Student loan consolidation is a financial strategy that many individuals consider to simplify their repayment process. This article delves into the intricacies of student loan consolidation, offering insights into its types, pros and cons, application process, and impact on student loans.

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan, often with a lower interest rate and a longer repayment period. This can make it easier for borrowers to manage their loans and potentially save money on interest payments.

How does Student Loan Consolidation work?

When a borrower consolidates their student loans, a new loan is taken out to pay off the existing loans. This new loan typically has a fixed interest rate, which can result in a lower overall interest rate compared to the individual loans. The borrower then makes a single monthly payment towards the new consolidated loan, simplifying the repayment process.

Benefits of Student Loan Consolidation

- Lower Interest Rates: Consolidating multiple loans can result in a lower average interest rate, potentially saving money over the life of the loan.

- Single Monthly Payment: Instead of managing multiple loan payments, borrowers only have to make one payment each month, making it easier to stay on top of payments.

- Extended Repayment Terms: Consolidation can also extend the repayment term, reducing the monthly payment amount and providing more flexibility in budgeting.

- Streamlined Repayment: With one loan servicer and one monthly payment, borrowers can simplify their repayment process and avoid confusion.

Types of Student Loan Consolidation

When it comes to student loan consolidation, there are different options available to borrowers. Two main types include federal student loan consolidation and private student loan consolidation. Each type has its own eligibility criteria and benefits.

Federal Student Loan Consolidation

Federal student loan consolidation combines multiple federal loans into one new loan with a fixed interest rate. This type of consolidation is offered through the Department of Education. Borrowers can choose from different repayment plans, such as Income-Driven Repayment (IDR) plans, which adjust monthly payments based on income.

- Federal student loan consolidation is available for most federal student loans, including Direct Loans, FFEL Loans, and Perkins Loans.

- The interest rate for a Direct Consolidation Loan is based on the weighted average of the interest rates of the loans being consolidated.

- Borrowers may be eligible for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), if they consolidate their loans.

Private Student Loan Consolidation

Private student loan consolidation involves refinancing multiple private student loans into a single loan with a new interest rate and repayment term. This type of consolidation is offered by private lenders, such as banks and credit unions. Borrowers with good credit scores may qualify for lower interest rates through private consolidation.

- Private student loan consolidation is only available for private student loans, not federal loans.

- Borrowers may be able to choose between fixed or variable interest rates when refinancing their loans.

- Private consolidation may offer different repayment terms and benefits compared to federal consolidation options.

Eligibility Criteria

- For federal student loan consolidation, borrowers must have federal student loans in repayment or in the grace period. They must also meet specific requirements depending on the type of federal loan.

- Private student loan consolidation eligibility criteria vary by lender but typically require a good credit score and stable income.

- Borrowers should carefully consider their options and compare the benefits and drawbacks of federal versus private student loan consolidation before making a decision.

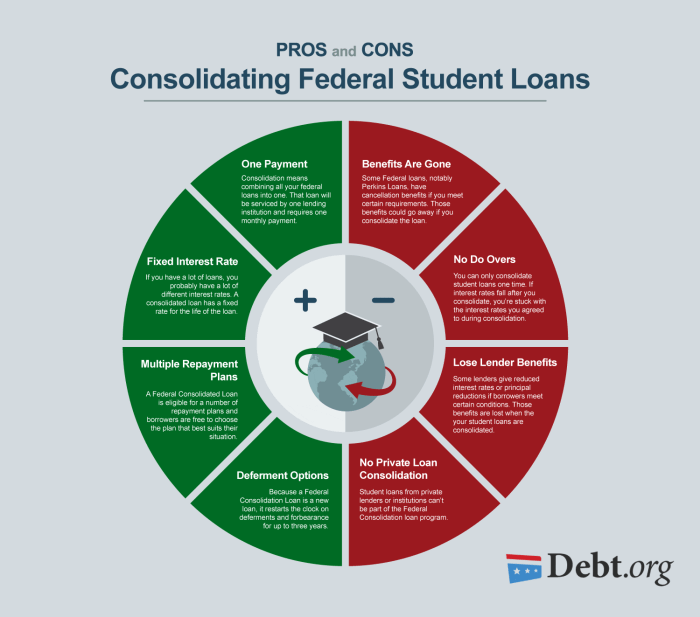

Pros and Cons of Student Loan Consolidation

When considering student loan consolidation, it is important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Consolidating Student Loans

- Lower Monthly Payments: Consolidating multiple student loans into one can result in a single, lower monthly payment, making it easier to manage finances.

