefined criteria. These platforms offer speed, efficiency, and precision in trading, eliminating human emotions and biases from the decision-making process. In contrast, traditional research tools require manual analysis and decision-making by investors, which can be time-consuming and prone to errors.

While automated trading platforms provide a systematic approach to trading, traditional research tools offer a more hands-on and personalized approach to investment decision-making. Investors can choose the tools that best suit their trading style and objectives, whether it be the speed and efficiency of automated platforms or the in-depth analysis provided by traditional research tools.

Features and Functions

Investment research tools come with a variety of features and functions that are crucial for making informed investment decisions. Let’s explore the key features to look for in these tools and how customization options and real-time data updates play a vital role in enhancing their usability and accuracy.

Key Features to Look for in Investment Research Tools

- Comprehensive Market Data: A good investment research tool should provide access to a wide range of market data, including stock prices, financial statements, analyst reports, and news updates.

- Advanced Charting Tools: The ability to analyze historical price movements, technical indicators, and create custom charts is essential for conducting in-depth analysis.

- Screening and Filtering Capabilities: The tool should allow users to screen and filter stocks based on specific criteria such as market cap, industry, or performance metrics.

- Portfolio Tracking: Tracking and managing portfolios is made easier with features that allow users to monitor performance, analyze allocation, and set alerts.

Customization Options for Enhanced Usability

- Personalized Dashboards: Customizable dashboards enable users to arrange widgets and modules according to their preferences, making it easier to access important information at a glance.

- Alerts and Notifications: Customizable alerts for price changes, news updates, or specific events help users stay informed and take timely actions.

- User Preferences: Tools that allow users to set personal preferences for data visualization, layout, and analysis methods enhance the overall user experience.

Real-Time Data Updates for Improved Accuracy

Real-time data updates play a crucial role in ensuring the accuracy of investment research by providing the latest information on market movements, news, and financial data. By receiving real-time updates, investors can make timely decisions based on the most up-to-date information available, reducing the risk of outdated or inaccurate analysis.

Benefits of Using Investment Research Tools

Investment research tools offer numerous benefits to investors, helping them make informed decisions and maximize returns on their investments. These tools provide valuable insights into the financial markets, enabling investors to identify potential opportunities, assess risks, and implement effective diversification strategies.

Identifying Potential Investment Opportunities

Investment research tools play a crucial role in helping investors identify potential investment opportunities. By analyzing market trends, financial data, and company performance metrics, these tools can highlight undervalued stocks, emerging markets, or sectors with growth potential. This information allows investors to capitalize on opportunities before they become widely recognized, giving them a competitive edge in the market.

Role of Risk Assessment Tools in Portfolio Management

Risk assessment tools are essential for effective portfolio management, as they help investors evaluate and manage the risks associated with their investments. By using tools such as risk analysis models, volatility indicators, and scenario analysis, investors can assess the potential downside of their investment decisions and adjust their portfolios accordingly. This proactive approach to risk management can help protect investors from unexpected market fluctuations and minimize losses.

Contribution to Diversification Strategies

Investment research tools also play a key role in diversification strategies, which aim to reduce risk by spreading investments across different asset classes, industries, or geographic regions. By providing comprehensive market data, correlation analysis, and performance metrics, these tools enable investors to build well-diversified portfolios that are resilient to market volatility. Diversification not only helps mitigate risk but also enhances long-term returns by capturing opportunities in multiple market segments.