Delving into the realm of personal loan options, this guide aims to provide a detailed analysis of the various types of loans available, factors to consider when choosing a loan, the application process, and alternatives to traditional personal loans. By the end, readers will have a thorough understanding of how to navigate the landscape of personal lending with confidence.

Types of Personal Loans

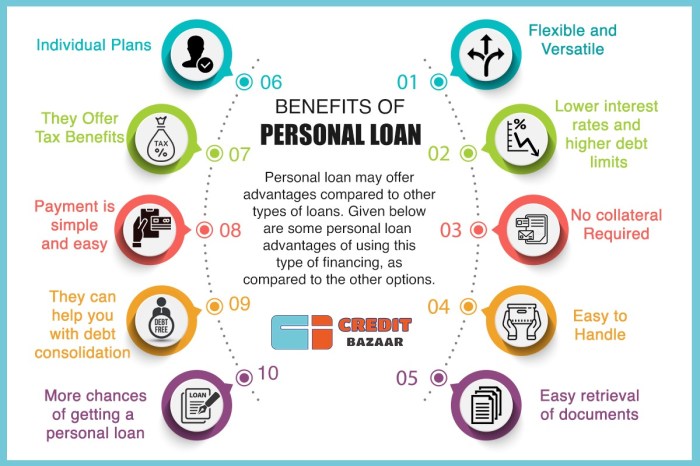

Personal loans are a popular financial product that can be used for various purposes such as debt consolidation, home improvements, or unexpected expenses. There are several types of personal loans available in the market, each with its own features and benefits.

Secured Personal Loans

Secured personal loans require collateral, such as a car or a savings account, to back the loan. This reduces the risk for the lender, allowing them to offer lower interest rates. If the borrower fails to repay the loan, the lender can seize the collateral to recoup their losses.

Unsecured Personal Loans

Unsecured personal loans do not require any collateral, making them a popular choice for borrowers who do not want to risk losing their assets. However, since there is no collateral involved, unsecured personal loans typically come with higher interest rates compared to secured loans.

Fixed-Rate Personal Loans

Fixed-rate personal loans have an interest rate that remains the same throughout the life of the loan. This provides borrowers with predictability and stability in their monthly payments, making it easier to budget and plan for the future.

Variable-Rate Personal Loans

Variable-rate personal loans have an interest rate that can fluctuate based on market conditions. While borrowers may benefit from lower initial rates, there is also the risk of rates increasing over time, leading to higher monthly payments.

Factors to Consider

When choosing a personal loan, there are several key factors to consider that can impact your overall financial health. It is important to make an informed decision based on your individual circumstances.

Credit Score Impact

Your credit score plays a crucial role in determining the type of personal loan options available to you. Lenders use your credit score to assess your creditworthiness and determine the interest rate you will be offered. A higher credit score typically results in lower interest rates and more favorable loan terms. On the other hand, a lower credit score may limit your options and result in higher interest rates.

Interest Rates and Repayment Terms

Interest rates and repayment terms are essential factors to consider when choosing a personal loan. The interest rate will determine the cost of borrowing the money, so it is crucial to compare rates from different lenders to find the most competitive option. Additionally, repayment terms such as the length of the loan and the monthly payment amount can impact your ability to manage the loan effectively. It is important to choose a loan with repayment terms that align with your financial goals and capabilities.

Application Process

When applying for a personal loan, there are specific steps you need to follow to ensure a smooth and successful application process. Below are the typical steps involved in applying for a personal loan, along with tips on how to improve your chances of approval and the documentation required.

Typical Application Process

- Research and Compare: Start by researching different lenders and comparing their interest rates, terms, and fees.

- Check Eligibility: Review the eligibility criteria of different lenders to ensure you meet the requirements.

- Submit Application: Fill out the loan application form with accurate information and submit it along with the required documents.

- Verification Process: The lender will verify the information provided and may request additional documents for verification.

- Approval Decision: Once the verification process is complete, the lender will make a decision on whether to approve or reject your loan application.

- Loan Disbursement: If approved, the loan amount will be disbursed to your bank account within a specified timeframe.

Tips to Improve Chances of Approval

- Check Credit Score: Ensure your credit score is in good standing before applying for a personal loan.

- Reduce Debt-to-Income Ratio: Lower your debt-to-income ratio by paying off existing debts before applying for a new loan.

- Provide Accurate Information: Fill out the application form accurately and honestly to avoid any discrepancies during verification.

- Add a Co-signer: If you have a low credit score, adding a co-signer with a good credit history can improve your chances of approval.

Documentation Required

- Proof of Identity: Valid government-issued ID such as a driver’s license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements to verify your income.

- Proof of Residence: Utility bills or lease agreements to confirm your current address.

- Employment Details: Contact information for your employer and proof of employment.

- Additional Documents: Depending on the lender, additional documents may be required for verification purposes.

Alternatives to Personal Loans

When considering borrowing money, personal loans are not the only option available. Alternative financing options such as credit cards or home equity loans can also be viable choices depending on individual circumstances. It is essential to compare the pros and cons of each alternative to determine the most suitable option for your financial needs.

Credit Cards

Credit cards offer a convenient way to access funds quickly and easily. They can be used for various purchases and expenses, providing flexibility in terms of repayment. However, credit cards usually come with high-interest rates, which can lead to significant debt if not managed responsibly. It is crucial to consider the interest rates, fees, and credit limit before opting for a credit card as a financing option.

Home Equity Loans

Home equity loans allow homeowners to borrow against the equity in their property. These loans typically come with lower interest rates compared to personal loans or credit cards since they are secured by the value of the home. Home equity loans can be used for large expenses, such as home renovations or debt consolidation. However, failing to repay a home equity loan can result in the loss of your home, making it a risky option for borrowing money.

Comparison of Personal Loans vs. Other Borrowing Options

- Personal loans offer fixed interest rates and predictable monthly payments, making budgeting easier compared to credit cards with variable rates.

- Credit cards provide flexibility in spending but often come with higher interest rates and fees, leading to potential debt accumulation if not managed wisely.

- Home equity loans offer lower interest rates but put your home at risk if you default on the loan, making it essential to consider the long-term implications.

It is crucial to assess your financial situation and borrowing needs carefully before choosing between personal loans, credit cards, or home equity loans.