- Fixed Interest Rate: Consolidation can provide the opportunity to lock in a fixed interest rate, protecting borrowers from potential interest rate increases in the future.

- Simplified Repayment: With a single loan to manage, borrowers may find it easier to keep track of payments and stay on top of their debt.

- Potential for Lower Interest Rate: Consolidation may lead to a lower overall interest rate, saving money over the life of the loan.

Potential Drawbacks of Student Loan Consolidation

- Loss of Benefits: Consolidating federal student loans may result in the loss of certain borrower benefits, such as loan forgiveness options or income-driven repayment plans.

- Extended Repayment Period: While lower monthly payments can be beneficial, extending the repayment period through consolidation may result in paying more interest over time.

- Accumulation of More Interest: If the new interest rate on the consolidated loan is higher than the individual rates of the original loans, borrowers may end up paying more in interest.

- Loss of Grace Period: Consolidating loans may result in the loss of any remaining grace period on the original loans, leading to immediate repayment after consolidation.

When Consolidation May or May Not Be a Good Idea

- Good Idea: Consolidation can be a good option for borrowers with multiple high-interest loans, seeking a fixed interest rate, or struggling to manage multiple payments.

- Not a Good Idea: It may not be advisable to consolidate if borrowers are close to paying off their loans, eligible for loan forgiveness programs, or have significantly lower interest rates on existing loans.

How to Consolidate Student Loans

Consolidating student loans can help simplify repayment and potentially reduce monthly payments by combining multiple loans into one. Here is a breakdown of the steps involved in consolidating student loans and the application process.

Application Process for Student Loan Consolidation

- Gather all loan information: Start by collecting details of all your existing student loans, including the loan servicer, balance, interest rate, and repayment status.

- Choose a loan servicer: Research different loan servicers and select one that offers the best terms and benefits for your consolidation.

- Submit application: Complete the application for student loan consolidation with the chosen loan servicer. This can typically be done online or through a paper application.

- Review the consolidation offer: Once your application is processed, review the consolidation offer provided, including the new interest rate, repayment term, and monthly payment amount.

- Accept the offer: If you are satisfied with the terms of the consolidation offer, accept it to move forward with the process.

- Continue making payments: While the consolidation is being processed, continue making payments on your existing loans to avoid any missed or late payments.

- Start repayment under the new terms: Once the consolidation is complete, start repaying the new consolidated loan according to the agreed-upon terms.

Documents Needed for Student Loan Consolidation

- Proof of income: Documents such as pay stubs, tax returns, or bank statements may be required to verify your income for the consolidation application.

- Loan information: Provide details of all your existing student loans, including account numbers, loan servicers, and current balances.

- Identification: A government-issued ID, such as a driver’s license or passport, will be needed to confirm your identity.

- Social Security Number: Your SSN will be required for the loan consolidation application for identification and credit check purposes.

- Contact information: Ensure your current address, phone number, and email are up-to-date when applying for student loan consolidation.

Impact on Student Loans

When it comes to student loan consolidation, there are several key impacts to consider. This includes how it affects credit scores, interest rates, repayment terms, and overall management of student loan payments post-consolidation.

Credit Scores

Consolidating student loans can have both positive and negative effects on credit scores. On one hand, consolidating multiple loans into one can simplify repayment and reduce the risk of missed payments. This can have a positive impact on credit scores. However, if the new consolidated loan has a higher interest rate or if the borrower misses payments, it could negatively impact credit scores.

Interest Rates and Repayment Terms

One of the main benefits of student loan consolidation is the potential to secure a lower interest rate. By consolidating multiple loans into one, borrowers may be able to lock in a lower rate, which can save them money over the life of the loan. Additionally, consolidation can also extend the repayment term, resulting in lower monthly payments but potentially higher overall interest costs.

Managing Student Loan Payments

After consolidating student loans, it’s important for borrowers to stay organized and on top of their payments. Setting up automatic payments can help ensure that payments are made on time, which can positively impact credit scores. Additionally, creating a budget and prioritizing student loan payments can help borrowers manage their debt effectively and avoid default.